The trading volume of VN-Index recorded in the morning session reached over 415 million units, with a value of over 9.6 trillion VND. HNX-Index recorded a trading volume of nearly 48 million units, with a trading value of over 994 billion VND.

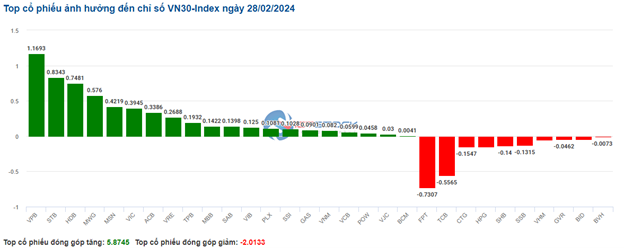

In the morning session, the stocks BID, CTG, FPT had the most negative impact, taking away nearly 1.5 index points. On the contrary, the stocks VRE, VIC, VPB had the most positive impact, compensating for more than 1.6 index points.

Source: VietstockFinance

|

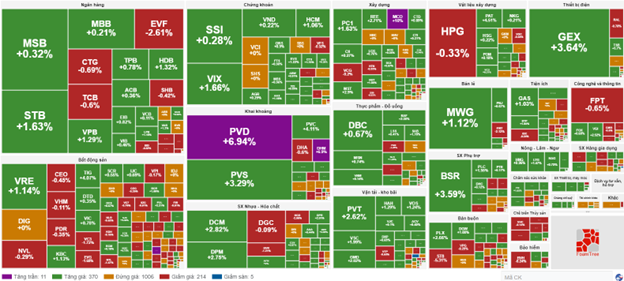

The mining sector continues to maintain its leading position in contributing the most to the index’s growth at the end of this morning session. Stocks in this sector have all performed well, such as PVD, which reached its limit increase right from the beginning of the session with a 6.94% increase, followed by PVS (+3.01%), PVC (+3.42%), PVB (+2.38%), C32 (+2.19%), DHM (6.4%),…

In addition, the plastics – chemicals industry is also one of the positive sectors in the morning session. Specifically, stocks in this group all had good increases, such as GVR with a 1.04% increase, DCM with a 2.08% increase, DPM with a 2.17% increase. The remaining stocks PHR, LAS, APH, DPR, CSV all maintained a positive green color.

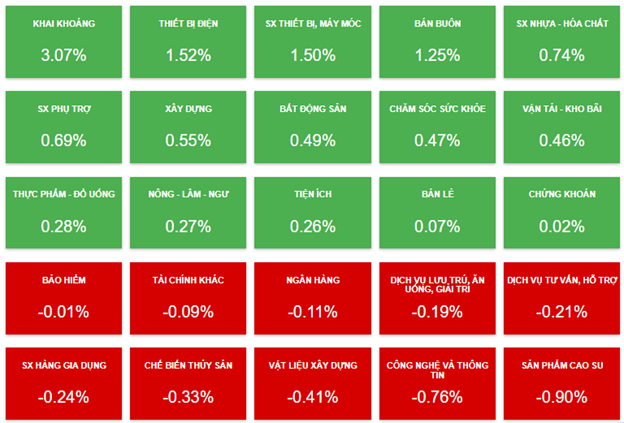

Development of sector groups at the end of the morning session on 28/02. Source: VietstockFinance

|

At the end of the morning session, the green color temporarily took the upper hand when looking at the overall industry. Among them, the mining sector is currently the most shining sector with a 3.07% increase. On the contrary, the rubber product sector is the most negative sector with a 0.9% decrease.

10:30 AM: Inclining towards an increase

VN-Index increased by 3.37 points, trading around 1,240 points. HNX-Index increased by 0.52 points, trading around 235 points.

Most of the stocks in the VN30 basket are colored in green. Among them, the 4 bank stocks VPB, STB, HDB, and ACB stand out with their contributions of 1.17 points, 0.83 points, 0.75 points, and 0.34 points to the VN30 index. On the other hand, FPT, TCB, CTG, and HPG are the stocks that are still under pressure to sell, taking away more than 1 point from the index.

Source: VietstockFinance

|

The mining sector of stocks was colored in green right from the beginning of the session. Among them, oil and gas stocks such as PVD increased limit, PVB increased by 2.86%, PVC increased by 3.42%, and PVS increased by 3.29%… The rest of the stocks were in a steady state, and some stocks were still under selling pressure, such as KSB, NBC, C32, and DHA.

The securities industry group also contributed to the overall market’s upward trend, with most of the stocks in this group such as SSI increasing by 0.28%, HCM increasing by 0.71%, VIX increasing by 1.93%, and FTS increasing by 0.38%…

Meanwhile, the rubber product sector is showing mixed movements, with stocks declining like CSM (-1.15%), DRC (-1.21%), BRC (-2.94%)

Compared to the opening of the session, buyers are still more dominant. With 381 stocks increasing (11 stocks increasing to the ceiling) and 219 stocks decreasing (5 stocks decreasing the floor). The total trading volume on all 3 exchanges reached over 367 million units, equivalent to over 8.3 trillion VND.

Source: VietstockFinance

|

Opening: Positive session with oil and gas stocks

At the beginning of February 28, by 9:30 AM, VN-Index fluctuated around the reference level, nearly 1,237 points. HNX-Index slightly increased, maintaining around 236 points.

The mining group led with a 3.17% increase in the early morning session. Among them, oil and gas stocks had strong gains, with PVS (+4.11%), PVC (+4.11%), PVB (+4.29%) leading the way. Meanwhile, PVD and DHM stocks hit the ceiling with increases of 6.94% and 6.9% respectively.

Crude oil futures rose on Tuesday (February 27), amid uncertainty about the prospects for a ceasefire in the Israel-Hamas war and with some investors expecting OPEC+ to extend production cuts after the first quarter.

In addition, Russia has approved a six-month ban on gasoline exports starting from March 1, 2024. These developments may be the driving force behind the increase in oil and gas stocks.

Wholesale group also recorded good growth, contributing positively to the index with a 1.19% increase. With the significant contribution of stocks like PLX (+2.1%), PET (+1.64%), PSH (+3.95%), SHN (+6.76%),…

In addition to the two groups mentioned above, many Large Cap stocks are experiencing positive movements. GAS, PLX, SAB, VIC, BCM are also contributing to the support of the index.

Lý Hỏa