9 companies have inventory worth over VND 10 trillion

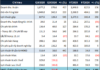

Statistics from VietstockFinance on 109 companies (on HOSE, HNX, and UPCoM) that published Q4/2023 financial statements in the real estate group, including residential and industrial real estate, the total value of inventory as of December 31, 2023, was VND 472.2 trillion, a decrease of nearly VND 1.2 trillion (equivalent to a decrease of 0.3%) compared to the beginning of the year. Among them, 45 companies decreased, 11 remained unchanged, and 53 companies increased their inventory compared to the beginning of the year.

Source: VietstockFinance

|

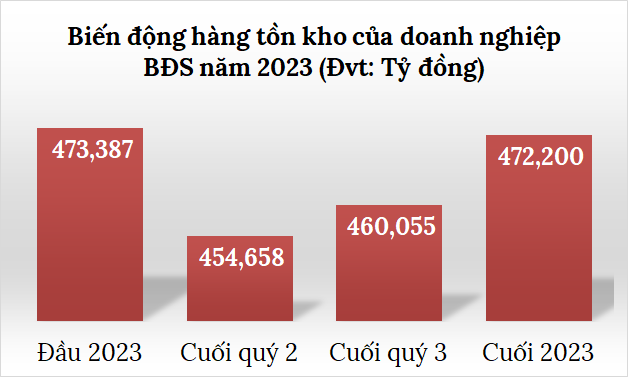

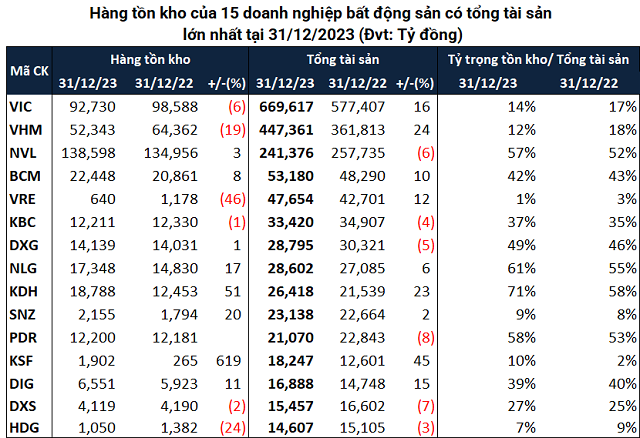

Novaland (NVL) continues to be the company with the highest inventory value of VND 138.598 trillion, an increase of 3% compared to the beginning of the year, accounting for 29% of the industry’s total inventory. Novaland’s inventory cost is mainly in large projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City. Among them, the majority is the value of real estate inventory for sale, under construction, nearly VND 130 trillion, including land use costs, design consultancy, construction, and other costs directly related to the projects.

In addition, Novaland has finished real estate inventory for sale, worth nearly VND 9.015 trillion, a 24% decrease compared to the beginning of the year.

Source: VietstockFinance

|

Vin Group’s two companies, Vingroup (VIC) and Vinhomes (VHM), rank immediately after Novaland with inventory values at the end of 2023 of VND 92.730 trillion and VND 52.343 trillion, respectively, a decrease of 6% and 19% compared to the beginning of the year. For VHM, most of the inventory is under-construction real estate, with VND 49.407 trillion, including construction costs and development of notable projects such as the Dream City eco-urban area, Dai An urban area, Grand Park, Vinhomes Ocean Park, Vinhomes Smart City…

One of the top industrial real estate companies with a significant amount of inventory is Becamex Industrial Investment and Development Corporation (BCM) with VND 22.448 trillion, an increase of 8% compared to the beginning of the period. BCM’s inventory is mainly in production costs, unfinished operations, nearly VND 20.120 trillion consists of compensation costs, land use rights, construction investment costs, and other costs related to projects.

Meanwhile, Khang Dien House Trading and Investment Joint Stock Company (KDH) recorded a record inventory value of VND 18.788 trillion, an increase of 51% compared to the beginning of the year.

