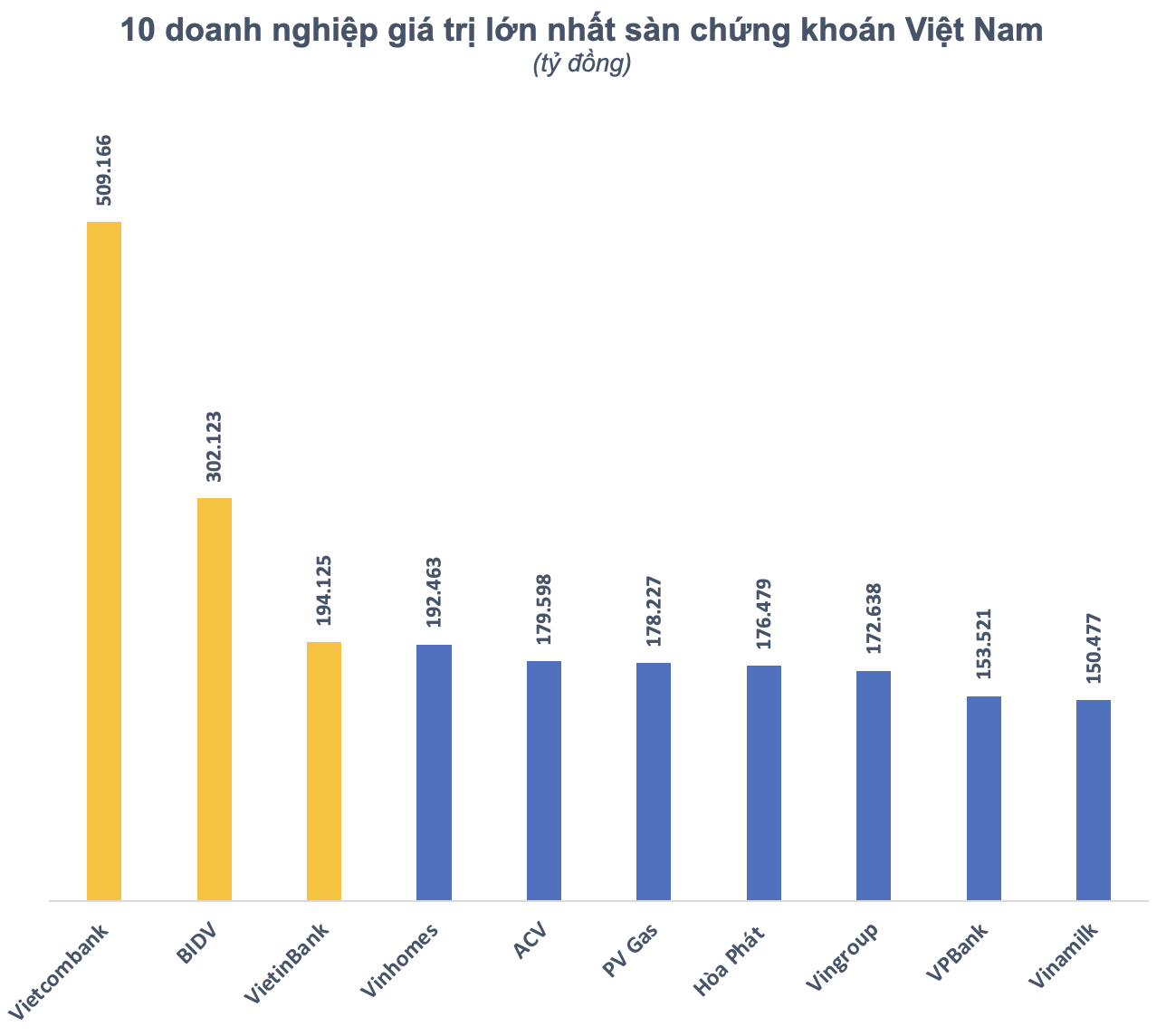

The Vietnamese stock market is soaring towards a 17-month high, led by the banking sector, particularly the “Big 3”: Vietcombank, BIDV, and VietinBank. On February 27, the shares of Vietcombank (VCB) increased by 1.79% to 91,100 VND, pushing the VN-Index to surge. This breakthrough raised Vietcombank’s market capitalization to over 509 trillion VND (21 billion USD), solidifying its position as the top-listed company on the stock exchange. Although this figure is 60.4 trillion VND (2.5 billion USD) higher than the beginning of 2024, it is slightly lower than the record reached in late July last year. Vietcombank remains the only company in the history of the Vietnamese stock market to exceed half a million trillion VND in market capitalization.

