Illustrative image

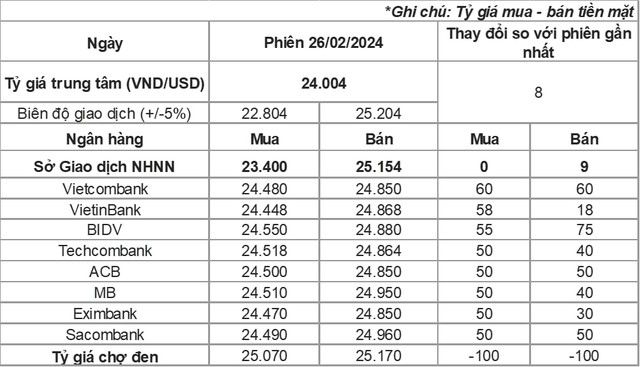

The central exchange rate today (26/2) announced by the State Bank at 24,004 VND/USD, up 8 dong compared to the previous weekend. Thus, the central exchange rate returned to the 24,000 dong threshold after nearly a month below this level.

With a margin of 5%, the USD exchange rate for commercial banks is allowed to trade from 22,804 – 25,204 VND/USD.

At the Transaction Office, the State Bank also increased the selling price of USD by an additional 9 dong, to 25,154 dong/USD, and kept the buying price at 23,400 dong/USD.

In the banking market, the USD price of commercial banks all increased this morning. According to a survey at 11am, Vietcombank increased 60 dong in both trading directions compared to the previous weekend, to buy – sell at 24,480 – 24,850 VND/USD. VietinBank increased the buying price by 58 dong and the selling price by 18 dong to trade at 24,448 – 24,868 VND/USD. BIDV increased the buying price by 55 dong and the selling price by 75 dong, to buy – sell at 24,550 – 24,880 VND/USD.

On the private group side, the USD price was also increased by 30 – 50 dong compared to the closing price of the previous week. It was mentioned that MB and Sacombank have raised the selling price of USD to the range of 24,950 – 24,960 VND/USD.

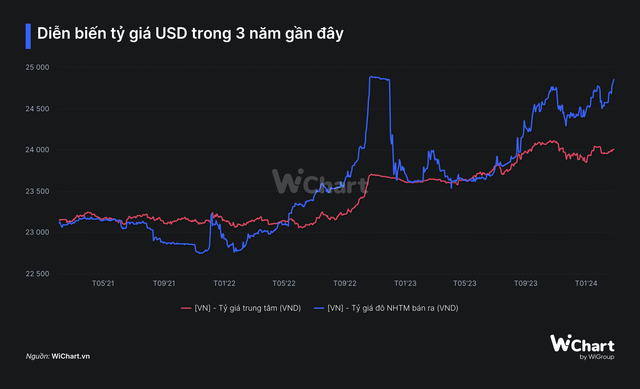

The USD exchange rate in banks has increased strongly after the Lunar New Year holiday. In less than 2 weeks, the USD price in banks has increased by about 280 – 300 dong/USD and is currently only about 30 – 50 dong away from the historical peak. Overall, since the beginning of the year, the USD price in banks has increased by about 400 – 450 dong in both trading directions, equivalent to 1.8%.

In the black market, the USD price is being bought – sold at 25,070 – 24,170 dong, and both the buying and selling prices have decreased by about 100 dong compared to the survey level of the previous weekend.

Source: Compiled by Quoc Thuy

According to analysts, the USD/VND exchange rate is under pressure due to increasing imports of petroleum products related to the upcoming maintenance plan of Binh Son Refining and Petrochemical Joint Stock Company (BSR). Besides, the exchange rate also faces many pressures in the context of the greenback’s strong recovery in the international market and the high USD – VND interest rate difference. The free USD exchange rate is also influenced by foreign currency demand for trade activities close to Tet and the price difference of gold domestically and globally,

Viet Capital Securities Company (VCSC) stated that in the first meeting of 2024, the US Federal Reserve decided to keep the basic interest rate at 5.25% – 5.50%, but the Commission also stated that the possibility of reducing interest rates in March is quite low. The Fed’s statement, along with the deep interbank interest rate difference between VND and USD, can continue to put pressure on the exchange rate. However, the abundant foreign capital inflows from FDI, remittances, high trade surplus, and narrowing trade deficit in services (thanks to the continuous improvement in international visitors) can help reduce pressure on the USD/VND exchange rate.

In a newly published macroeconomic report, Vietcombank Securities Company (VCBS) stated that the interest rate level continues to break the deep bottom range, causing the exchange rate pressure to always exist when DXY is still at a high level. Accordingly, the possibility of VND depreciation will still exist, and the exchange rate performance will largely depend on the foreign currency supply at each point in time with factors subject to direct and indirect investment capital flows, remittances, etc.