However, in this revision, the credit institution’s secured asset retention rights are no longer maintained as stipulated in Resolution 42 on the pilot handling of bad debts. Therefore, credit institutions will have to consider and tightly control credit granting from accessing files, disbursement process, use of borrowed capital and debt recovery as well as handling secured assets…

REDUCING PRESSURE AND LOSSES WHEN SELLING SECURED ASSETS AT LOW PRICES

After 7 years of implementation, Resolution 42/2017/QH14 on the pilot handling of bad debts by credit institutions has contributed to removing difficulties, obstacles, and promoting the quick and effective handling of bad debts.

The provisions of Resolution 42 partially guarantee the rights of parties, promote customer’s proactiveness and payment. From there, it minimizes uncooperative behavior of customers, enhances the awareness of individuals and businesses about their obligation to repay borrowed capital to credit institutions. At the same time, relevant authorities also coordinate and support credit institutions in handling the recovery of bad debts.

Compared to Resolution 42, the Law on Credit Institutions (amended) allows credit institutions to extend the property retention period due to debt settlement to 5 years, instead of 3 years. This provision is positively received by the market.

According to experts, the factors which may cause uncertainty, challenges, and difficulty make the processing time of credit institutions’ secured assets prolonged. Therefore, the 5-year retention period as stipulated by the amended Law on Credit Institutions is relatively reasonable considering the current conditions and near future of the real estate market.

In a positive aspect, extending the property retention period due to debt settlement to 5 years instead of 3 years will help reduce the pressure and increase the ability to recover debts for businesses. Extending the property retention period allows credit institutions more time to find suitable buyers, thereby reducing the pressure to sell assets at low prices and limiting losses.

Selling properties at better prices helps credit institutions recover debts more effectively, minimize bad debts. This also helps release the amount of real estate held by credit institutions and contributes to liquidity for the real estate market.

However, there are concerns about the risks of long-term property retention. Holding properties for a long time can lead to the risk of declining asset value due to market fluctuations, affecting the financial situation of credit institutions. In addition, managing a large amount of real estate can cause high costs and increase the management burden for credit institutions.

Extending the property retention period due to debt settlement can bring benefits to both credit institutions and the debt trading market. However, experts recommend that detailed regulations on implementing the Law should have effective management measures to limit risks and ensure transparency in debt handling.

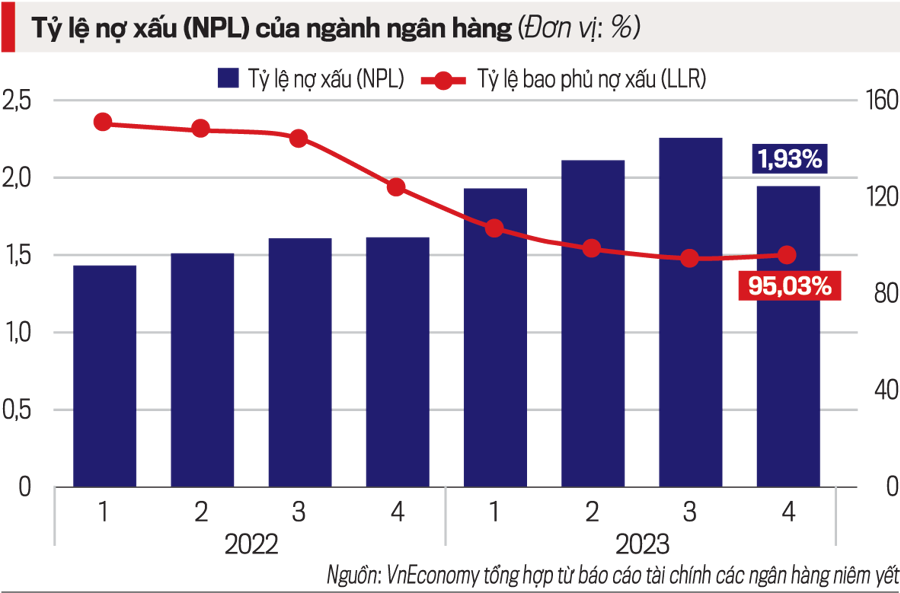

The bad debt ratio of the banking system decreased significantly in the fourth quarter of 2023 to only 1.93% from 2.24% at the end of the third quarter of 2023 (VnEconomy updated from financial reports of listed banks). However, it should be noted that credit growth increased sharply in the fourth quarter of 2023 before strong directions from the Government, which contributed to reducing the scale of bad debts for the total credit reached. and also contributes to restructuring the borrowing for some businesses, thereby reducing the bad debt ratio for the system at the end of 2023.

BANKS WORRY WHEN LOSING SECURED ASSET RETENTION RIGHTS

According to Dr. Nguyen Quoc Hung, Deputy Chairman cum Secretary General of the Vietnam Banks Association (VNBA), bad debts are currently very high. In particular, the regulations allowing the extension and postponement of debts, keeping the debts unchanged under Circular 02/2023/TT-NHNN of the State Bank of Vietnam only help to delay difficulties. If Circular 02 is extended, bad debts will be pushed into the future rather than disappear. Therefore, Hung assessed the prospects for bad debt handling of the banking system will be very difficult in the coming time.

Analyze more about the risks of the economy in 2024, Mr. Tran Long, Deputy General Director of Vietnam Investment and Development Bank (BIDV), assessed that the economic growth momentum such as exports, consumption, industrial production, private investment… is still slow; business operations still have many difficulties such as legal, business environment, logistics costs increase due to the war, while the market is still difficult.

The number of newly established enterprises in January 2024 increased by 2.2% compared to the previous month and increased by 25% compared to the same period last year, but the number of temporarily suspended businesses also increased by 25% compared to the same period in 2023. “The financial capacity of businesses is reduced, their ability to withstand is weak. Many large businesses in the petroleum, electricity sector are facing legal risks. The above difficulties lead to an increase in bad debts in banks, and the coverage ratio of bad debts decreases,” emphasized Mr. Long.

Many recent surveys show that many businesses have low management capacity, weak financial health, inconsistent financial reports, leading to difficulties in evaluation and credit granting. Another situation is that businesses borrow from many different credit institutions. When a business has been loaned by 4 state-owned commercial banks, small joint-stock banks also lend without collateral or security measures. Managing cash flow, limits, and management of accounts receivable for credit institutions is difficult…

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam