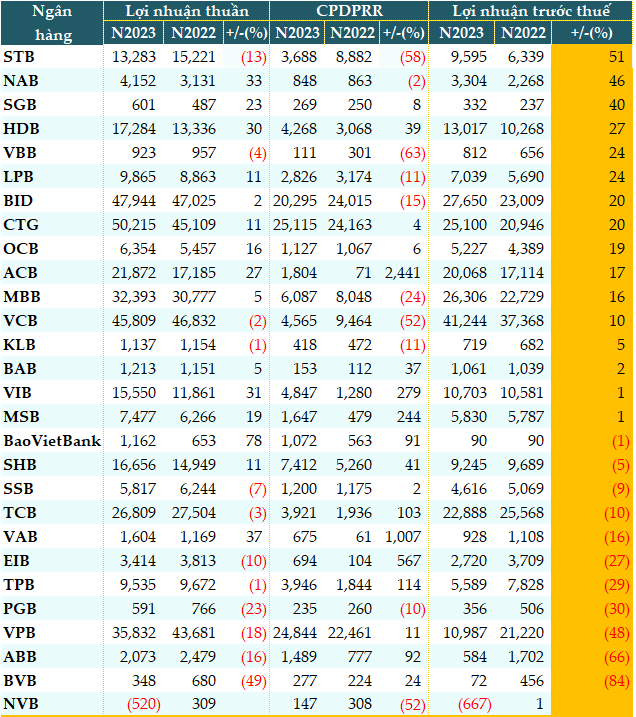

9/28 banks shrink main revenue

Despite the general difficulties of the economy, credit growth in the first 3 quarters of 2023 had slowed down and only picked up pace in the final quarter. Data from the State Bank of Vietnam (SBV) shows that credit growth in 2023 was 13.71%. In terms of value, the banking system provided about 1.5 quadrillion VND to the economy last year, bringing the total credit outstanding to about 13.56 quadrillion VND.

Although credit accelerated towards the end of the year, the main revenue of banks still declined.

Data from VietstockFinance shows that the total main revenue of 28 banks in 2023 increased by 5% compared to the previous year, reaching 448.85 trillion VND in net interest income.

By the end of the fourth quarter, the situation had improved as only 9 out of 28 banks reported a decrease in main revenue, compared to 16 banks in the third quarter. NVB suffered the highest decrease in net interest income (-51%), with only 457 billion VND remaining; ABBank (ABB) decreased by 24% to 2,873 billion VND; Eximbank (EIB) decreased by 18% to 4,597 billion VND, and so on.

The decline in main revenue by many banks can be explained by the need to lower interest rates to support businesses and individuals in overcoming difficulties.

ABBank’s main activity generated only 2,873 billion VND in net interest income, a 23% decrease compared to the previous year due to the implementation of interest rate adjustments to timely support businesses in difficult times as directed by the Government.

BVBank stated that due to the ongoing challenges faced by individual and corporate customers, as well as the implementation of the SBV’s policy on sharing difficulties with customers through enhanced interest rate incentives and interest rate reductions, the net interest income was affected. Therefore, BVBank’s net interest income in 2023 was only 1,479 billion VND, a 14% decrease compared to the previous year.

Source: VietstockFinance

|

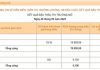

Bancassurance drags down service revenue

The main non-interest income – revenue from services – also declined. In 2023, the total service revenue of 28 banks decreased by 3% compared to the previous year, amounting to only 63.249 trillion VND.

Out of the 28 banks, 14 banks reported a decrease in net profit from services. NVB remained the bank with the strongest decline (-74%), followed by PGB (-56%) and Sacombank (STB, -50%).

However, there were still banks that saw a significant increase in service revenue in 2023. ABBank had the highest growth with nearly 749 billion VND in net profit from services, 3.2 times higher than the previous year. LPB earned 3,566 billion VND in service revenue, 2.2 times higher. NAB also recorded a 2.2-fold increase in service profit with 590 billion VND.

