The Board of Directors of Vietcombank has agreed on a plan to increase capital through the payment of dividends in the form of shares from the remaining after-tax profit, and allocate funds from the year 2022 to seek the opinion of the State Bank of Vietnam (SBV).

Vietcombank stated that in 2022, the audited separate after-tax profit of the Bank reached over VND 29,387 billion. After setting aside a supplementary reserve of charter capital (VND 1,470 billion), a financial reserve fund (VND 2,939 billion), and a reward and welfare fund (VND 3,291 billion), the Bank will use the remaining after-tax profit of VND 21,680 billion to distribute dividends in the form of shares to shareholders.

Therefore, with Vietcombank’s current charter capital of nearly VND 55,891 billion and the value of dividends in the form of shares of over VND 21,680 billion, the estimated rate of implementing the right to dividends in the form of shares is 38.79% / charter capital, equivalent to issuing an additional 2.2 billion shares to distribute dividends (shareholders owning 1,000 shares will receive nearly 388 shares).

After completing the dividend distribution in 2022, Vietcombank’s charter capital will increase by VND 21,680 billion, reaching over VND 77,571 billion.

|

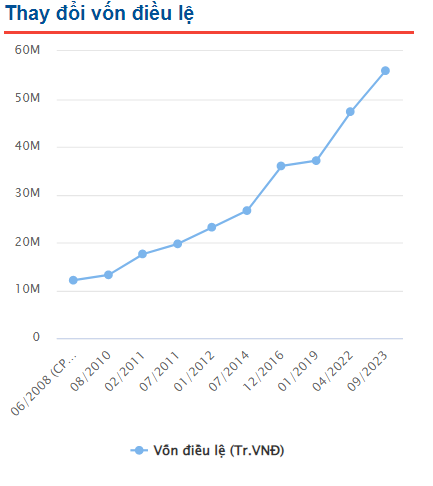

The process of Vietcombank’s capital increase

Source: VietstockFinance

|

In 2023, Vietcombank completed the capital increase from the 2020 profit and the remaining profit of 2019 with a rate of 18.1%, raising the charter capital to nearly VND 55,891 billion.

|

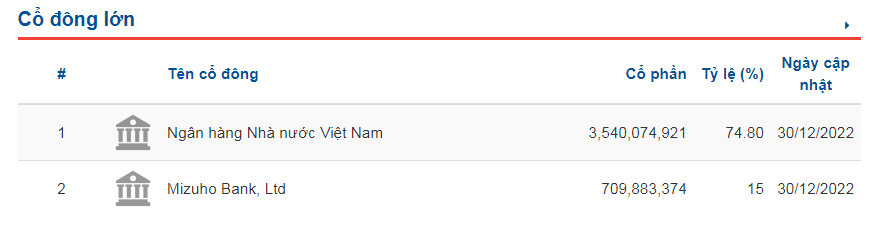

Major shareholders of Vietcombank

Source: VietstockFinance

|

According to the latest update (as of December 31, 2022), Vietcombank has 2 major shareholders: SBV (holding 74.8% of capital) and Mizuho Bank (owning 15%).

With the above ownership ratios, after issuing shares as dividends to increase capital, the ownership ratios of the 2 major shareholders will remain the same but the number of shares held will increase. In which, SBV will hold over 5.8 billion VCB shares and Mizuho Bank will hold nearly 1.2 billion VCB shares.