The BlackRock Bitcoin ETF witnessed a massive influx of $520 million in net inflows from $577 million in net inflows, immediately pushing the price of Bitcoin to break the $60,000 level.

This week has been fantastic for Bitcoin Spot ETFs as they saw a $520 million inflow on Monday and recorded another massive inflow of $577 million on Tuesday.

The massive inflow comes after BlackRock’s iShares Bitcoin ETF witnessed its own $520 million inflow, causing BTC to rise to $60,000.

BlackRock leads the Bitcoin Spot ETF money flow

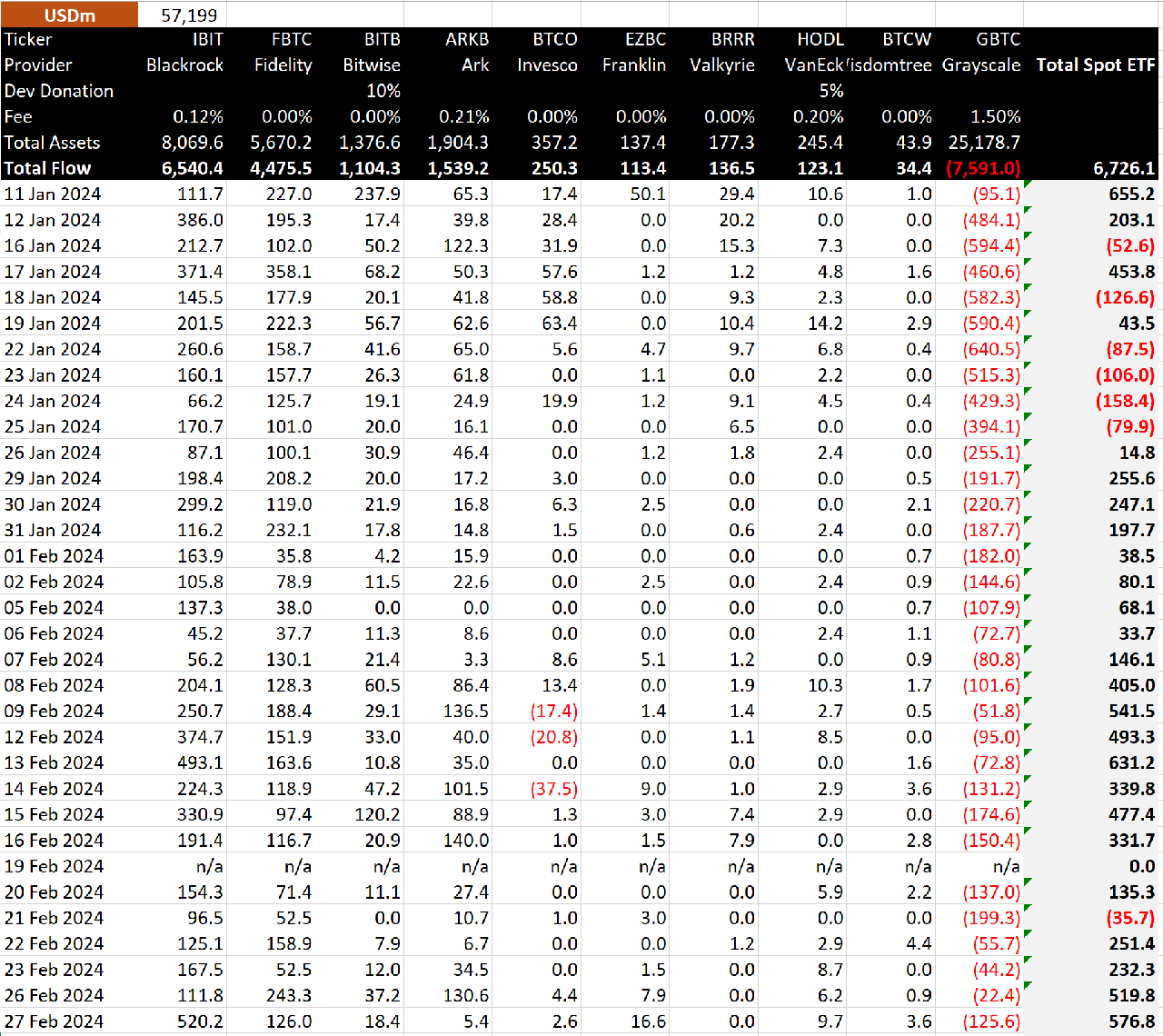

According to data from BitMEX Research, Bitcoin Spot ETFs witnessed a net inflow of $577 million (equivalent to 10,167.5 BTC) on February 27th.

This is the third-largest inflow since its debut, with all 9 Bitcoin ETFs experiencing massive trading volumes. In particular, Grayscale’s GBTC saw a rebound on Tuesday after falling to $22.4 million the day before.

BlackRock iShares (IBIT) reached over $520 million, breaking the record for the largest inflow to date. IBIT also achieved a record-breaking trading volume of $1.3 billion, surpassing the daily trading volume of most large-cap stocks in the US.

According to the latest figures, BlackRock’s net inflow reached over $6.5 billion and the assets held increased by over 141,000 BTC.

In addition, Fidelity (FBTC) and Ark 21Shares (ARKB) recorded $126 million and $5.4 million, respectively. Bitwise (BITB), VanEck (HODL) and other Bitcoin ETFs also witnessed significant inflows.

Notably, GBTC saw an outflow of $125.6 million, increasing from an inflow of $22.4 million on Monday.

Bloomberg analyst Eric Balchunas revealed that the daily trading volume of the 9 new Bitcoin ETFs excluding GBTC has exceeded $2 billion for the second consecutive day while BTC price has remained above $57,000.

BTC price breaks above $60,000

The BTC price surged to over $60,000, just a few percentage points away from the all-time high of $68,600 set 27 months ago. The low and high within 24 hours were $56,329 and $60,450, respectively.