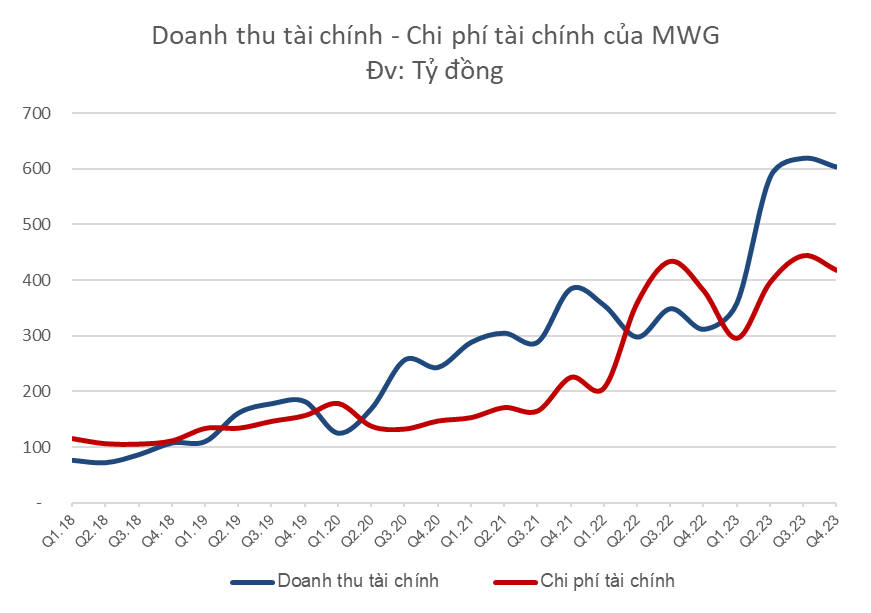

From Q2 2020 to Q1 2022, Mobile World Joint Stock Company (stock code MWG) has emerged as a highly efficient “money dealer”. Despite having short-term debts of tens of thousands billion dongs, Mobile World is able to maintain cash and bank deposits ranging from 10,000 to 15,000 billion dongs. The company has used clever techniques on interest rates and terms to consistently achieve financial revenue that is over 100 – 150 billion dongs higher than financial costs, resulting in a positive net profit from financial activities.

After maintaining this state for 8 consecutive quarters, in Q2 2022, the financial costs of Mobile World skyrocketed, causing the company to switch to a loss from financial activities.

This is also a challenging period for ICT businesses as market demand decreases, purchasing power drops, and interest rates increase. Not to mention, Mobile World has not been successful with new chains such as Pharmaceuticals, Fashion, Mother and Baby… and Bach Hoa Xanh has not been profitable.

However, by 2023, Mobile World has returned to being an efficient “money dealer” as it achieves a positive net profit from financial activities in all 4 quarters of this year. In fact, in the last 3 quarters, the net profit from financial activities reaches 170 – 180 billion dongs, which is much higher than the profitable period before.

In 2023, Mobile World profits 611 billion dongs from financial activities, accounting for 89% of the company’s pre-tax profit. Specifically, the difference between revenue from interest on deposits and interest expenses, as well as expenses for loan arrangements, amounts to nearly 360 billion dongs.

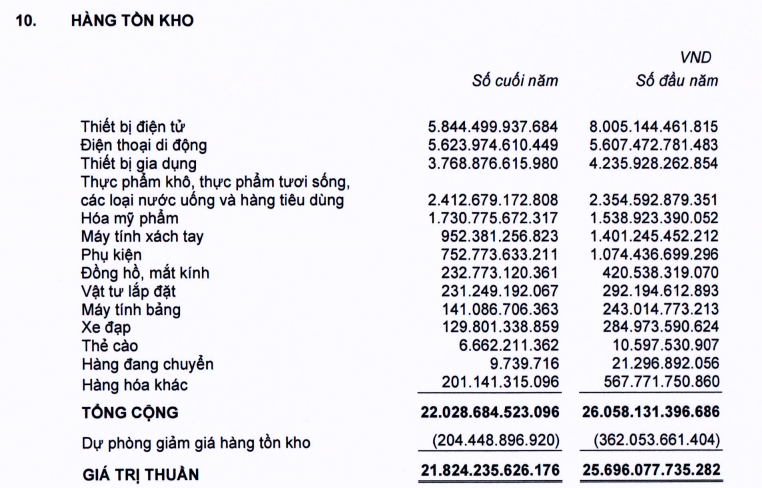

By the end of 2023, Mobile World holds 1 billion USD in “fresh” cash, an increase of over 9,000 billion compared to the beginning of the year. Positive cash flow from business operations is greatly supported by the aggressive inventory reduction policy (reducing over 4,000 billion dongs).

The three largest items in inventory are electronic devices, which decrease by over 2,000 billion dongs, household appliances, which decrease by over 460 billion dongs, while mobile phones slightly increase. Laptops also witness a strong inventory clearance as it decreases by 450 billion dongs, accessories decrease by 320 billion, and bicycles decrease by over 150 billion.

As the largest retailer in the electronics and mobile phone sector, Mobile World is negatively impacted by a decline in consumption, especially non-essential products during the economic downturn. Mobile World and Dien May Xanh have traded revenue growth and gross profit margin to create a price war. The company’s profits have fallen from a peak of 2,000 billion dongs/quarter to 130-200 billion dongs/quarter. In 2023, net profit only reaches 168 billion dongs, a decrease of 95.9% compared to the previous year and the lowest level to date.

According to observations of VCBS Securities Corporation, recent price competition in the market only intensifies for Iphone products, as they have a high value, fewer models, and are easy to compare. For other phone brands such as Samsung, Xiaomi, Oppo, retailers tend to collaborate exclusively on a few models to apply more flexible pricing.

In addition, there will be other directions to add value for customers (such as CellphoneS) instead of focusing solely on price competition.

In addition, government support policies such as 8% VAT until the end of June 2024, especially a more relaxed consumer credit disbursement, in the context of low interest rates and sustained credit demand, will be a driving force for the recovery of the ICT industry.