Source: VietstockFinance

|

One of the reasons for the decline in bank service revenue in the past year is the difficulties in the insurance business, particularly in Bancassurance.

VIB’s net profit from services in 2023 increased by 4% compared to the previous year, reaching 3,327 billion VND. The relatively low growth rate was due to a 32% decrease in insurance commission income, which amounted to only 879 billion VND.

Similarly, at TPBank, revenue from business services, insurance, and advisory decreased to only 377 billion VND, a 57% decrease compared to the previous year. Techcombank also saw a 62% decrease in revenue from insurance collaboration services, reaching only 667 billion VND.

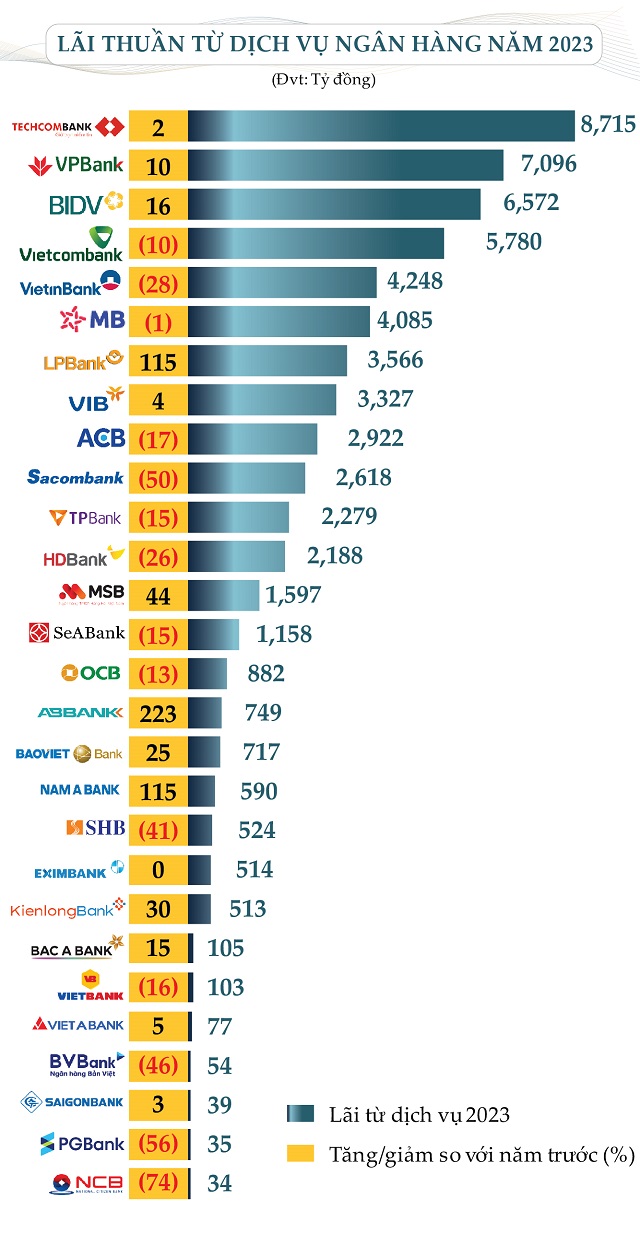

Extraordinary profit from stock investments

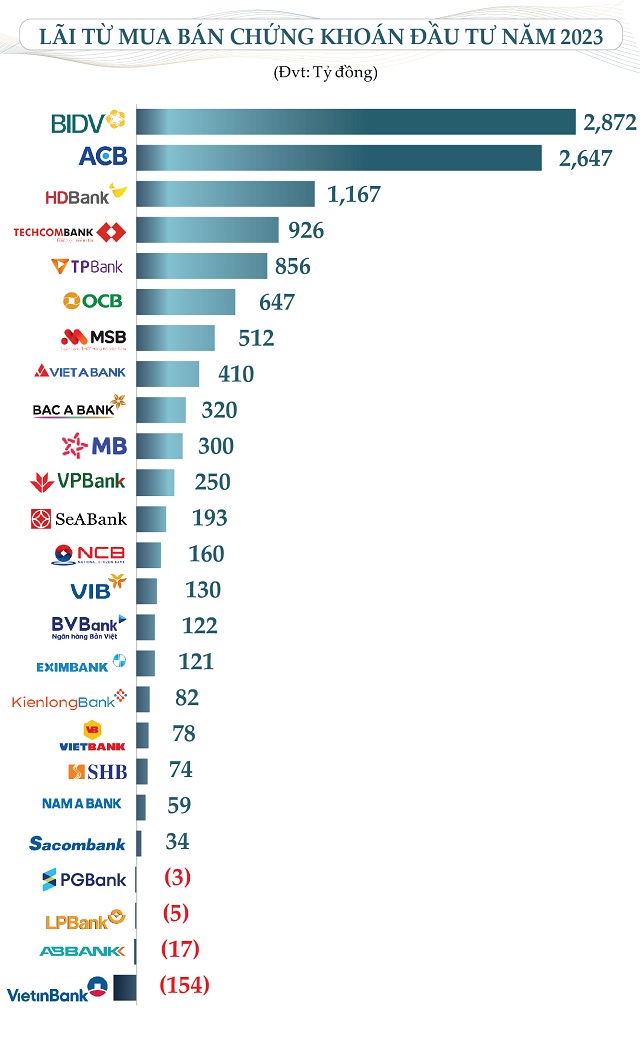

Significantly, there was a remarkable increase in profit from stock investments by some banks, contributing significantly to their non-interest income.

ACB stated that the contribution of non-interest income to total revenue was 24%; as a result, the pressure on interest income decreased. Specifically, foreign exchange trading services and investment activities significantly contributed to the growth of ACB’s revenue.

In addition, the stock trading activities turned from a loss to a profit of more than 168 billion VND. The investment in stock trading generated an extraordinary profit of 2,647 billion VND, while in the previous year, it only reached nearly 21 billion VND.

BIDV recorded a profit of 2,872 billion VND from stock investments, compared to 258 billion VND in the previous year.

KLB earned a profit of 82 billion VND from stock investments, a ten-fold increase from the previous year. This was the main source of income contributing to the overall revenue growth for the bank.

BVBank earned a profit of over 122 billion VND from stock investments, while the previous year reported a loss, thanks to nearly doubling bond trading volume.

Source: VietstockFinance

|

Prof. Dr. Nguyen Huu Huan, a lecturer at Ho Chi Minh City University of Economics, believes that when profits from lending activities decline, Bancassurance profits also decline, forcing banks to seek alternative sources of profit. Therefore, profit from stock investments has been one of the sources used in the past year to optimize income.

However, this depends on the specific strategies of each bank, and the profit from this item may come from securities trading, stock trading, trading bonds before maturity, etc. Nonetheless, these items do not bring substantial profit to the bank, as the main focus should be on the core business profit, rather than profit from securities trading or stock investment, which are not the main activities of banks.

Ultimately, the most important concern should be the growth of core business profit, while other sources of income are considered “extra”, and they may increase unusually this year but may not be present in subsequent years.

