In the latest investor’s letter, Mr. Petri Deryng, the founder and manager of PYN Elite Fund, made some assessment about the Vietnamese stock market.

The boss of Pyn Elite Fund believes that investors can expect good returns from the Vietnamese market in 2024. The strong performance of VN-Index has motivated domestic investors to return to the market, resulting in a 10% increase in the performance of PYN Elite Fund since the beginning of the year.

Mr. Petri Deryng believes that the currency market, banking liquidity, and interest rates have stabilized and return to attractive levels. Therefore, listed companies in Vietnam will see a profit growth of more than 20% in 2024.

Particularly, the head of Pyn Elite Fund has high expectations for the banking sector – currently the largest proportion on the stock exchange. Mr. Petri Deryng expects significant profit growth in the banking sector.

“Stocks in general, especially banking stocks, have been undervalued for the past few years. There is a great potential for price increase when the Vietnamese economy continues to thrive with a favorable monetary market cycle,” Mr. Petri Deryng expressed his opinion.

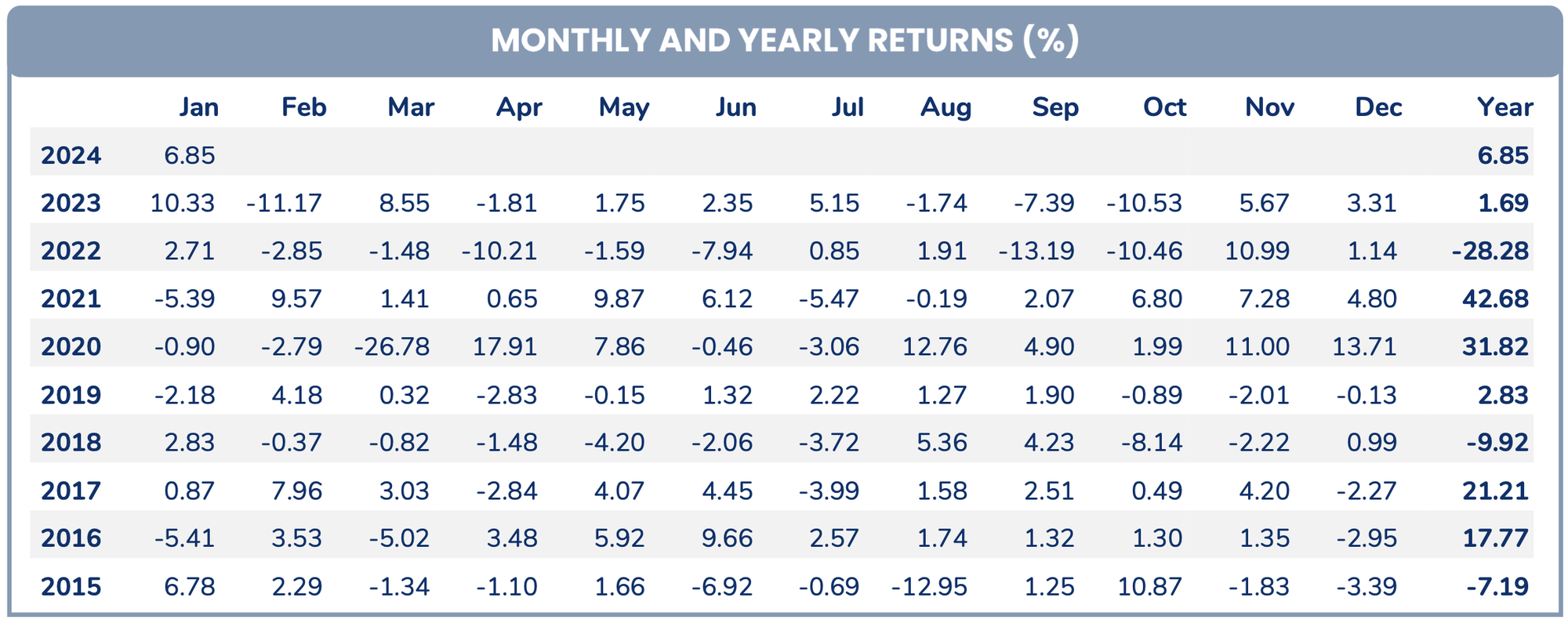

Prior to that, Pyn Elite Fund had a favorable first month in 2024. After a struggling year in 2023, the fund achieved an investment performance of 6.85% in January, exceeding the 3% increase of VN-Index. This is the third consecutive month that the foreign fund from Finland has recorded positive performance.

