Illustrative photo

Wheat is an important staple food worldwide, however, it has experienced many fluctuations since the beginning of 2022. The El Nino weather phenomenon has caused droughts in most of Asia in 2023 and is forecasted to continue in the first half of 2024, posing a threat to wheat, rice, and other agricultural exports and imports in some of the world’s leading agricultural markets.

Each year, Vietnam spends billions of USD to import wheat. According to preliminary statistics from the General Department of Customs, in the first month of 2024, wheat imports surged with 535,349 tons, worth over 156 million USD, a 126% increase in volume and an 80% increase in value compared to the same period in 2023.

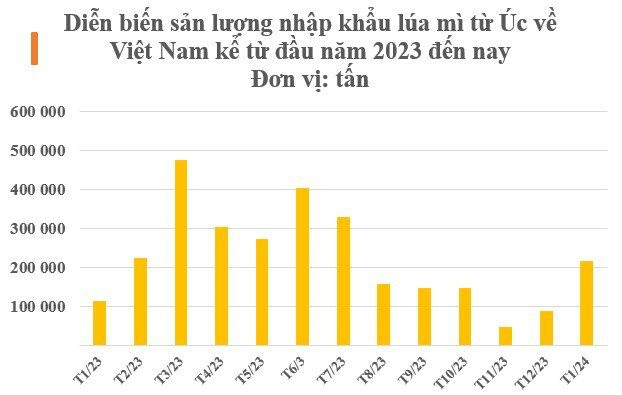

In terms of market, Australia is the largest supplier to Vietnam and has witnessed a sharp increase since the beginning of the year. Specifically, in January 2024, Vietnam imported 215,823 tons of wheat from Australia, equivalent to a value of over 69.3 million USD, a strong increase of 144% in volume and 137% in value compared to the previous month, accounting for 40% of the total wheat imports.

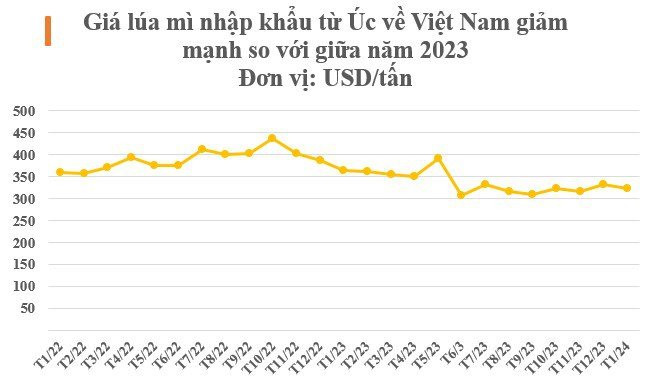

The average import price reached 321 USD/ton, a decrease of 11% compared to the same period in 2023.

In addition to Australia, Vietnam’s major wheat suppliers include Brazil, Ukraine, the United States, Russia, and Canada.

Prolonged heatwaves in 2023 have limited this year’s harvest in Australia – the world’s second largest wheat exporter, ending its record-breaking harvest streak.

India’s next wheat crop is also threatened by moisture stress, which could force the world’s second largest wheat consumer to seek imports for the first time in 6 years as its domestic stocks have fallen to their lowest in 7 years.

According to Reuters, China – the world’s largest wheat producer and consumer – bought about 2 million tons of Australian wheat in the new season in October 2023, with delivery starting from December. China has also booked around 2.5 million tons of wheat from France since September for delivery from December to March, which is an unusually large purchase volume compared to previous years.

China’s wheat imports for 2023 are forecasted to reach about 12 million tons, surpassing the record of 9.96 million tons in 2022, and strong buying demand is expected to continue in 2024.

China’s aggressive wheat buying activity is likely to support global wheat prices, which have fallen over 25% this year – amid ample supplies from leading wheat exporter, Russia.

Although Australia’s wheat production is forecasted to decrease to 26 million tons (a decrease from the record of 39.7 million tons in the previous season) due to drought caused by the El Nino weather pattern, this also leads to better quality wheat this year, with higher protein content due to dry weather conditions.