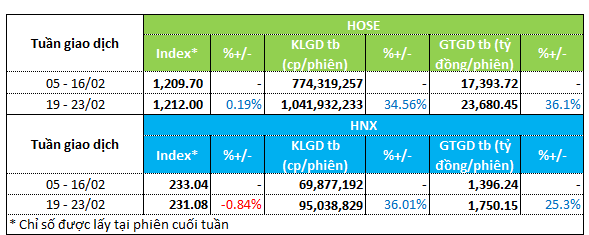

During the trading week of 19-23/02, the indexes of HOSE and HNX had contrasting movements. Specifically, VN-Index increased slightly by 0.2% to 1,212 points, while HNX-Index decreased nearly 1% to 231.08 points.

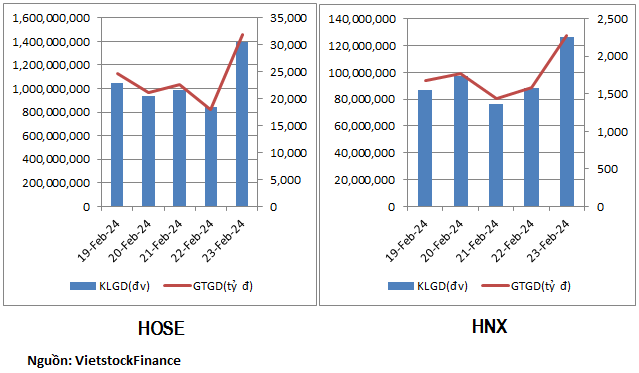

The market liquidity showed a vibrant activity with strong increases on both listed exchanges. Compared to the period of 05-16/02 (sessions before and after Lunar New Year), the trading volume and value on both HOSE and HNX increased significantly.

Specifically, the trading volume on HOSE increased over 34% to over 1 billion units/session, and the trading value increased 36% to 23.6 trillion dong/session. On HNX, the trading volume increased 36% to over 95 million units/session, and the trading value increased 25% to 1.75 trillion dong/session.

|

Weekly liquidity overview 19-23/02

|

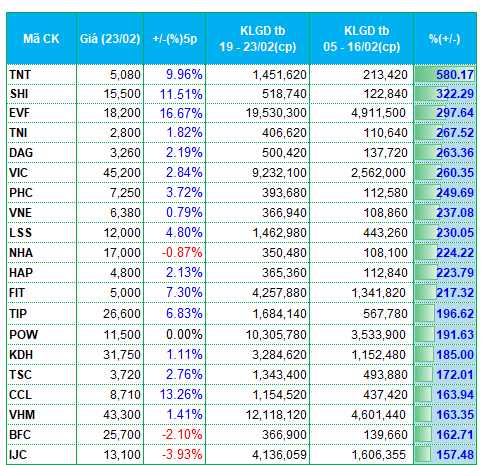

The liquidity increased strongly, and the money flow showed a trend flowing into real estate stocks. On HOSE, many real estate stocks had an increased liquidity compared to the previous period. Representatives of those stocks include VIC, NHA, TIP, KDH, CCL, VHM. Along with that, HNX had representatives such as IDJ, AAV, NDN.

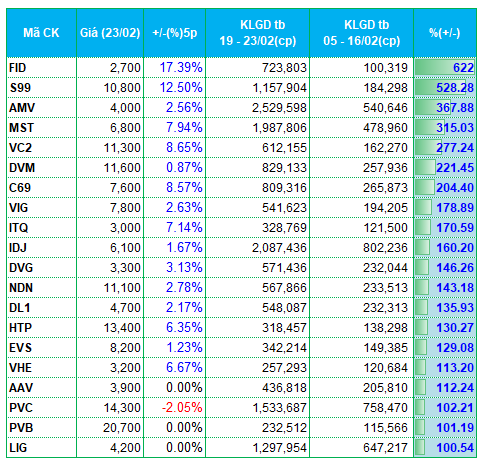

Hand in hand with the real estate group, the construction group also attracted money. Construction stocks like PHC, VNE, S99, MST, VC2, C69, LIG all had a trading volume increase of over 100% compared to the period before and after Lunar New Year.

In contrast to the money flow trend, the agriculture sector experienced a withdrawal of money. HSL, HAG, HNG, BAF, CTP had a sharp liquidity decrease.

Some transportation stocks like HAH, VOS, DXP had a slight decrease in trading volume.

|

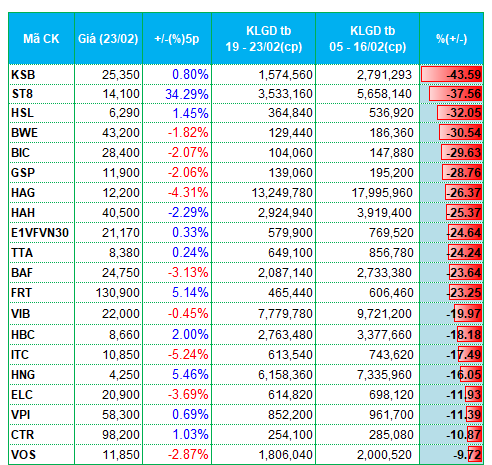

Top 20 stocks with the highest liquidity increase/decrease on HOSE

|

|

Top stocks with the highest liquidity increase/decrease on HNX

|

List of stocks with the highest liquidity increase/decrease based on the average trading volume of over 100,000 units/session.