Warren Buffett

|

The golden age of investing is over

In a letter to shareholders on February 24, the Oracle of Omaha mentioned that there are very few deals that can have the same impact as previous deals, such as the acquisitions of Geico Insurance Company and National Indemnity, or the railroad company BNSF.

“There are only a few companies in the United States that can really have an impact on Berkshire Hathaway and these companies will be chosen by us or by others,” he said. “Outside the United States, there are hardly any candidates for Berkshire’s capital infusion.”

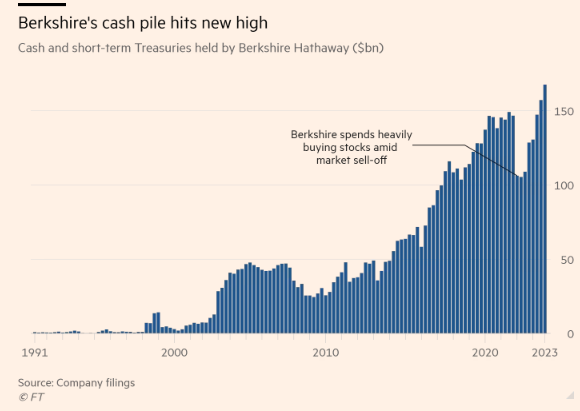

This has been a problem that Warren Buffett has been grappling with for nearly a decade, as Berkshire Hathaway has had too much cash on hand.

In recent years, Warren Buffett’s $905 billion empire has spent billions of dollars to acquire Pilot Flying J truck stop operating company and Alleghany insurance company. However, these big spending moves have only slightly reduced Berkshire Hathaway’s cash pile.

By the end of 2023, this cash pile had reached a record $167.7 billion, an increase of $39 billion from the end of 2022.

“The scale of cash is too large and increasing competition is also a factor that is causing us headaches,” Buffett shares. “For a long period of time, we have seen too many potential companies to evaluate. If I miss an opportunity (I have missed many), then another opportunity will come. Those days are behind us.”

The 93-year-old legend says Berkshire Hathaway can still operate “a little better” than an average American company, and more importantly, operate with very low capital risk.

He adds, “Expectations beyond ‘a little better’ are just fond dreams.”

Challenges await successors

Recently, Warren Buffett also suffered the loss of his “right-hand man” Charlie Munger – the man he praised as Berkshire Hathaway’s architect.

Warren Buffett praises Charlie Munger as Berkshire Hathaway’s architect

Munger’s departure has also drawn more attention to the future of Berkshire without Buffett. Greg Abel, who will succeed Buffett, along with Todd Combs and Ted Weschler, will then steer the conglomerate in the future.

Warren Buffett and Charlie Munger (right)

|

The challenges awaiting them are not small. Since 1964, Berkshire Hathaway’s stock has risen 4.4 million percent, far surpassing the 31,233% increase of the S&P 500.

Buffett’s letters along with his comments at annual meetings and hundreds of interviews over the years will form a handbook for future leaders of Berkshire Hathaway.

“Panics infrequently occur, but occur they will”

In the letter, the Oracle of Omaha emphasizes a principle that has made him famous in the investment world.

“The investment rule at Berkshire will never change: Don’t lose money,” he writes. “Thanks to favorable winds in the United States and the power of compound interest, you will be rewarded if you make some good decisions in life and stay away from serious mistakes.”

Buffett adds that Berkshire Hathaway will continue to seize opportunities as they arise, as it did in early 2022. At that time, the conglomerate poured over $50 billion into the stock market during a selloff.

“Panics do not occur frequently, but they will occur,” he says. “The ability to deploy large amounts of money quickly as the market plunges, along with solid business operations, can bring huge opportunities for Berkshire Hathaway.”

However, the company is facing much fiercer competition than during the turn of the century as private equity funds have less capital at that time. Buffett has continuously complained about the overvaluation of businesses when the market sets records and companies focused on acquiring businesses accepting overly high prices. During these periods, Berkshire Hathaway mostly stood on the sidelines.

Instead, they chose to purchase treasury stock. In the fourth quarter of 2023, Berkshire Hathaway spent $2.2 billion repurchasing treasury shares, bringing the total amount purchased in 2023 to over $9 billion.

Net-selling stocks for 5 consecutive quarters

In the context of the stock market continuously reaching new highs, Berkshire Hathaway has been selling stocks. The company has net-sold stocks for 5 consecutive quarters, with the total amount sold in 2023 reaching $24 billion.

|

Berkshire Hathaway’s buy/sell activity in 2023

|

Berkshire Hathaway’s investment decisions are closely watched by investors to understand what Warren Buffett thinks of the market. When Warren Buffett is not taking action, it is understood that he views the US stock market as being overly expensive.

“At Berkshire Hathaway, we are particularly fond of rare businesses that can generate high returns on incremental invested capital in the future,” he said. “To own one or a few businesses like that and sit tight can bring wealth that is unmatched.”

“Berkshire is a fortress even in financial disasters”

Warren Buffett reassures investors that Berkshire Hathaway, despite financial risks and the absence of Deputy Charlie Munger, will survive.

In an annual letter to shareholders yesterday, Warren Buffett – CEO of Berkshire Hathaway – said the conglomerate worth over $900 billion is a “fortress that can stand strong even in the event of financial disasters.” “Berkshire is built to withstand,” he writes.

This year’s annual shareholders meeting is scheduled for May 4 in Omaha. Following Munger’s departure, this year there will only be two vice-chairmen Greg Abel and Ajit Jain sharing the stage with Buffett at this annual meeting – where he spends hours answering shareholders’ questions, with millions of others watching online.

Warren Buffett’s company makes over $96 billion in net profit, with a record $167 billion in cash