After rising sharply to the range of 1,235 points – 1,255 points, corresponding to the short-term price peak in September 2023, VN-Index had a volatile trading week. The selling pressure rose, causing the market to have a sharp decline at the end of the week with a sudden surge in trading volume. However, VN-Index still ended the week of 19-23/2 with a slight increase compared to the previous week, stopping at 1,212 points, maintaining the psychological price level of 1,200 points

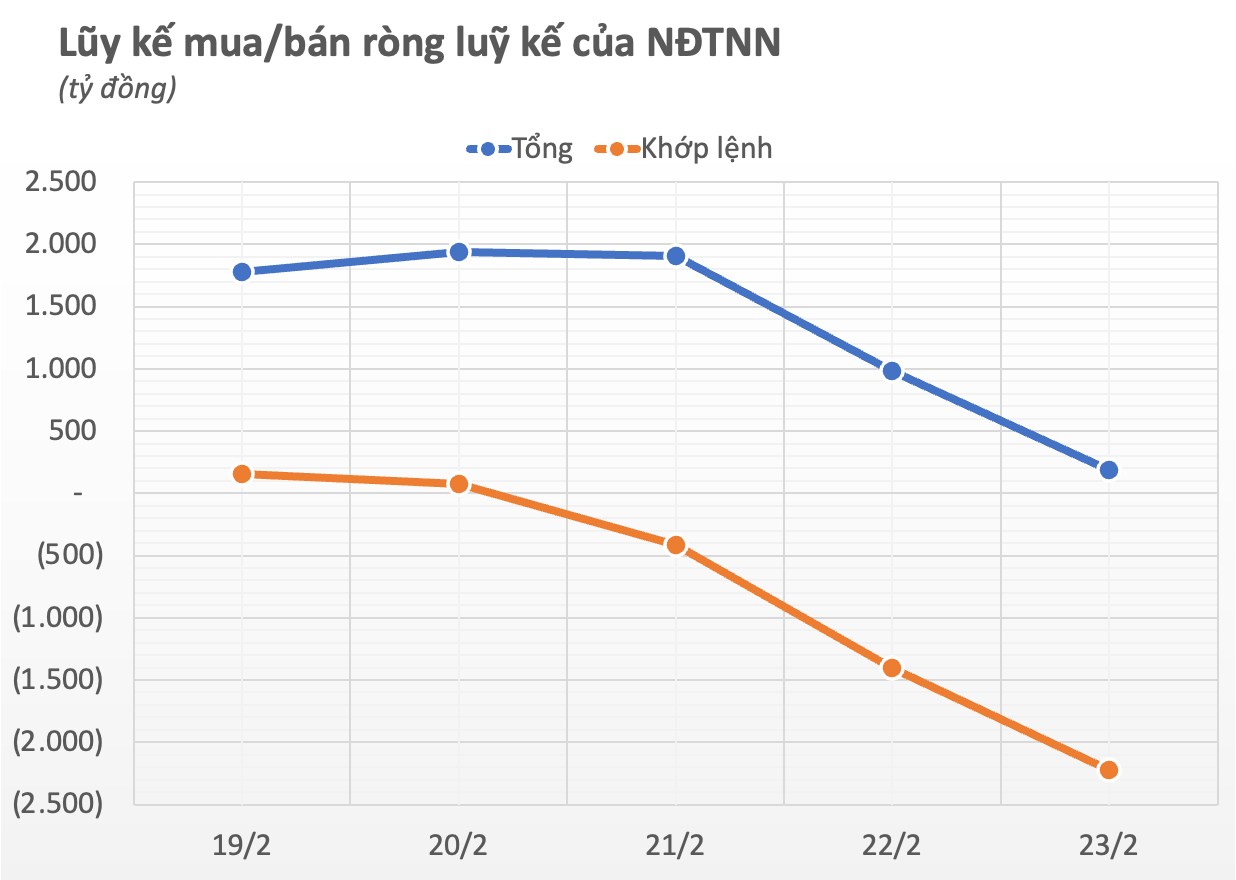

In that context, continuous net selling by foreign investors has somewhat weakened the market support. Last week recorded foreign investors net selling on the matched channel at the end of the week, in contrast to the sudden net buying. The total net buying value for the week reached 190 billion VND, of which net selling on the matched orders reached 2,225 billion VND and net buying on negotiated transactions reached 2,416 billion VND.

Looking at each exchange during the week, foreign investors net sold 1,458 billion VND on HoSE, net sold 40 billion VND on HNX, and net bought 1,689 billion VND on UPCoM.

