A loophole in the EU’s sanctions allows the import of Russia’s crude oil if it is refined elsewhere, which resulted in Russia pocketing an estimated $1.2 billion from fuel sales in the European Union last year.

For over a year, the EU has banned the import of crude oil and fuel by sea from Russia, as the bloc and other allies such as the US and the UK sought to curtail oil revenue.

However, Russia’s crude oil has been refined into fuel elsewhere, such as in India, and can be imported into the EU, and the Kremlin is still earning revenue from fuel that is “laundered” outside of Russia.

Global Witness has tracked seaborne flows of Russian crude to refineries around the world and then to European ports, and revealed that an estimated 35 million barrels of Russian oil entered the EU in 2023 as refined petroleum products.

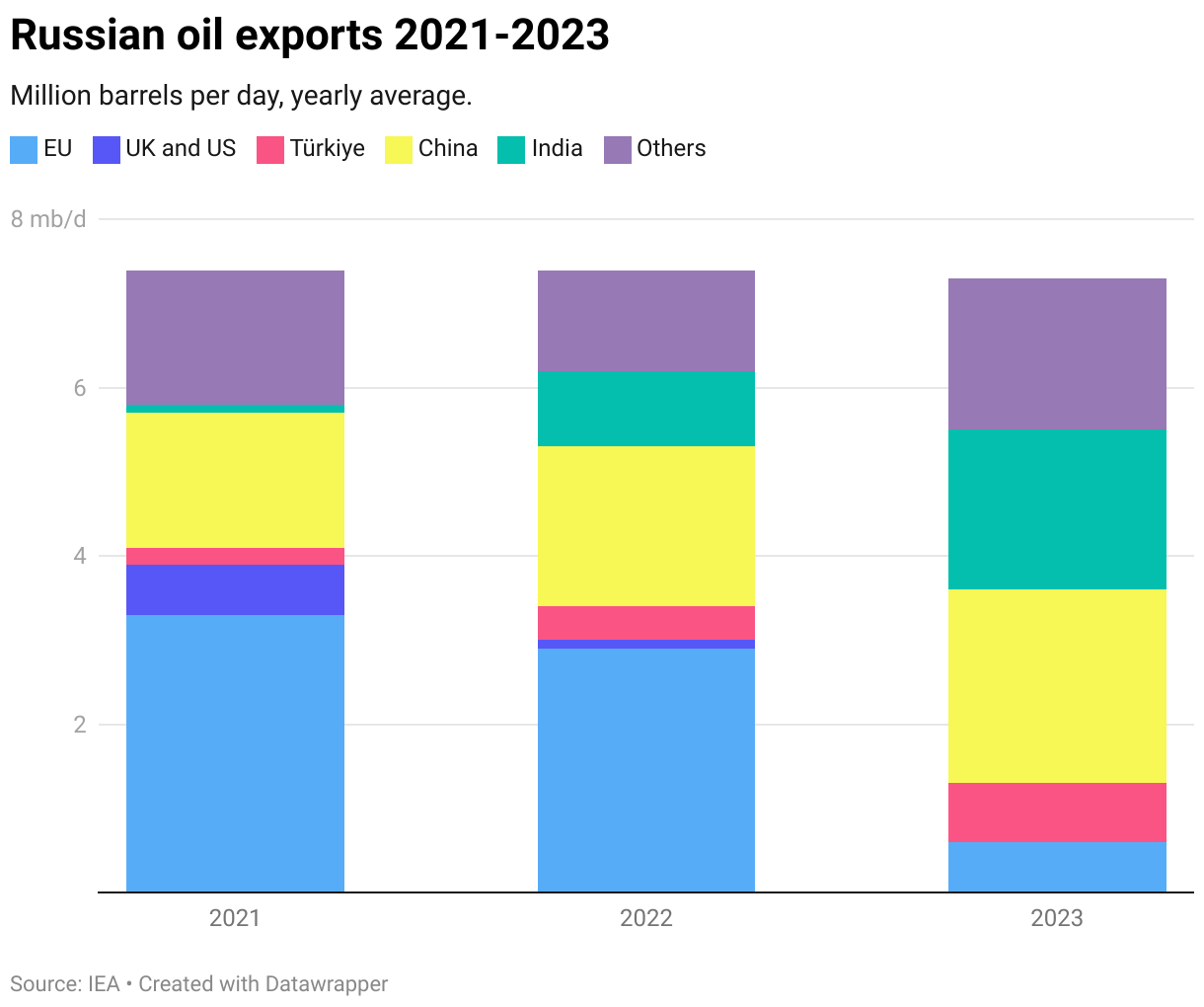

Russian oil exports, 2021-2023

While it is not possible to trace specific molecules, Global Witness has analysed the relative proportions of Russian and non-Russian oil used in refinery feedstocks, where data is available.

“Fuel is flowing in through a not insignificant loophole left by the EU sanctions, allowing refined products from Russian oil to flow into the bloc. This has led to a ‘launderette’ where refineries in countries like India and Turkey, can import discounted Russian crude, refine it into products like diesel, jet fuel or gasoline, and sell the refined oil legally to sanctions-constrained jurisdictions like the EU,” Global Witness said.

Through a similar loophole, Russian fuels are also making their way into the UK and the US. In August 2023, an analysis by Global Witness showed that one out of every 20 flights in the UK was fueled by Russian oil, and in November, Global Witness reported that the US had imported 30 million barrels of fuel from refineries that import Russian oil.

It is clear that Russia’s energy is too attractive to ignore due to its super cheap prices.

China and India are currently Russia’s largest energy importers, surpassing the EU for the past two years. Both Asian countries mainly import oil, followed by natural gas and coal. Turkey has also increased its energy imports from Russia to match the EU.

Prime Minister Modi of India has repeatedly stated that the country plans to continue buying energy products from Russia as long as they are competitively priced. Despite announcing some ambitious climate commitments, India continues to heavily rely on oil and coal, with expected demand to increase along with population growth and industrialisation.

Meanwhile, China’s expenditure on importing energy from Russia has reached nearly $60 billion since the conflict broke out. China has imported a range of Russian energy products at discounted prices, contributing to an estimated $18 billion reduction in China’s energy bill.

Reference: Oilprice