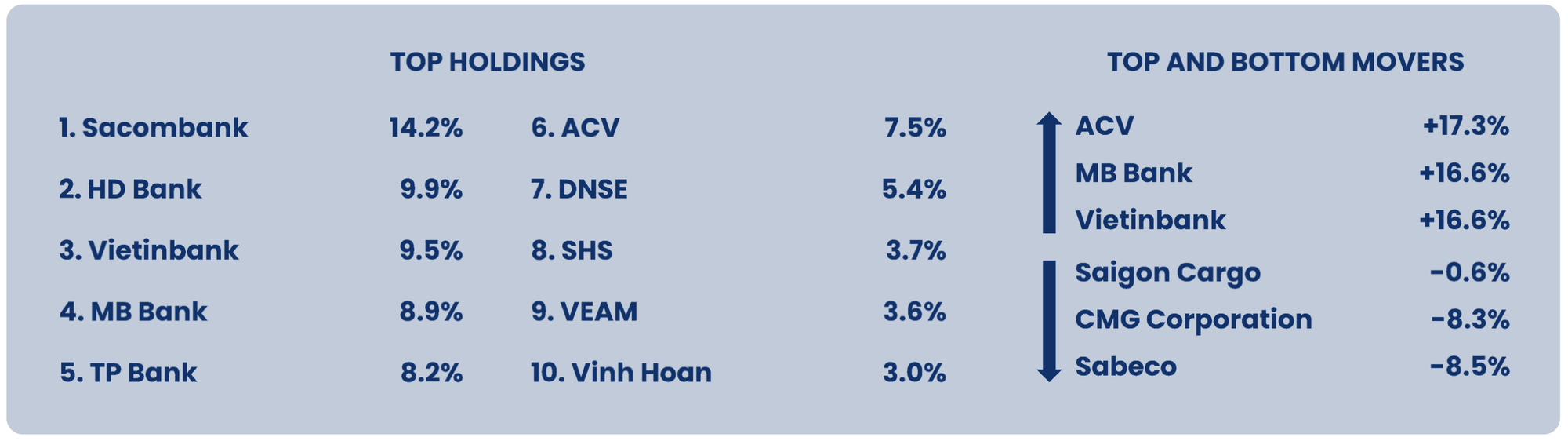

The above results were driven by the excellent recovery of ACV and banking stocks. At the end of January 2024, the managed portfolio scale of Pyn Elite Fund reached over 747 million EUR (~ 19,650 billion VND). The top 5 largest investments are all banks including STB, HDB, CTG, MBB, TPB, accounting for a total proportion of 50.7%. Following are ACV, DNSE, SHS, VEAM, and VHC, respectively.

According to Pyn Elite Fund’s explanation, banking stocks in the fund’s portfolio have good performance partly thanks to high profit growth. The Q4/2023 total income of the 6 banks in the fund’s portfolio increased by 31% compared to the same period of 2022. Throughout 2023, this figure is 18% while the rest excluding banks had a 13% negative total income compared to 2022.

In addition, the case involving the non-listed bank SCB was handled well and the unrelated listed banks are expected to have a strong growth in 2024. The bad debt of the 15 largest normal operating banks is still well maintained, reaching a peak of only 2.34% in Q3/2023, before decreasing to 1.91% in Q4.

According to Pyn Elite Fund, the above results were driven by the excellent recovery of ACV and banking stocks. At the end of January 2024, the managed portfolio scale of Pyn Elite Fund reached over 747 million EUR (~ 19,650 billion VND). The top 5 largest investments are all banks including STB, HDB, CTG, MBB, TPB, accounting for a total proportion of 50.7%. Following are ACV, DNSE, SHS, VEAM, and VHC, respectively.

According to the explanation of Pyn Elite Fund, banking stocks in the fund’s portfolio have good performance partly thanks to high profit growth. The Q4/2023 total income of the 6 banks in the fund’s portfolio increased by 31% compared to the same period of 2022. Throughout 2023, this figure is 18% while the rest excluding banks had a 13% negative total income compared to 2022.

In addition, the case involving the non-listed bank SCB was handled well and the unrelated listed banks are expected to have a strong growth in 2024. The bad debt of the 15 largest normal operating banks is still well maintained, reaching a peak of only 2.34% in Q3/2023, before decreasing to 1.91% in Q4.