Similarly, the shares of VietinBank (CTG) also had a strong upward momentum, approaching their historical peak in mid-2021. The market capitalization of this bank has also increased to over 194 trillion VND (8 billion USD), which is approximately 48.6 trillion VND (2 billion USD) higher than the beginning of 2024. This positions VietinBank as the third most valuable company on the stock exchange.

On the other hand, BIDV’s shares experienced a slight adjustment after reaching their historical peak and are currently hovering at 53,000 VND/share. The corresponding market capitalization of the bank has reached over 302 trillion VND (12.5 billion USD), an increase of approximately 54.7 trillion VND (2.3 billion USD) compared to the beginning of 2024. Since the beginning of the uptrend in November last year, BIDV’s market capitalization has increased by nearly 100 trillion VND.

Therefore, the total market capitalization of the three banks Vietcombank, BIDV, and VietinBank has exceeded 1 million trillion VND, equivalent to about 1/5 of the total value of HoSE (Ho Chi Minh Stock Exchange). This is a unprecedented record in the history of the Vietnamese stock market.

The Capital Increase Story

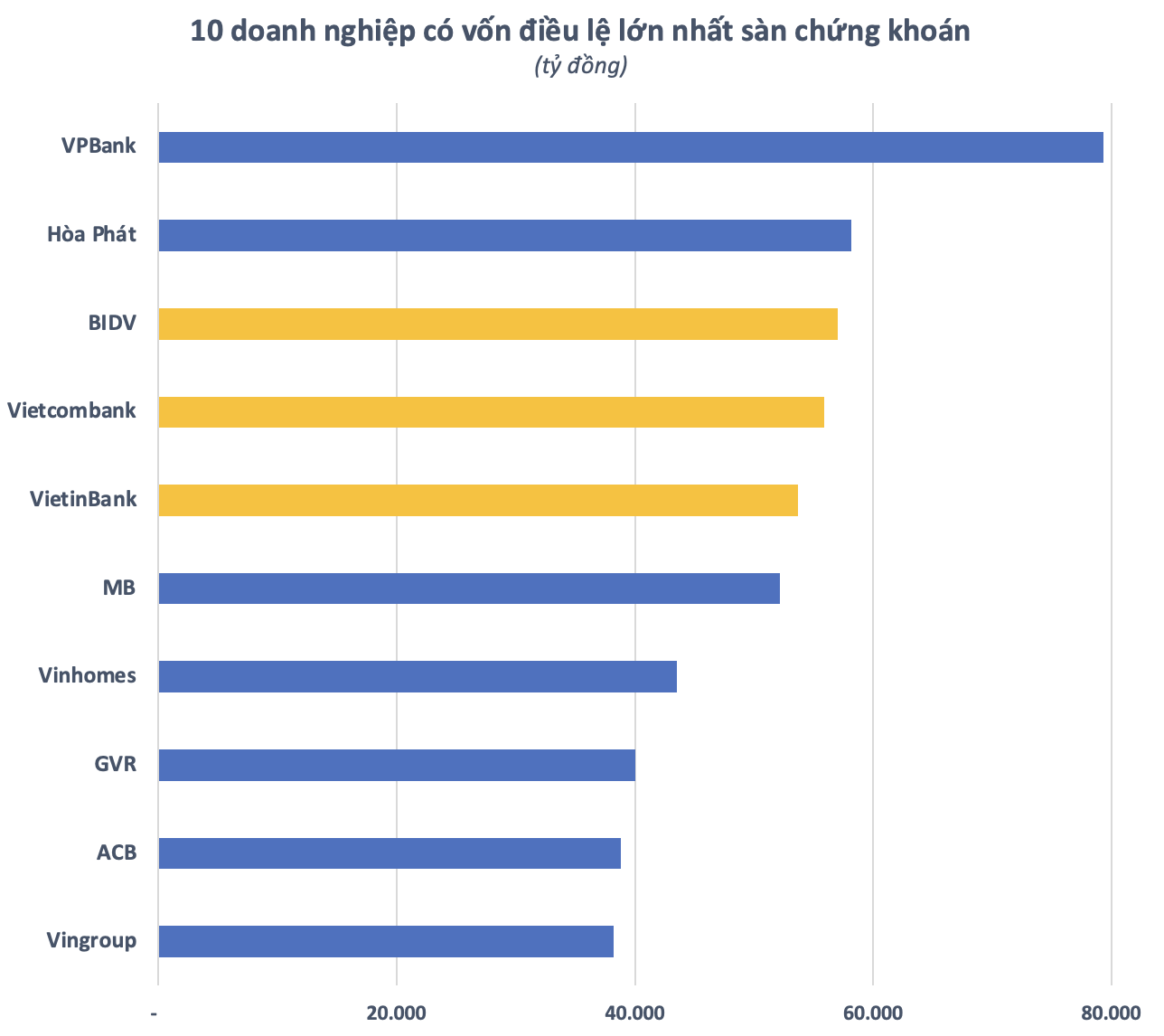

A common point among the “Big 3” banks is their plan to increase capital. Most recently, the Board of Directors of VietinBank decided to distribute the remaining profit after deducting required funds and welfare funds of 11.648 trillion VND in 2022. According to the approval of the authorized state agency, the bank will use this entire remaining profit to distribute dividends in the form of shares. If successful, VietinBank’s charter capital will increase from 53.7 trillion VND to 65.3 trillion VND.

