According to our survey, as of now (27th February), there have been 2 banks, Sacombank and BVBank, that adjusted their interest rates for certain terms.

Specifically, the latest savings interest rate at Sacombank was adjusted upwards for short terms, after two cuts.

Specifically, for terms from 1 month to below 2 months, Sacombank raised it by 0.2 percentage points to 2.4% p.a. Deposit interest rates for terms from 2 months to below 3 months increased by 0.2 percentage points to 2.5% p.a. Deposit interest rates for terms from 3 months to below 4 months increased by 0.1 percentage points to 2.7% p.a. Deposit interest rates for a 4-month term increased by 0.1 percentage points to 3% p.a. Deposit interest rates for a 5-month term increased by 0.4 percentage points to 3.4% p.a.

For other terms, interest rates remain unchanged. Specifically, the interest rate for a 6-month term is 3.7% p.a. The interest rates for 8-month and 9-month term deposits are listed at 4% p.a. The bank pays interest of 4.8% p.a. for a 12-month term, 5.4% p.a. for an 18-month term, and 5.5% p.a. for a 24-month term. The highest interest rate that Sacombank currently applies at the counter is 6% p.a. for a 36-month term.

The latest savings interest rate table at Sacombank.

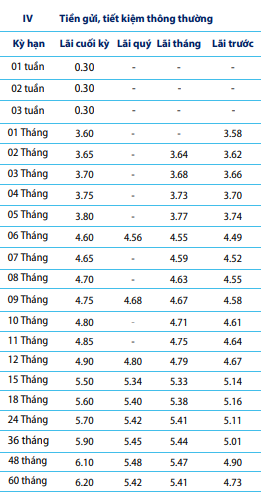

Previously, the latest savings interest rate at BVBank increased by an additional 0.1-0.2 percentage points for longer terms such as 15 months (5.5% p.a.), 18 months (5.6% p.a.), 24 months (5.7% p.a.), 36 months (5.9% p.a.), 48 months (6.1% p.a.), and 60 months (6.2% p.a.).

This bank reduced interest rates for terms from 6 months to 11 months and kept them unchanged for terms from 1 month to 5 months.

The latest savings interest rate at BVBank.

According to experts, savings interest rates tend to increase again after a long period of continuous declines to attract deposits after the Lunar New Year credit usually increases rapidly. In a previous report, MBS experts predicted that interest rates would likely bottom out in Q1-2024 because it would be difficult to further decrease as credit demand tends to rise. This unit also forecasted that the 12-month term deposit rate of large commercial banks could increase by 25-50 basis points, returning to 5.25%-5.5% in 2024.