Illustration photo

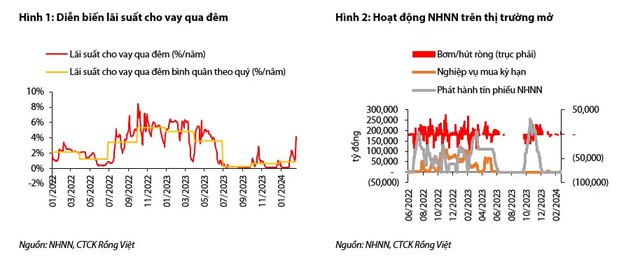

Interbank interest rates are gradually increasing

In contrast to the same period last year, interbank interest rates in February 2024 are increasing sharply but are showing signs of cooling towards the end of the month.

Specifically, the average interest rate for overnight loans in February 2024 (as of February 23rd) is 2.21% per annum, 1.97 percentage points higher than the average rate in January 2024. The same trend is seen in the interest rates for 1-week loans. However, the upward movement of interbank interest rates is weaker for longer maturities. Accordingly, the average interbank interest rates for 2-week and 1-month terms in February 2024 are 2.21% and 3.06% respectively, an increase of 1.7 percentage points and 0.85 percentage points compared to the previous month’s average rates. It is worth noting that the interbank interest rates for 3-9 months have not changed much in February 2024, and have all decreased by 0.21 percentage points compared to the previous month’s average rates.

In the trading session on February 21st, the overnight loan interest rate reached its highest level since May 2023, at 4.14% per annum, but gradually cooled down to 3.63% per annum in the last trading sessions of the week by February 23rd.

Parallel to the interbank market trends, the State Bank of Vietnam (SBV) has also resumed its money pumping activities through open market operations on a larger scale than in the previous month. In the week of February 19th-23rd, the SBV auctioned 31,000 billion VND in 7-day term, but only 6,037.51 billion VND was awarded at an interest rate of 4.0% per annum. In both auction sessions (February 20th and 21st), there was only one member participating and being awarded the bid.

These developments indicate liquidity shortages at some banks before and after the Lunar New Year holiday. However, VDSC believes that this is not a cause for concern and systemic liquidity can return to normal in March 2024 based on the following reasons: 1) overnight lending rates are decreasing, 2) the scale of liquidity injection by the SBV is low in terms of volume and number of participants in the open market, and 3) there is no significant fluctuation in longer-term interbank interest rates.

Although short-term upward fluctuations in interbank interest rates are not too worrisome, the long-term trend shows that interbank interest rates are gradually rising, from a low of 0.23% per annum in the third quarter of 2023 to 0.62% in the fourth quarter of 2024 and 0.85% per annum in the first two months of 2024, according to VDSC.

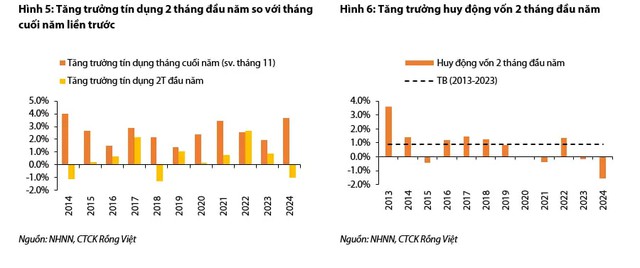

Funding mobilization at the beginning of 2024 is lower than in previous years

According to the figures from the State Bank of Vietnam, credit growth for the entire economy has been negative in the first two months of the year. Specifically, credit growth as of the end of January is -0.6%, and as of February 16th is -1.0%. The credit growth of some typical banks in January 2024 has declined more sharply than the industry average, such as Vietcombank (-2.3% compared to the end of 2023), BIDV (-1.3%), or MB (-0.7%).

According to VDSC, low credit growth in the early months of the year is a common phenomenon, with an average credit growth of 0.56% in the first two months of the period 2013-2023. Negative credit growth in the first two months of the year occurred in 2014, 2018, and 2024. Although official data for the end of February 2024 is not available, analysts believe that the negative growth in the first two months of 2024 seems more severe because this year’s conditions are different from the period before when the SBV licensed the entire credit limit from the beginning of the year.

Not only has credit growth been negative in the first two months of the year, but capital mobilization for the economy is also not optimistic. Growth in capital mobilization as of February 16th is estimated at -1.6% compared to the end of 2023. Specifically, capital mobilization in VND decreased by 1.25% and in USD decreased by 5.9%.

“Looking back at historical data, the growth of capital mobilization in the early months of the year tends to slow down in the period from 2020 until now. However, based on the estimates as of February 16th, 2024, the capital mobilization activities this year are also lower than in previous years. This partly explains the signs of stress in the system’s liquidity in the early months”, evaluates VDSC.

On the other hand, in February 2024, the trend of decreasing deposit interest rates in the banking system continues, especially in private joint-stock banks with a decrease of 0.1-0.2 percentage points. However, some banks have adjusted their deposit rates upward in the past month, such as Sacombank, Techcombank, or ACB, with increases ranging from 0.1-0.4 percentage points.

VDSC believes that the opposite adjustments in deposit interest rates by some banks in February, combined with the upward trend of interbank interest rates, may imply a scenario of gradually increasing deposit interest rates from the second quarter of 2024, earlier than the previous expectations of the analysis group that deposit interest rates may increase from the second half of 2024.