Non-performing loans (NPLs) are one of the concerns of banks in 2024 as the economy remains challenging, the real estate market has not recovered, and especially the restructured debts according to Circular 02/2023 of the State Bank will expire on June 30.

Forecasted increase in NPLs

Mr. Ngo Quang Trung, CEO of BVBank, believes that the unfavorable macroeconomic developments in recent times have quickly eroded the “health” of the economy and businesses. “Persistent weak demand in the market for commodities, services, and real estate may continue to put significant pressure on the asset quality of credit institutions in the first half of this year. However, the economy is forecasted to recover more positively with a low-interest rate environment that can stimulate loan demand,” said Mr. Trung.

Maintaining attractive interest rates and designing long-term fixed-rate loan packages will stimulate housing loans, thereby supporting the recovery of the real estate market. Photo: TAN THANH

At the recently concluded credit push conference aimed at supporting businesses and promoting economic growth in 2024, leaders of Agribank emphasized that the economic recovery has been slow, while the debts restructured according to Circular 02/2023 will expire on June 30. Therefore, if this circular is not extended, it will create pressure on the handling of bad debts.

According to economist – TS Dinh The Hien, the real estate market has been restructured but has been slow to recover, while bad debts of banks are usually associated with real estate debts of businesses. In addition, pressure from bond maturities of businesses still exists. “Bad debts and potential debts are issues that the banking sector still has to make efforts to deal with in the coming time,” noted Mr. Hien.

The 2024 strategic report of SSI Securities Company also acknowledged that this year poses challenges to the banking sector in terms of asset quality, despite the decrease in cost of capital and the increase in pre-provision profit helping credit institutions to have a better buffer. “Bad debts and debt of concern in credit institutions by the end of 2023 have increased by 40% and 24% respectively compared to the beginning of the year. The bad debt ratio may continue to increase in the first half of 2024 as credit growth slows down and macroeconomic factors have not shown clear signs of improvement,” SSI Securities Company stated.

In the context of slow economic recovery, commercial banks are recommending extending the implementation period of Circular 02/2023 for about 6 months to 1 year without considering the number of debt restructuring for customers. To facilitate businesses and commercial banks, the State Bank of Vietnam has also stated that it will consider extending Circular 02/2023.

Credit flow is blocked

Data from the State Bank of Vietnam shows that as of January 2024, credit growth in the real estate sector increased by 11.81% compared to the end of 2022, accounting for 21.28% of the total loans in the economy. Among them, credit for real estate business increased by 35.38% while credit for real estate consumption only increased by 1.08%, indicating low demand for home loans or real estate investment.

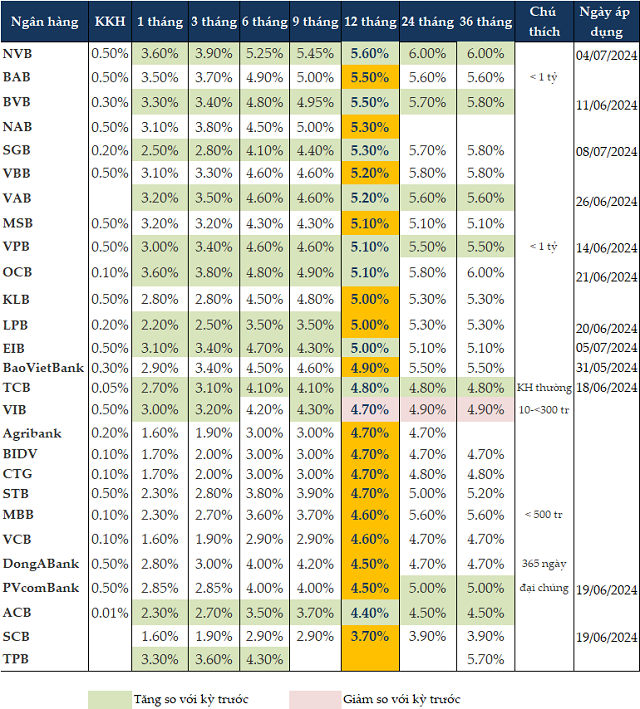

Many banks affirm that interest rates have never been as low as they are currently. Nevertheless, credit growth in January 2024 still decreased by 0.6% compared to the end of 2023, reflecting the low absorption capacity of the economy. In reality, eligible businesses do not have a need for loans while businesses lacking capital cannot meet loan conditions – partly due to strict control of loan quality by banks to limit the occurrence of bad debts.

In terms of real estate businesses, the CEO of a small-scale company reflected that to obtain a loan, projects have to go through many legal procedures and must meet the requirements of having at least 10% matching capital. “Not every bank wants to lend to small businesses, especially new ones that do not have a credit history. As for businesses, a 1-2% reduction in interest rates is necessary, but more importantly, a smooth loan process is needed to implement projects,” said the CEO.

Mr. Nguyen Pham Anh Duy, Director of Investment Advisory Department of CBRE Vietnam, pointed out some of the top challenges in sourcing funds for real estate investment activities in Asia-Pacific, including Vietnam. These include high loan-to-value ratios, interest rate volatility, and increased borrowing costs for new loans.

A branch director of a bank in Ho Chi Minh City said that banks still want to lend to good borrowers, ensuring interest rates according to the requirements of the State Bank and the general market. However, risk management is important. Therefore, requirements for borrowers still include collateral, matching capital, feasible projects, and proper legal procedures.

(*) See Bao Nguoi Lao Dong from the issue dated February 22

Stable long-term interest rates needed

According to SSI Securities Company, a series of laws on real estate, land, and credit institutions recently passed are expected to create more favorable conditions for sustainable development of the real estate market.