Similarly, Vietcombank has announced plans to hold its 2024 Annual General Meeting to discuss the increase in charter capital from the remaining profit in 2022. Previously, the 2023 Annual General Meeting approved the plan to distribute dividends in the form of shares from the entire after-tax profit in 2022 (over 21,000 trillion VND). In 2023, Vietcombank had successfully increased capital from the 2020 profit and the remaining profit in 2019, bringing its charter capital to nearly 56 trillion VND.

As for BIDV, a recent report by Vietcap Securities also predicts that the sale of shares by the bank will be a highlight in the banking sector in 2024. Previously, the 2023 Annual General Meeting approved a plan to issue over 1 billion shares, including nearly 642 million shares for dividend payment in 2021 and the rest through public offering or private placement (455 million shares). At the end of 2023, BIDV had issued nearly 642 million shares for dividend payment in 2021.

According to Vietcap, one of the reasons why BIDV was unable to sell shares in 2023 was the unfavorable economic conditions. With expectations of economic recovery in 2024, coupled with a low interest rate environment, analysts expect that the capital mobilization activities through share issuance can be successful.

In its 2024 strategic report, SSI Research evaluates that banks with the potential to increase capital earlier will have better conditions to accelerate the bad debt resolution process, gain more market share, and achieve better results compared to other banks.

Strong Start, Will There Be a Price Correction?