Other companies with inventory values above VND 10 trillion include Nam Long Group (NLG) (VND 17.348 trillion, an increase of 17%), Dat Xanh Group (DXG) (VND 14.139 trillion, an increase of 1%), Khang Dien Investment and Trading Joint Stock Company (KBC) (VND 12.211 trillion, a decrease of 1%), and Phat Dat Real Estate Development Corporation (PDR) (VND 12.200 trillion, approximately the same as the beginning of the year).

In total, there are 9 real estate companies with inventory values above VND 10 trillion as of the end of 2023.

Inventory fluctuations in different directions

In the past year, although the overall inventory of the industry did not change much, many companies experienced fluctuations in their inventory.

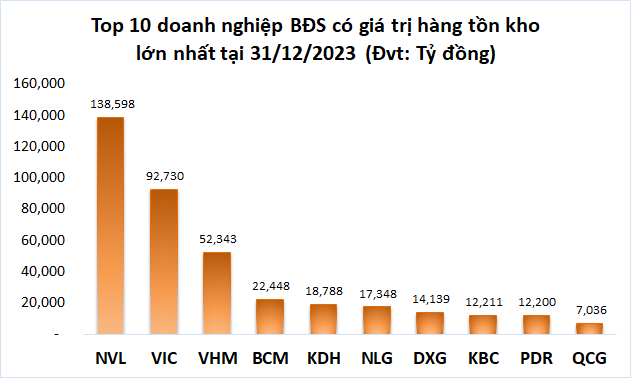

In the decreasing group, Đức Trung Investment Joint Stock Company (DTI) is the most notable with a decrease of 94% compared to the beginning of the year, leaving it with nearly VND 2 trillion in inventory.

Danh Khoi Group (NRC) had VND 12 billion in inventory, an 81% decrease. This change was due to a sharp decrease in the production costs and unfinished operations of NRC, which amounted to only VND 11 billion, while it was over VND 60 billion at the beginning of the year.

Da Nang Housing Investment and Development Joint Stock Company (HNX: NDN) had an inventory of over VND 133 billion, a 67% decrease, due to the production costs and unfinished operations of the Monarchy – Block B complex project, which decreased by 69% compared to the beginning of the year, to VND 123 billion.

Khai Hoan Land Group (KHG) also decreased by 54% to VND 211 billion; among which, the value of the inventory was real estate goods belonging to commercial projects, villas in Long Hau commune, Can Giuoc district, Long An province; mixed-use commercial office and residential area in Ban Yen Nhan ward, My Hao town, Hung Yen province; and mixed-use commercial center, office space, high-end apartments in Quang Trung ward, Vinh city, Nghe An province.

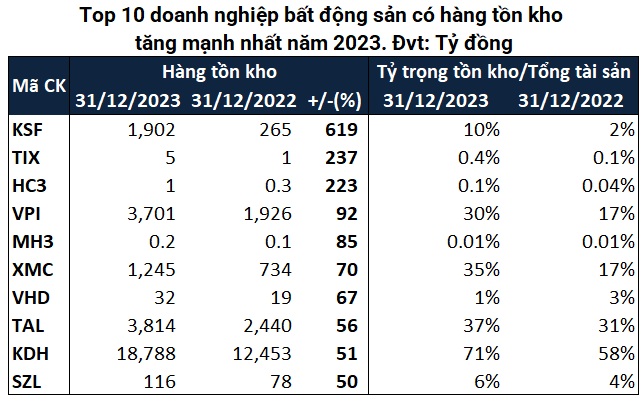

Source: VietstockFinance

|

Regarding the growth rate, the most notable is Real Tech Group (KSF) with an inventory increase of VND 1.902 trillion, more than 7 times the beginning of the year; mostly in production costs and unfinished operations of over VND 1.643 trillion, 400 times higher than the beginning of the year, reflecting the costs of unfinished construction at the Sunshine Golden River project.

Van Phu – INVEST Investment Joint Stock Company (VPI) had an inventory of VND 3.701 trillion at the end of 2023, an increase of 92% compared to the beginning of the year; this increase came from the production costs and unfinished operations of two projects, Song Khe – Noi Hoang (Bac Giang) with nearly VND 202 billion and Vlasta Thuy Nguyen (Hai Phong) with over VND 1.727 billion. In addition, VPI also has The Terra Bac Giang project, which is worth over VND 1.478 trillion and is under unfinished production and operation.

