The stock market has experienced a strong breakthrough in February, continuing its 4-month upward trend. The VN-Index has increased nearly 90 points in a month to surpass its highest level in over a year. Money has also flowed strongly into the stock market, with the average trading value on HOSE exceeding 18,000 billion VND, a significant increase compared to the previous month.

A series of stocks have recorded impressive gains, with the “champion” tripling in value in just one month of trading.

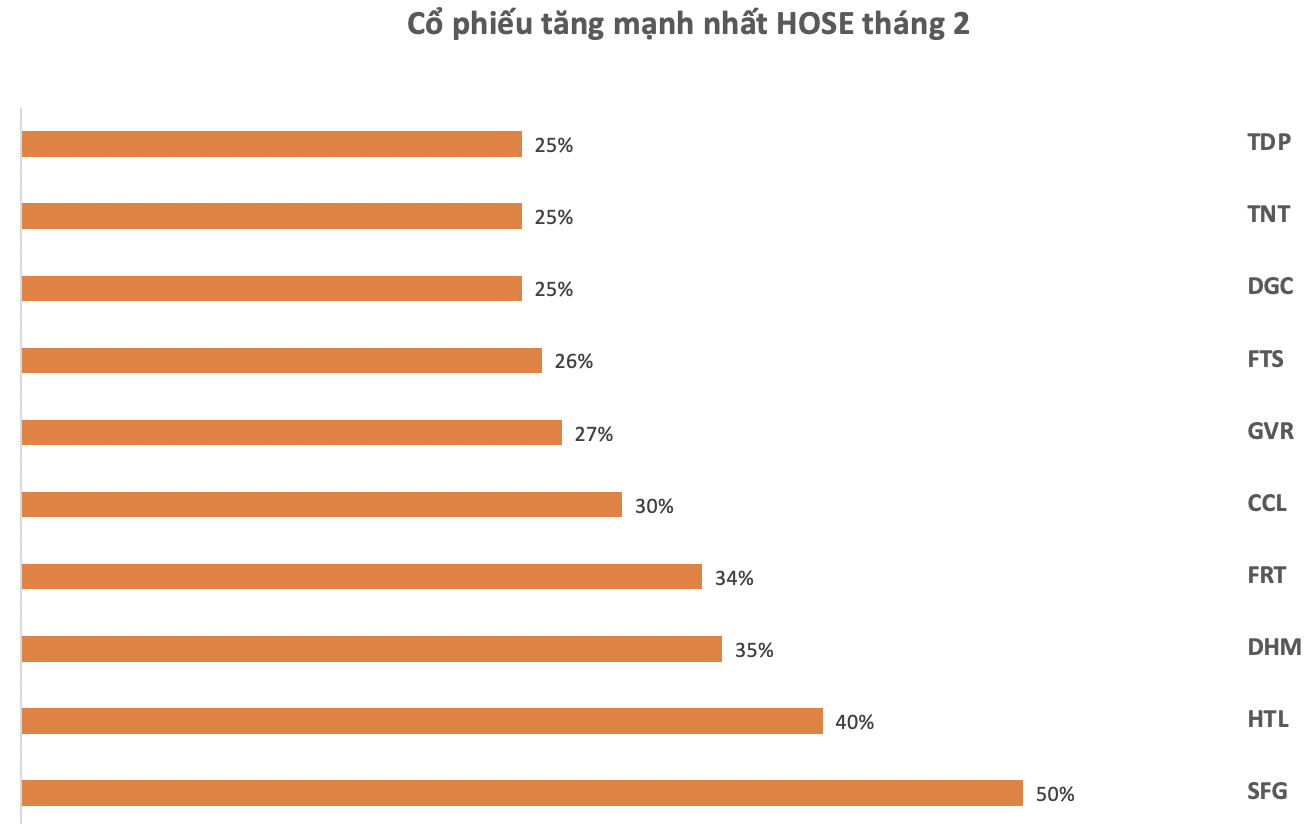

The stock that has seen the strongest growth on HOSE in February is SFG of Southern Fertilizer Joint Stock Company. After a period of stagnation, this stock has continuously surged to reach 14,100 VND/share, a 50% increase in one month and the highest level in 20 months. The liquidity of this stock has also significantly improved, with tens of thousands of shares traded in each session.

FPT Group’s stocks have also been on the rise, with both FRT and FTS reaching their all-time highs. FRT, a stock of FPT Retail, has made an impression with a 34% increase in the past month to reach its highest level in history. Compared to its price a year ago, FRT has tripled to 145,000 VND/share, resulting in a market capitalization of over 19,700 billion VND.