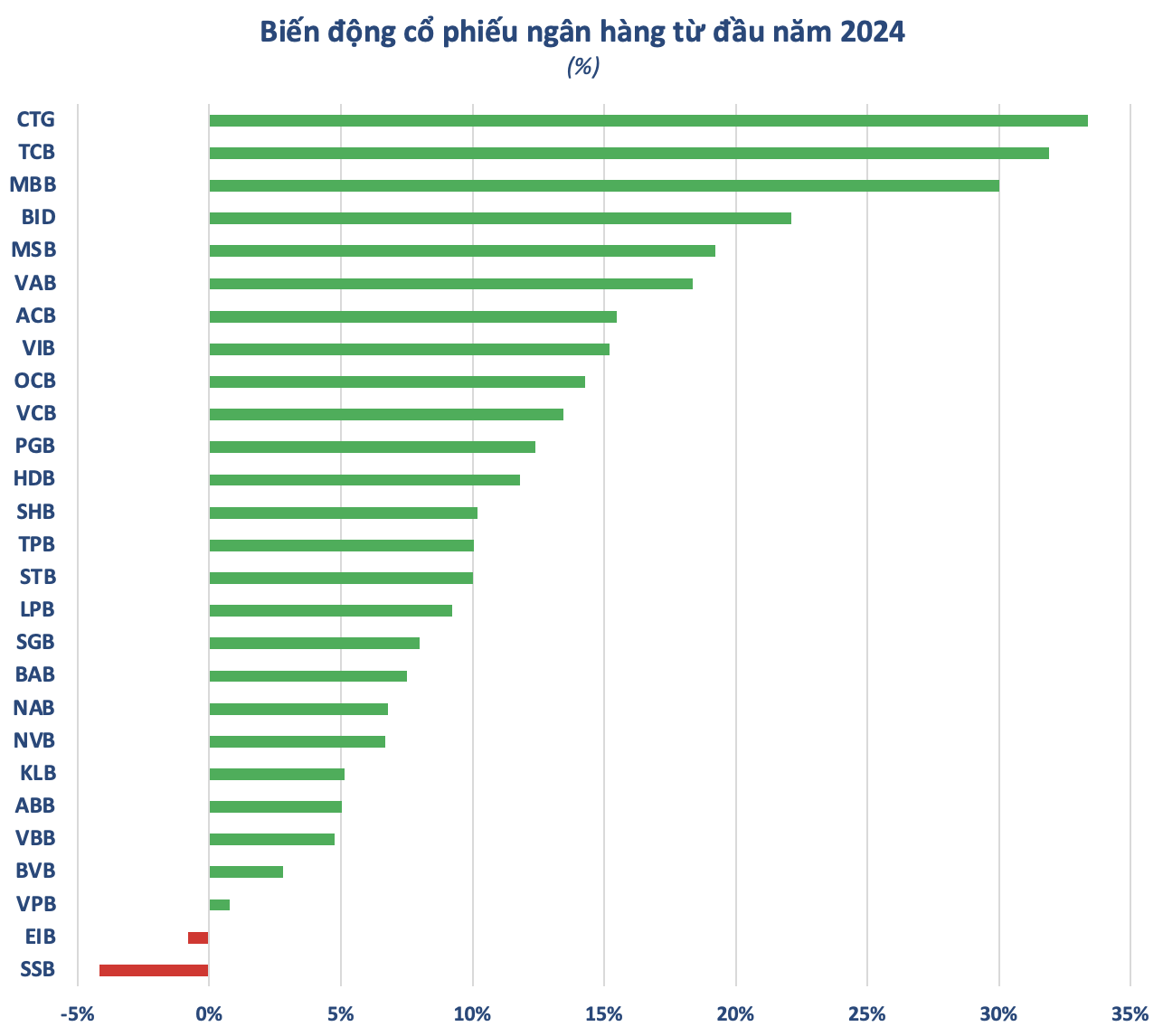

In general, with or without capital increase plans, bank stocks have had a relatively smooth start in 2024. Since the beginning of the year, almost all banking stocks (except SSB and EIB) have increased in price, mostly by double digits. Some names like CTG, TCB, MBB, BID, and others have even surged by more than 20% in less than 2 months.

However, whether there will be a price correction remains a question as the banking industry is expected to face both opportunities and challenges in 2024. According to SSI Research’s estimate, the pre-tax profit in 2024 of banks within their research scope is forecasted to grow by 16.5% compared to the same period last year. This figure is higher than the 5.2% growth rate in 2023.

