The GDP of Vietnam in 2023 is estimated to increase by 5.05% compared to the previous year. This is a high growth rate compared to the region and the world. The GDP scale at current prices in 2023 is estimated to reach over 10.2 million trillion dong, equivalent to 430 billion USD.

The average consumer price index in 2023 is expected to increase by 3.25% (lower than the set target of about 4.5%). The foreign exchange market and basic interest rates remain stable, with interest rates decreasing by about 2% compared to the end of 2022.

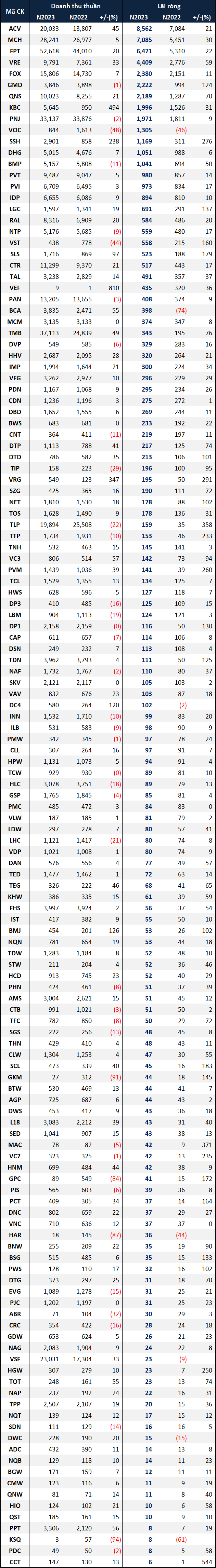

137 companies report record profits

In 2023, up to 137 companies listed on the stock exchanges (HOSE, HNX, and UPCoM) reported record profits. Among them, 13 companies achieved profits exceeding 1 trillion dong, including ACV, MCH, FPT, VRE, FOX, GMD, QNS, KBC, PNJ, VOC, SSH, DHG, and BMP.

|

137 companies listed on the stock exchanges reported record profits in 2023 (Unit: Trillion dong)

Source: VietstockFinance

|

Despite the expectation that the international air transport market has not fully recovered, Vietnam Airport Corporation (UPCoM: ACV) still achieved record profits in 2023 and topped the list. Specifically, the Vietnam Airport Corporation recorded over 20 trillion dong of net revenue and nearly 8.6 trillion dong of net profit, an increase of 45% and 21% respectively compared to the previous year.

ACV stated that in 2023, it served 113.5 million passengers, an increase of 15% compared to 2022; in which international passengers reached 32.6 million, an increase of 173% compared to 2022. The total volume of goods and parcels handled reached 1,207 thousand tons. The total takeoffs and landings reached 710 thousand flights.

FPT Corporation (HOSE: FPT), the giant in the information technology industry in Vietnam, also joined the record profit club in 2023 with IT service revenue abroad exceeding 1 billion USD, reaching 24,288 billion dong, an increase of over 28% compared to 2022. The momentum from the technology sector helped FPT achieve a net profit of nearly 6.5 trillion dong, an increase of 22%.

The above results were achieved thanks to the key markets in the technology sector maintaining their growth momentum, such as the Japanese market which increased revenue by over 43% despite the depreciation of the Yen, due to the large expenditure on information technology, especially for digital transformation.

The real estate sector recorded significant revenues for the industrial park group. Kinh Bac Urban Development Corporation (HOSE: KBC) achieved record profits from its core operations of land leasing and infrastructure leasing for industrial parks.

The revenue from land leasing and infrastructure leasing for industrial parks in 2023 of KBC increased dramatically to over 5,247 billion dong, eight times higher than the previous year. Thanks to that, KBC achieved approximately 2 trillion dong in net profit, an increase of 31%.

The case of Binh Minh Plastic Corporation (HOSE: BMP) shows that the profit exceeding 1 trillion dong is not due to revenue growth, but due to cost advantages.

BMP benefits from the ecosystem of the Thai plastic giant, SCG Group, indirectly owning BMP through Nawaplastic Industries (holding 54.99% of BMP’s capital at the end of 2023). In addition, the company has the ability to increase import of PVC from DGC when the German-Giang Nghi Son plant starts operating, in order to increase the localization rate of raw material supply, according to a report published by KBSV Securities in October 2023. As a result, the gross profit margin in 2023 is 41%, higher than the 34% level of the previous year, helping to increase profitability.

In contrast to the above-mentioned companies, the driving force behind Gemadept’s (HOSE: GMD) record profit does not come from its core business activities but from financial activities.

In the second quarter of 2023, GMD transferred its entire 84.66% capital in Nam Hai Dinh Vu Port to a group of investors including Container Corporation of Vietnam (Viconship, HOSE: VSC), Doan Huy Trading and Investment Company Limited, Huy Hoang Import-Export Metal Trading Company Limited, and Mr. Nguyen Dinh Huong. As a result, GMD recorded a profit from the transfer of financial investment of over 1,840 billion dong.