Furthermore, VPI has finished real estate inventory worth over VND 106 billion, of which Vlasta Sam Son contributed VND 85 billion (construction and the infrastructure of villas in Thanh Hoa province).

Source: VietstockFinance

|

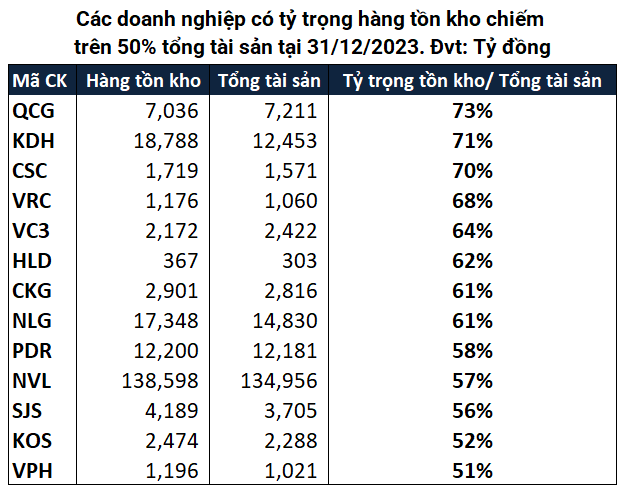

Inventory accounts for over 50% of total assets

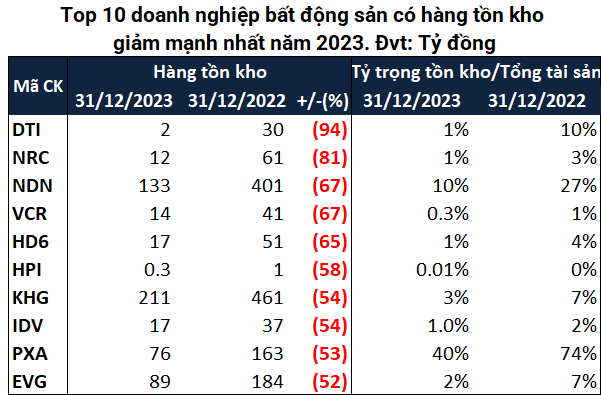

Statistics show that as of the end of 2023, there are 13 real estate companies with inventory accounting for over 50% of total assets, mostly in residential and land segments.

Quoc Cuong Gia Lai Joint Stock Company (HOSE: QCG) has inventory accounting for 73% of total assets, about VND 7.036 trillion, a 2% decrease compared to the beginning of the year. Among them, the cost of unfinished real estate, compensation, land use rights, construction costs, and other costs related to the projects accounted for the majority with nearly VND 6.532 trillion.

Nam Long Group (NLG) has inventory worth VND 17.348 trillion, accounting for 61% of total assets and concentrated in unfinished projects such as Izumi (about VND 8.551 trillion), Waterpoint Phase 1 (VND 3.560 trillion), Waterpoint Phase 2 (about VND 1.604 trillion), Hoang Nam – Akari (about VND 1.667 trillion), and Can Tho project (about VND 1.281 trillion). Coming last in this top is Van Phat Hung Corporation (VPH) with a 51% ratio.

Source: VietstockFinance

|

If considered by total assets, the three giants, VIC, VHM, NVL, account for 60% of the industry’s total inventory. For industrial real estate segment, the inventory of the top 3 companies, BCM, KBC, and SNZ is about VND 36.814 trillion, accounting for only about 8% of the industry’s total inventory.

Source: VietstockFinance

|

| According to the report data from 53 out of 63 localities, as reported by the Ministry of Construction, there were about 16.315 properties in inventory in Q4/2023 (including apartments, detached houses, and land lots). Among them, there were 2.826 apartments, 5.173 detached houses, and 8.316 land lots. The majority of the inventory was in the residential housing and land lot segments of the projects. |