FTS, a stock of FPT Securities, has also attracted attention with a continuous surge to reach 57,000 VND/share – the highest level ever listed. Looking further, this stock has increased 3.5 times in the past year.

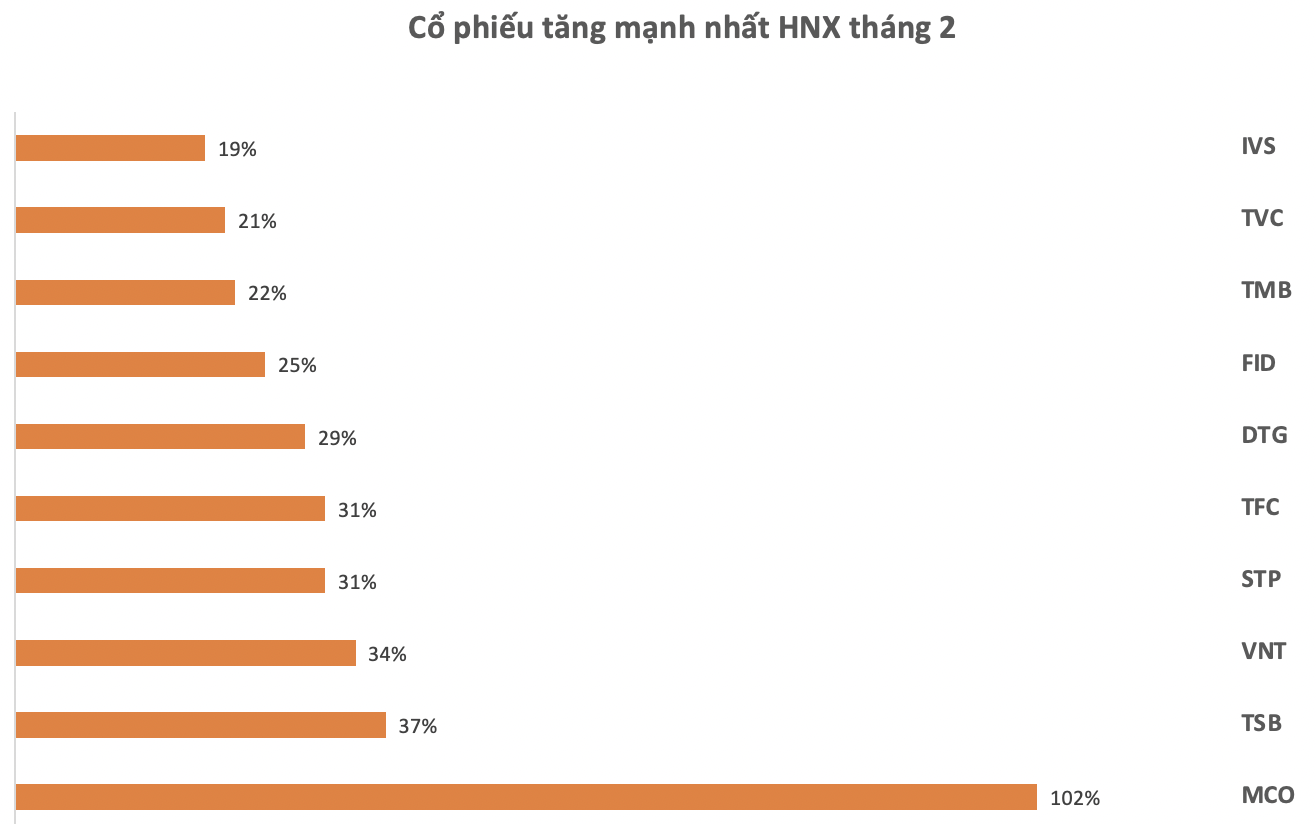

On HNX, MCO of BDC Vietnam Investment and Construction Joint Stock Company has shown remarkable growth in February. After several limit-up sessions, MCO has reached 19,800 VND/share. In addition to the strong price increase, the liquidity of LDP shares has also been positive, with hundreds of thousands of shares traded, while previously it was only a few hundred to a few thousand shares per session.