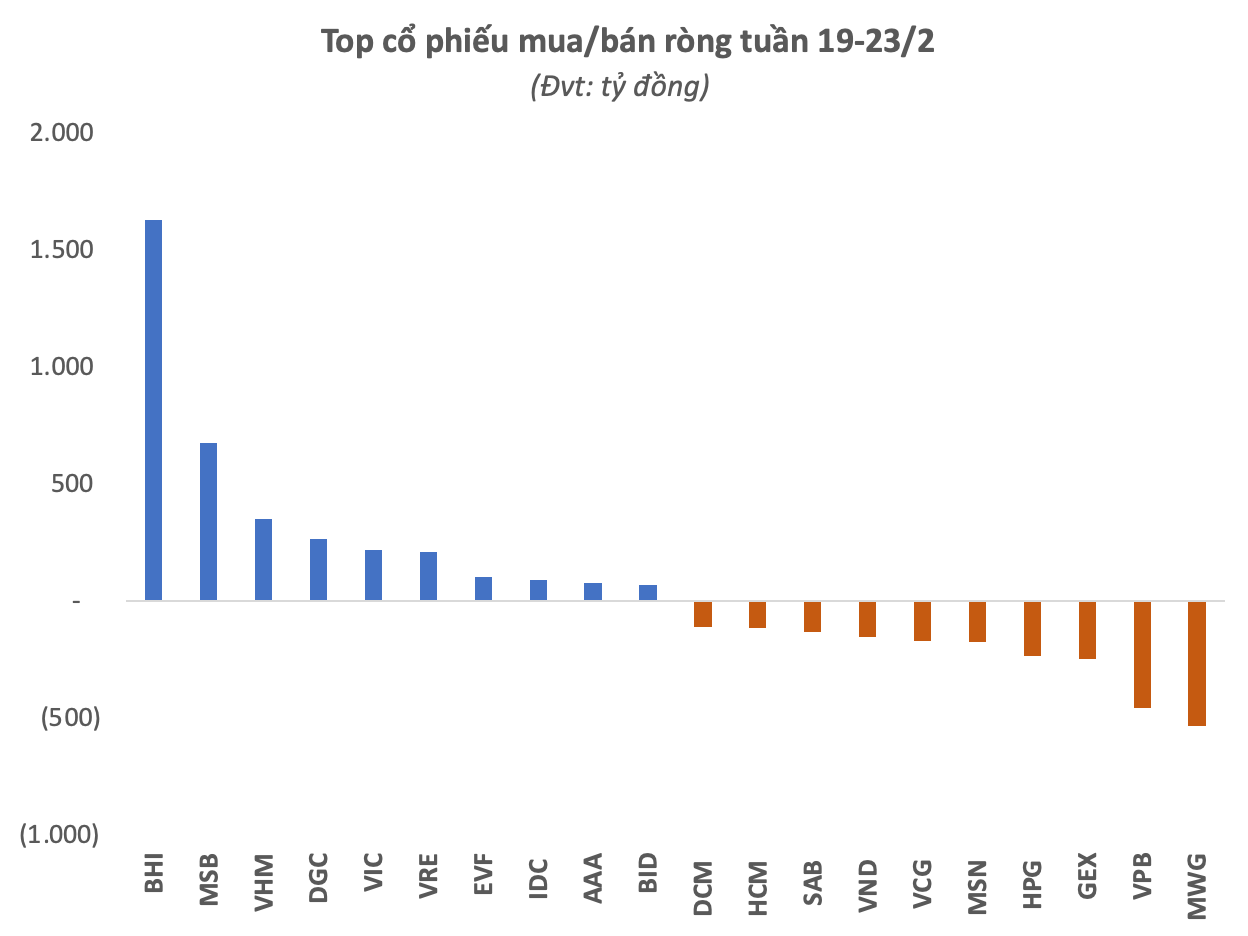

Statistics on each stock, the selling pressure was mainly seen in retail sector stock MWG with a value of 531 billion VND, followed by VPB and GEX, which were also net sold for 455 billion VND and 244 billion VND respectively. The net selling list also included HPG with a value of 234 billion VND and MSN with a net selling of 174 billion VND.

Construction sector stock VCG was also heavily net sold by foreign investors with nearly 168 billion VND, followed by VND with a net selling of 150 billion VND. The net selling list of foreign investors in the past week also included SAB, HCM, DCM,…