With the unexpected financial revenue, GMD ended 2023 with a record net profit of nearly 2,222 billion dong, 2.2 times higher than 2022, despite almost flat net revenue.

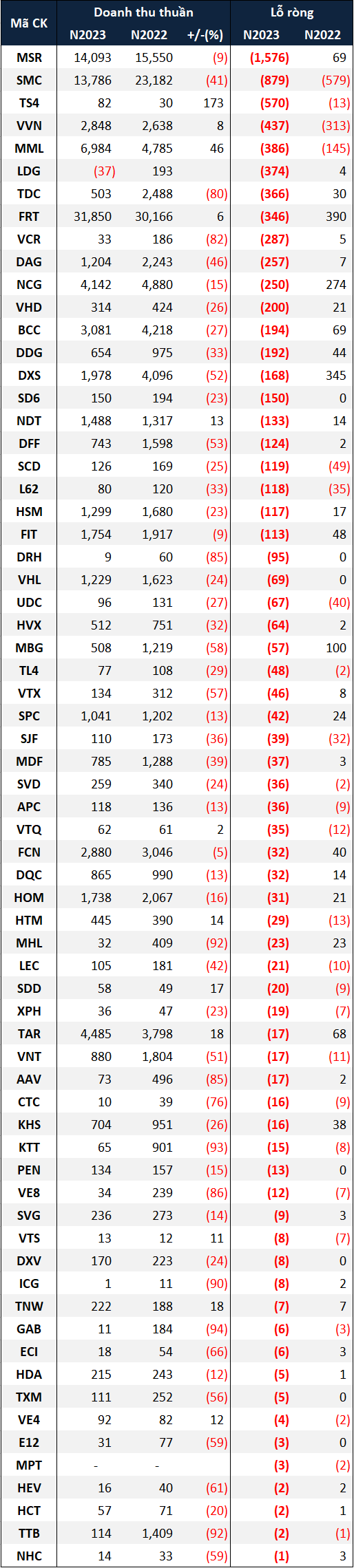

67 companies record record losses

Contrary to the above-mentioned companies, many companies listed on the stock exchanges have to bear record losses in 2023 due to various factors, mostly small and medium-sized companies.

|

67 companies listed on the stock exchanges record record losses in 2023 (Unit: Trillion dong)

Source: VietstockFinance

|

One of the outstanding companies recording record losses is SMC Investment Corporation (HOSE: SMC) with a net loss of nearly 880 billion dong, mostly due to bad debt provisions (over 500 billion dong).

SMC’s business activities began to face difficulties in the second half of 2022 when the real estate crisis emerged, along with the weakening of the economy as a whole.

For a company with a high proportion of construction steel trade like SMC (about 40%), the situation of stagnant projects and mounting debts that could not be recovered has dealt a heavy blow to its business operations. Moreover, the overall demand of the economy has also slowed down as people’s income decreases. The remaining two sectors, steel production and processing, are not very optimistic either.

Speaking of the difficulties in 2023, we cannot fail to mention the real estate sector. In the context of a sluggish market, despite the introduction of many new laws, it takes time for the market to gradually absorb them. As a result, many companies in the sector have incurred losses, even record losses in the past year.

LDG Investment Corporation (HOSE: LDG) is one of the notable companies in this group with negative revenue of 37 billion dong due to the refund of real estate value of over 85 billion dong. As a consequence, the company closed 2023 with a record loss of 374 billion dong. In reality, LDG’s business results in the past year have been greatly affected by the incident at the Tan Thuan residential area – the construction of 500 villas illegally, along with the disruption of the top-level structure when the former Chairman of the Board of Directors Nguyen Khanh Hung was arrested for his involvement in the case.

Another real estate company also suffered historical losses is DRH Holdings Corporation (HOSE: DRH) when it did not record any revenue from both real estate business and sales. DRH’s net loss in 2023 was 95 billion dong (less than 100 million dong in the previous year). This is the highest loss of DRH since its listing.

When the market is difficult, not only the investors but also real estate brokerage companies share the same fate. Dat Xanh Real Estate Services Corporation (HOSE: DXS) achieved nearly 2 trillion dong in net revenue in 2023, a decrease of more than half compared to the previous year.

The reason lies in the sharp decrease in revenue from real estate services such as brokerage, which only reached nearly 648 billion dong, compared to over 2.3 trillion dong the previous year; combined with a loss from joint ventures and associates of more than 107 billion dong, DXS experienced its first loss since listing with over 168 billion dong.

The number of DXS employees as of December 31, 2023 is only 2,275 people, a decrease of nearly 32% compared to the beginning of the year.

Ha Le