The Vietnamese electronic wallet market is developing vigorously and leading brands are still in the “burning money” stage. Photo: Vietdata

Top Growth in the Region

According to the data from FiinGroup – a company specializing in providing integrated services for financial data, business information, industry research, and other services – as of the end of 2023, there are 36 million active electronic wallets in Vietnam.

FiinGroup defines electronic wallets as one of the intermediary payment services, alongside other services such as payment gateways, financial switch, electronic clearing, support for collections and remittances. The number of electronic wallets continues to grow strongly thanks to the good growth momentum in recent years.

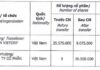

In Vietnam, the electronic wallet market has witnessed rapid development. Specifically, from 2018 to 2023, the number and value of transactions through electronic wallets continuously achieved double-digit growth rates of 80.4% and 83.5%, respectively.

According to FiinGroup, digital payments via smartphones are popular in Vietnam, and the active participation of intermediaries has helped increase the number of electronic wallets. Currently, the smartphone usage rate in Vietnam is estimated to reach 73.5% in 2022, equivalent to nearly 72.5 million people, and is projected to reach about 82.2 million in 2025.

According to the State Bank of Vietnam, in the first 11 months of 2023, mobile payments reached nearly 7.13 billion transactions with a value of over 49.4 million billion dong, increasing by about 61.1% in terms of volume and 11.7% in terms of value.

According to the Statista platform (Germany), in 2022, Vietnam ranked third in Southeast Asia in terms of the number of electronic wallets, following Indonesia and the Philippines.

Complete data on the number of electronic wallets in the region for the past year is not available. However, Statista forecasts that the ranking order of the top 3 will continue to be maintained until 2026, with Indonesia, the Philippines, and Vietnam having 215.7 million, 69.8 million, and 67.6 million electronic wallets, respectively.

Meanwhile, according to a survey by Visa in 2022, Vietnam, Indonesia, and the Philippines were also among the top countries in this region in terms of the popularity of electronic wallets in digital payments.

Market Dominated by a Few Giants

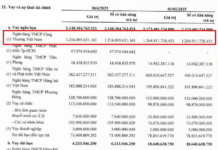

FiinGroup evaluates that despite the crowded market with 50 payment intermediaries, the number of electronic wallet users in Vietnam is concentrated in a few big players, especially Momo, Shopee Pay, and VNPay.

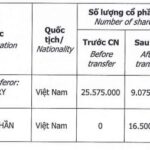

Momo showcases its ambition to become a super app by actively diversifying its partnerships and services through mergers and acquisitions as well as investments in startups or other companies. Recently, this Fintech company acquired a cybersecurity company, stepping into the investment field.

Meanwhile, ShopeePay leverages the e-commerce strengths of Shopee, while VNPay focuses on its core business as a payment gateway at local retail stores and a nationwide partner network.

In addition to the almost absolute advantage of some “big players” according to FiinGroup, small payment intermediaries currently face challenges in operating efficiently.

The “Burning Money” Race Continues

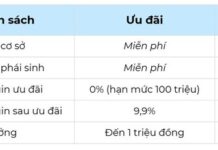

Despite impressive growth figures, electronic wallets have not yet escaped the capital burning race to attract and retain customers, according to FiinGroup. The reason is that many users choose electronic wallet payments due to attractive offers and discounts they receive. Users tend to be interested in promotional programs and then switch to another provider.

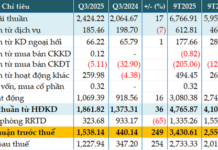

This requires continuous promotional efforts from electronic wallets and payment gateways, leading to significant cost burdens for these companies. Therefore, leading providers with millions of users like Momo or Shopee Pay continue to operate at a loss, regardless of net revenue growth.

The long-term competition in the electronic wallet market is expected to shift from discount-driven races to technology competition, comprehensive ecosystem, customer experience, and diversification of revenue through additional financial services.

Some wallets have shown interest in the digital lending sector. However, regulations in Vietnam prohibit non-bank organizations from directly providing loans. Therefore, payment intermediaries choose to collaborate with banks or financial companies to launch consumer loans on their platforms.