On March 1, FTSE Rusell will announce the quarterly Q1 2024 portfolio of the FTSE Vietnam Index, the underlying index of the FTSE Vietnam Swap UCITS ETF (FTSE Vietnam ETF).

On March 9, it will be the turn of the MarketVector Vietnam Local Index, the underlying index of the Vaneck Vectors Vietnam ETF (VNM ETF), to announce its periodic portfolio composition. The aforementioned ETFs will complete the restructuring of their entire portfolios on March 15.

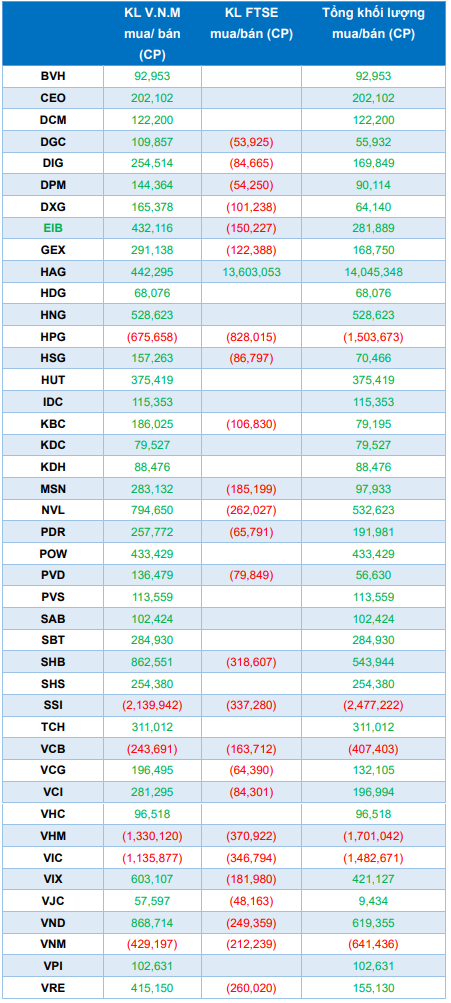

Yuanta Securities has provided forecasts of the component stock portfolios and the quantity of shares to be bought/sold for the respective index-tracking ETFs.

Regarding VNM ETF, Yuanta forecasts that the MarketVector Vietnam Local Index will not add or remove any stocks. Therefore, the VNM ETF will only buy and sell to change the weightings of stocks in its portfolio. As of February 26, the total size of the VNM ETF was nearly $530 million (~13.065 trillion VND).

Yuanta projects that the VNM ETF will buy an additional 867,000 shares of VND, 863,000 shares of SHB, 795,000 shares of HAG, 603,000 shares of VIX, and 529,000 shares of HNG,…

In contrast, 2.1 million shares of SSI, 1.3 million shares of VHM, and 1.1 million shares of VIC may be sold to reduce their weightings in the portfolio.

Regarding the FTSE Vietnam Index, Yuanta forecasts that the FTSE Vietnam Index will add HAG stocks and not remove any stocks. Currently, the size of the FTSE Vietnam ETF is over 8.83 trillion VND.

According to the aforementioned forecast, 13.6 million shares of HAG will be added to the portfolio of the FTSE Vietnam ETF. In contrast, 828,000 shares of HPG, 371,000 shares of VHM, 347,000 shares of VIC, and 319,000 shares of SHB may be sold during this restructuring period.