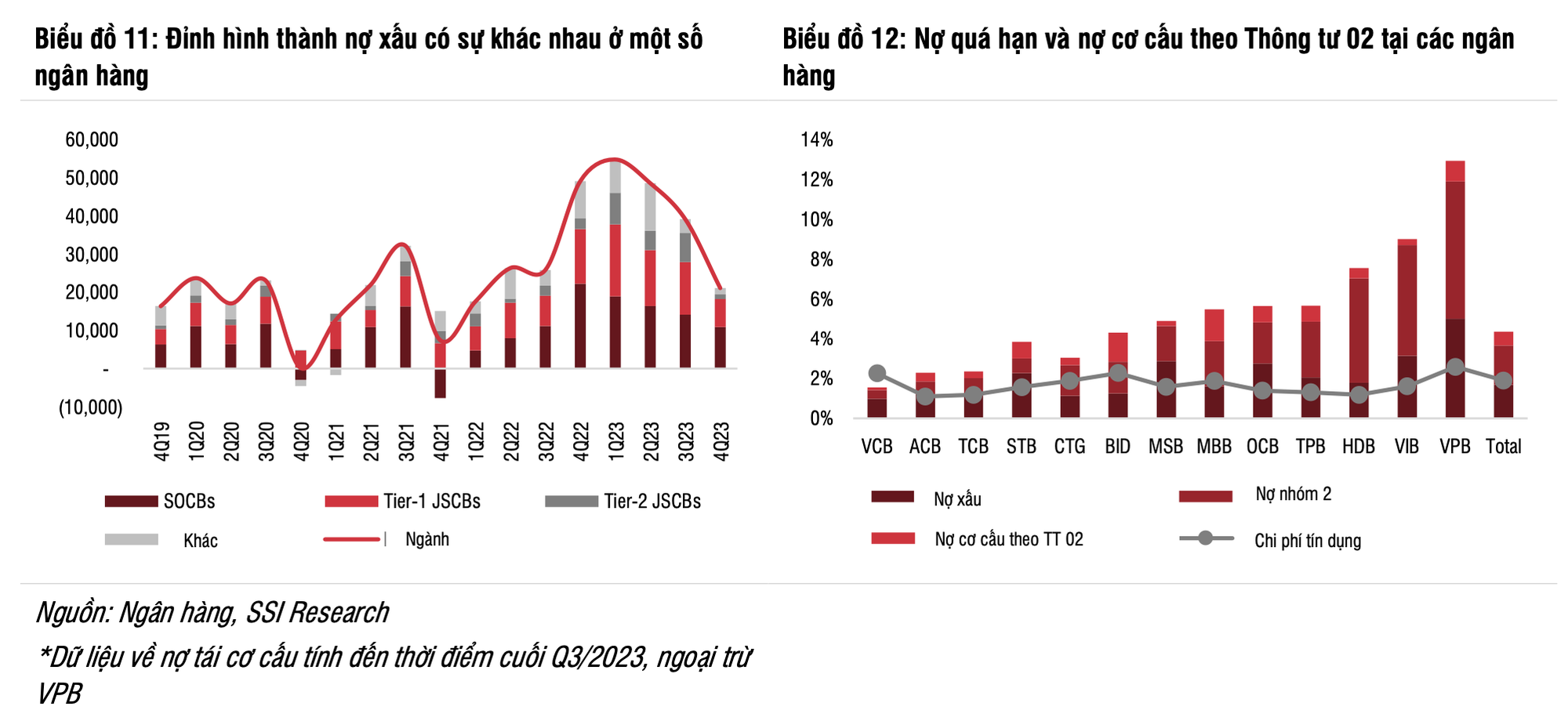

In terms of asset quality, SSI Research believes that the overall situation of banks will improve compared to 2023, mainly due to the significantly lower cost of capital and improved pre-provision operating profit (PPOP), which allows banks to have a better buffer for provisioning.

The non-performing loan ratio may increase in the first half of 2024 due to a slowdown in credit growth and macroeconomic factors that have not shown significant improvement. However, the non-performing loan ratio is forecasted to decrease slightly compared to 2023 (1.63% vs. 1.68%) as banks are expected to aggressively clean up bad debts and the economy is projected to recover strongly by the end of the year.

On the other hand, monitoring is still required for problematic debts (including Group 2 debts, restructuring loans, overdue corporate bonds, and old loans). Furthermore, if the draft amendment to Circular 16 loosening the restrictions on banks’ investment in corporate bonds is passed, there is a possibility that some credit risks may reemerge for banks that actively repurchase corporate bonds.