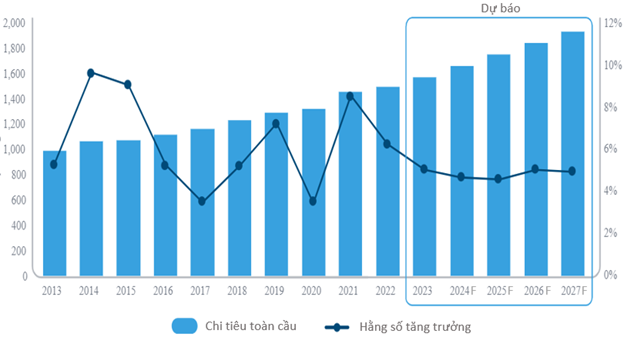

Retail sector continues to grow

In 2023, the total retail sales of goods and consumer service revenue at current prices is estimated to reach 6,231.8 billion VND, an increase of 9.6% compared to the previous year. Therefore, this growth rate has exceeded the government’s target set at the beginning of the year, which is to increase by 9% compared to the same period last year.

The growth rate of the retail sector in 2023 is lower than last year, but it is still growing and continues to outpace the GDP growth rate. In addition, the Prime Minister has set specific strategic objectives for the period 2021 – 2030, the value of domestic trade is expected to grow at an average rate of about 9 – 9.5% per year; contribute about 15 – 15.5% to the country’s GDP by 2030; the total retail sales of goods and consumer service revenue are expected to grow at an average rate of 13 – 13.5% per year.

Comparison of growth rates between the retail sector and GDP from 2016 to 2023

(Unit: Percentage (%))

Source: General Statistics Office

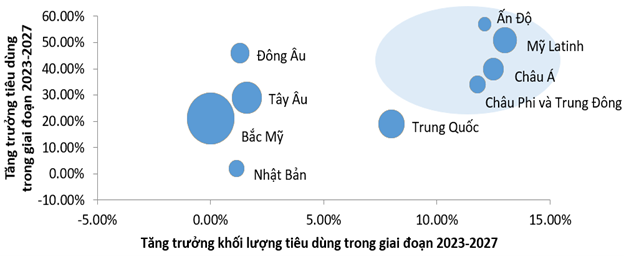

Consumers remain optimistic despite economic challenges

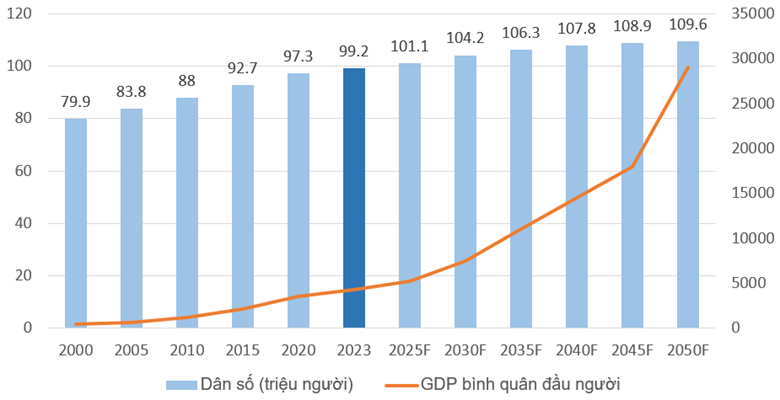

The outlook for Vietnam’s development in the next decade remains optimistic, as GDP has rebounded – according to McKinsey’s analysis. Annual GDP growth is expected to reach 2 – 7% from 2023 to 2030. The level of confidence and optimism in Vietnam’s economic recovery potential is among the highest in Asia.

Confidence in the economic recovery potential of countries around the world

Source: McKinsey Global Institute

The middle class in Vietnam will grow strongly

In recent years, Vietnam’s middle class has maintained its development momentum, expanding geographically and becoming more diverse. The consumer force is growing stronger, with higher and more demanding requirements.

Half of Vietnam’s population will join the middle class after 2030, creating more disposable income and driving consumption. The ICT retail sector will benefit in the long term from this trend.

Growth of the middle class in Vietnam from 2000 to 2030

(Unit: Million people)

Source: McKinsey Global Institute

Notable stocks

Mobile World Investment Corporation (HOSE: MWG) is an enterprise with a dominant market share, with over 3,300 retail stores, surpassing competitors such as FPT Shop and Viettel Store.

Number of stores of technology retail companies

Source: VietstockFinance

Revenue structure of MWG accumulated in 11 months of 2023

Source: MWG

The divestment of Bach Hoa Xanh will bring breakthrough potential for MWG. After a period of restructuring in April 2022, Bach Hoa Xanh currently has nearly 1,700 operating stores. Currently, this retail chain is offering 10% of its shares for sale, instead of the initial plan of 20%. The reduction is due to the positive business results of Bach Hoa Xanh, which has become the only bright spot in MWG’s revenue structure. Previously, in late September 2023, Reuters reported that the valuation of Bach Hoa Xanh could be in the range of $1.5-1.7 billion.

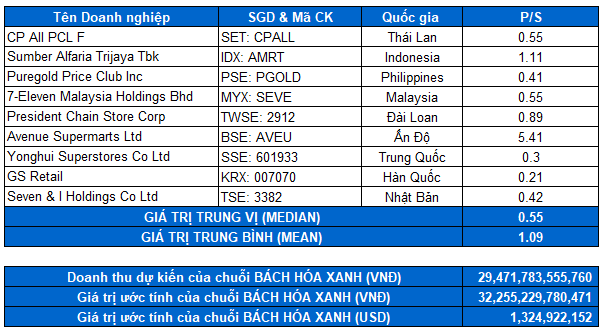

According to the author’s own valuation, Bach Hoa Xanh will have a value of about $1.32 billion, assuming that its revenue in 2023 is about 29.5 trillion VND and P/S ratio of comparable stocks in the Asian region (calculated on average) is 1.09 times.

Comparison table of companies in the consumer retail sector

Source: Investing & MWG

If the deal is successful, Bach Hoa Xanh in particular and MWG in general will have a very large capital injection, which will greatly facilitate business operations and expansion in the future. Thereby, achieving the goal of achieving breakeven in 2024 and generating profits in the following years.

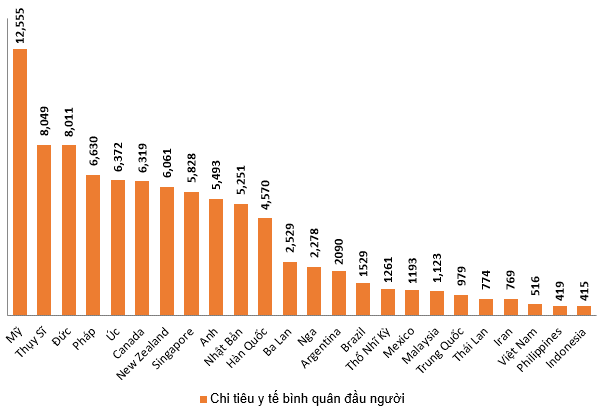

Investment Outlook 2024: Pharmaceutical Retail Sector

Enterprise Analysis Department, Vietstock Advisory Department