Recently, the Board of Directors of Vinacomin’s Six Column Coal Joint Stock Company (stock code: TC6) approved the registration dossier for the issuance of shares to exchange shares under the merger agreement between the Company and Vinacomin’s Nai River Coal Joint Stock Company (stock code: TDN), which was approved by the extraordinary general meeting of shareholders of both parties at the end of 2023.

Specifically, under the approved option, a new company named Nai River – Six Column – Vinacomin Joint Stock Company, headquartered in Cam Pha City, Quang Ninh Province, will be formed after a successful merger, while ending the existence of TC6 and TDN and transferring all legal rights and benefits, unpaid debts, labor contracts, and other obligations to the merged company.

This new company is expected to issue nearly 62 million shares to existing shareholders of TC6 and TDN in exchange for all shares of shareholders in the merged companies at a 1:1 exchange ratio (1 share of TC6 or TDN will be exchanged for 1 share of the merged company) but without transfer restrictions.

The inauguration of TDN’s production. Source: quangninh.gov.vn

|

Also in this resolution, the Board of Directors of TC6 also approved the issuance of shares to comply with the regulations on foreign ownership ratio. Accordingly, the State Securities Commission confirmed the maximum foreign ownership ratio is 0% in both companies and the merged company, which will inherit the entire business activities from TC6 and TDN.

Due to the 1:1 exchange ratio for the share swap between TC6 and TDN to implement the merger, the expected foreign ownership ratio in the merged company will equal the total number of foreign investors’ shares in both companies on the date of the exchange.

In addition, both companies have also registered the maximum foreign ownership ratio with the State Securities Commission to lock the room of foreign investors, in order to avoid increasing the foreign ownership ratio in the company before the merger.

According to the second extraordinary shareholders’ meeting of TC6 in late 2023, the merged company is likely to not mine coal at the current mines of TC6 and TDN but will mine coal at the Six Column – Nai River mine cluster in Cam Pha City, Quang Ninh Province.

Prior to that, TDN was assigned to implement this coal mine project and is currently carrying out preparatory work for the project, including obtaining investment approval, preparing environmental impact assessment reports, reviewing and approving facility designs, and applying for mining licenses, in order to ensure the planned progress.

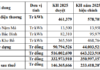

Therefore, the main business activities of the company after the merger will still focus on the core business area operated by each enterprise before the merger, which is coal mining. In 2024, the estimated revenue of the merged company is around VND 5.8 trillion, with after-tax profit of VND 67 billion and a dividend payout ratio calculated on face value of 6%.

The current coal mine being exploited by TC6. Source: TC6

|

Both TC6 and TDN are subsidiaries of the Vietnam National Coal-Mineral Industries Group (Vinacomin), which holds 65% of the shares. After the merger, all employees of both companies will become employees of the merged company and inherit the labor contracts of the two previous enterprises, as well as other working arrangements.

The merger of TC6 and TDN is implemented based on Vinacomin’s decision in October to approve the restructuring of the Group until 2025, aiming to improve efficiency in production and business, solve difficulties in exploration, reserves, waste disposal, streamline organizational structure, and arrange reasonable labor.

Prior to that, UHY Auditing and Consulting Limited Liability Company chose the asset-based method to calculate the value of shares as the basis for calculating the exchange ratio in the merger of the two companies. Specifically, the asset-based method accurately reflects the value of existing assets and the potential of the company at the time of the appraisal, but evaluates assets in a static state.

Tu Kinh