In the session on February 27, the market saw a strong rebound. The VN-Index maintained its upward trend throughout the trading session and closed at the highest level thanks to the increase in large-cap stocks such as banks, securities, and steel… At the end of the session, the VN-Index increased by 13.29 points to 1,237.46 points. Foreign trading contributed positively with a net buying value of 55 billion VND across the market.

In this context, securities companies recorded net selling reversing with a value of 421 billion VND.

On HoSE, securities companies recorded net selling of 420 billion VND, with net selling of 494 billion VND on the matching order channel but net buying of 73 billion VND on the negotiated order channel.

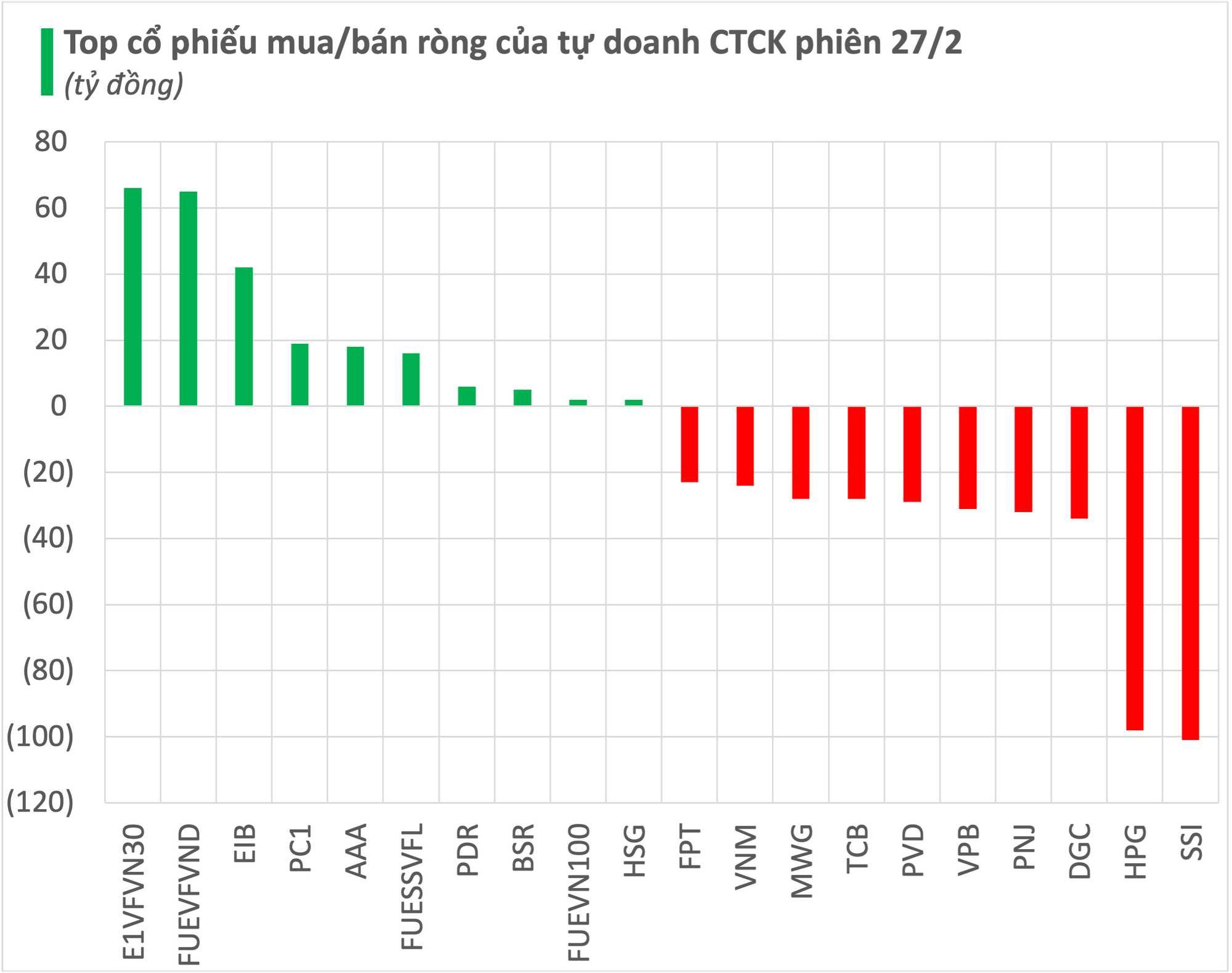

In detail, the most strongly sold stocks by securities companies were SSI with 101 billion VND, followed by HPG and DGC with net selling of 98 billion VND and 34 billion VND respectively. Additionally, PNJ also saw net selling of 32 billion VND. Other stocks that were net sold in today’s session included VPB, PVD, TCB, MWG, VNM…

On the contrary, securities companies had the strongest net buying activity in two fund certificates E1VFVN30 and FUEVFVND with net buying of 66 billion VND and 65 billion VND respectively. Additionally, EIB and PC1 stocks were also net bought with values of 42 billion VND and 19 billion VND for each stock.