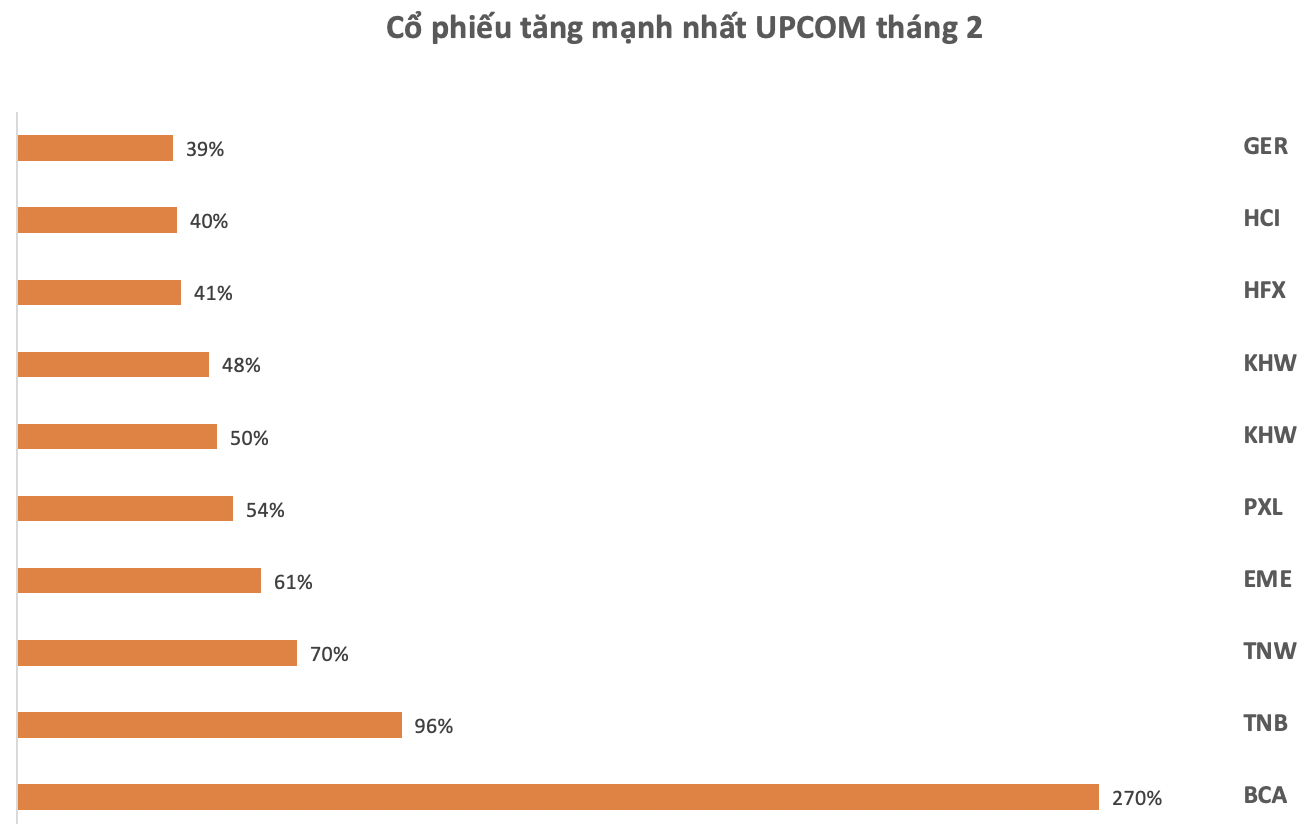

On UPCOM, the top 10 stocks have all increased by more than 40%, but the most prominent one is BCA. After a period of silence, BCA’s stock has unexpectedly surged with several limit-up sessions. From a price of only 6,700 VND/share on January 31, BCA has skyrocketed to 24,800 VND/share on February 29, equivalent to a 270% increase in just one month. The liquidity of BCA shares is not high but has remained at hundreds of thousands of shares traded in each session.

Prior to this, BCA had a 54% breakthrough from December 6, 2023, to December 18, 2023. After that, the stock price cooled down to around 6,000 VND/share and moved sideways until it resumed its upward trend recently.

Regarding the recent fluctuations of BCA stocks, the company’s leadership believes that the price volatility depends entirely on the market’s supply-demand and investors’ sentiment, affirming that there is no direct impact on the trading price on the market.

In 2023, the company recorded a revenue of over 3,853 billion VND, a 55% increase compared to 2022. The after-tax profit reached 398 billion VND, while it suffered a loss of 73.9 billion VND in the same period last year. Both revenue and profit of BCA have reached record highs in its operating history. However, if we take a closer look at BCA’s financial situation, the profit in 2023 did not come from core business operations, but from the transfer of shares to acquire subsidiary companies.

BCA was established in 2004 in Hai Duong province with an initial charter capital of 8 billion VND. After three expansions, BCA’s charter capital has increased 23.8 times to 190 billion VND.

BCA is currently engaged in diversified business activities, with its main sectors being steel billets, construction steel, metal scrap, coke, and other supporting products for the steel industry.