The U.S. Securities and Exchange Commission (SEC) has approved Bitcoin ETFs from major players like BlackRock, Invesco, and Fidelity, as well as smaller companies like Valkyrie. The fund certificates of these funds will start trading on January 11.

Standard Chartered analysts this week stated that ETFs could attract between $50 billion to $100 billion in assets this year, pushing the price of Bitcoin to $100,000. Other analysts predict that inflows could reach $55 billion in the next 5 years. Andrew Bond, CEO and financial technology analyst at Rosenblatt Securities, commented: “This is a significant positive movement towards Bitcoin’s institutionalization. The approval of ETFs will further legitimize Bitcoin as an asset.”

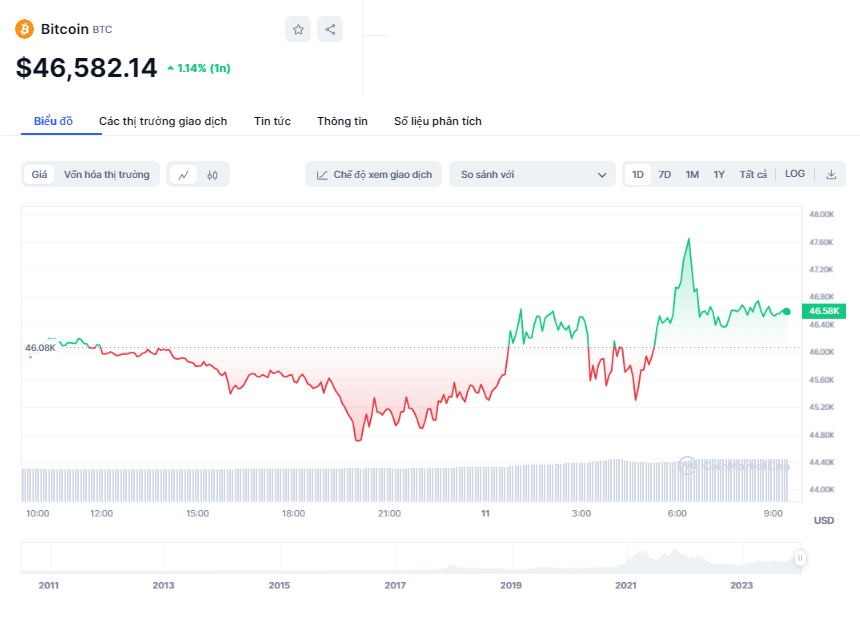

After this breakthrough, the price of Bitcoin initially rose over 3%, but then cooled off and increased by just over 1% to $46,500.

This approval decision represents a rare compromise from the SEC, after over a decade of opposition to Bitcoin ETFs. The proposal for the first Bitcoin ETF came from Bitcoin billionaires Tyler and Cameron Winklevoss back in 2013.

Prior to this, financial giant BlackRock unexpectedly filed an application to establish a Bitcoin ETF in June 2023, sparking a rapid surge in Bitcoin’s price in the latter months of the year. Thanks to these expectations, Bitcoin became the best-performing asset of 2023, with a 160% increase.

“While we are approving the listing and trading of certain same-day Bitcoin ETF shares today (January 11), we do not approve or endorse Bitcoin,” SEC Chairman Gary Gensler said in a statement. “Investors should be cautious about a range of risks related to Bitcoin and related virtual products.”

In previous rulings against Bitcoin ETFs, the SEC argued that no regulated exchange could adequately oversee Bitcoin transactions in a way that would reliably detect fraud and manipulation. Ark Investments, led by renowned investor Cathie Wood, and other organizations then objected to the SEC’s argument. They provided data showing a high correlation between same-day and futures trading on the CME Group platform.

In reviewing the latest proposals, the SEC indicated that they examined the correlation between same-day and futures trading across different time frames and concluded that price volatility could occur in a manner that abnormal activities on exchanges like Kraken and Coinbase may appear in the futures contracts.

Therefore, the SEC has moved towards an agreement to share comprehensive monitoring with CME – the futures exchange for Bitcoin contracts. “The supervision of CME can help detect the impacts of abnormal factors on the Bitcoin futures contract price,” the SEC stated.