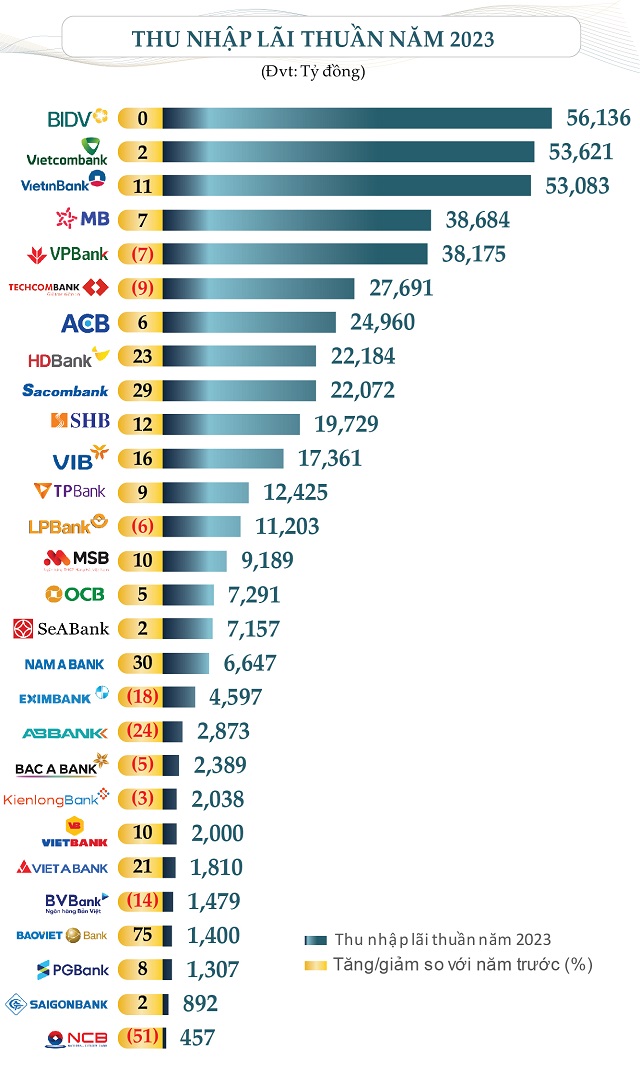

Provisions erode profit

2023 was not a bright year. The main revenue and non-interest income had a significant differentiation, with 12 out of 28 banks reporting a decrease in net profit from business activities and 1 bank reporting a loss.

In addition, banks increased their provisions for credit risk to increase the total provisioning expense of the 28 banks to 123.98 trillion VND, a 3% increase compared to the previous year. Out of the 28 banks, 18 banks increased their provisions, eroding their net profit.

As a result, 11 banks experienced a decrease in pre-tax profit in 2023, and 1 bank recorded a loss.

For example, VAB achieved a net profit from business activities of 1,604 billion VND (+37%), but set aside 675 billion VND for provisions (11 times higher), resulting in a 16% decrease in pre-tax profit to only 928 billion VND.

Eximbank also experienced a similar situation, with a net profit from business activities of 3,414 billion VND, a 10% decrease compared to the previous year. At the same time, the bank set aside provisions of 694 billion VND (6.7 times higher), resulting in a 27% decrease in pre-tax profit to 2,720 billion VND.

|

Pre-tax profit of banks in 2023 (Unit: Billion VND)

Source: VietstockFinance

|

Prof. Dr. Dinh Trong Thinh, an economic expert, assessed that the decrease in bank profits is due to the fact that the profits of commercial banks currently depend on lending. Therefore, the first obvious reason is that if loans cannot be granted, the profit will decrease.

In addition, banks are currently increasing provisions to prevent risks for bad debts in accordance with the decision of the SBV.

When the effectiveness of Circular 02/2023/TT-NHNN expires (which is under consideration for extension by the SBV), the pressure to set aside provisions for restructured loans or non-restructured bad debts will increase, significantly reducing bank profits.

According to Prof. Dr. Nguyen Huu Huan, in general, the overall profit of the banking system still grew, but there was a differentiation into two groups. Large banks maintained or even increased their profits, while small banks saw a decrease in profits mainly due to increased provisions and higher bad debt risks compared to large banks.

Although large banks also experienced an increase in bad debt ratios during this difficult period, their rate of increase was not as high as that of small banks.

The most important factor to consider is still the growth of core business profit. Other sources of income are “savings,” which may increase unusually this year but may not be present in subsequent years.

Prof. Dr. Cat Lam