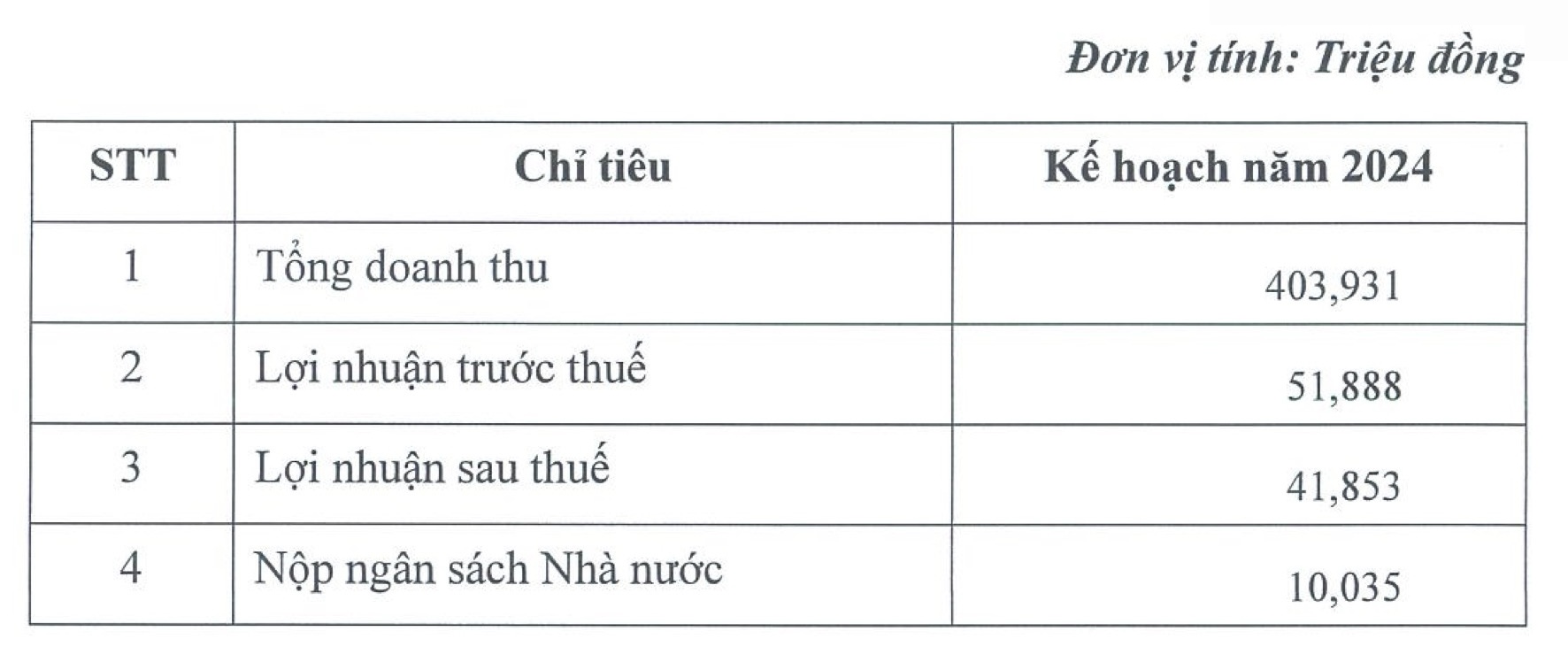

At the annual meeting, the BOD of PCT presented and approved the business targets for 2024. Specifically, the company aims for a revenue of 404 billion VND, a slight decrease from the previous year’s performance. The target pre-tax and after-tax profit are 52 billion VND and 42 billion VND respectively, representing a growth of nearly 11%.

|

PCT’s business plan for 2024

Source: PCT

|

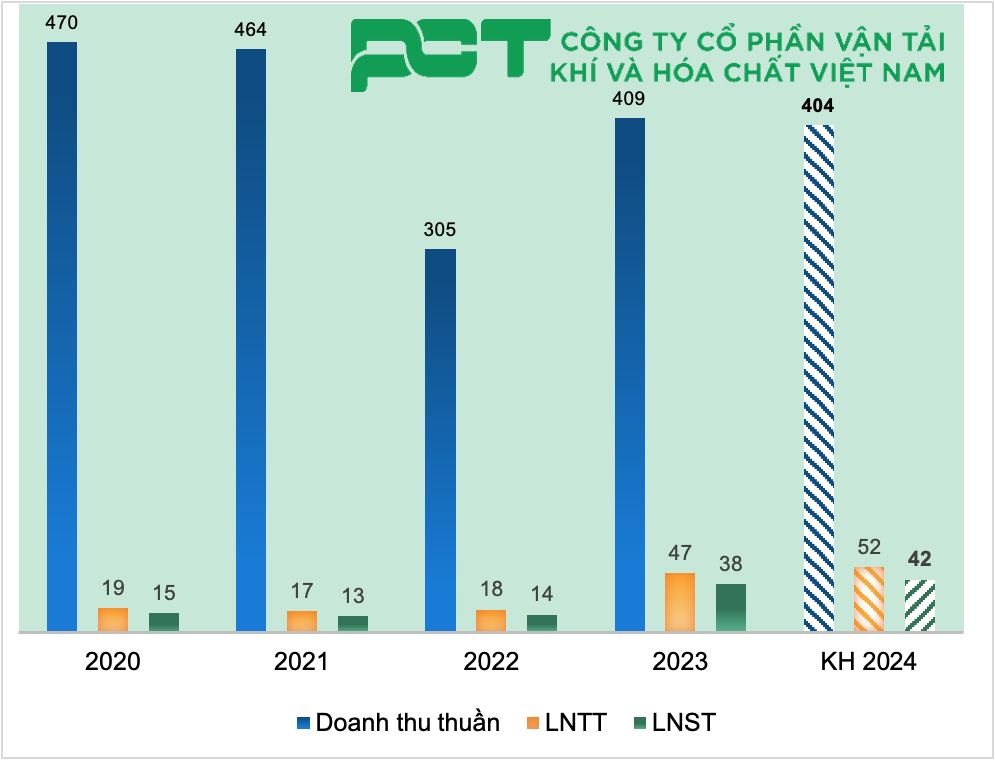

This plan was devised after a successful year for PCT. In 2023, the company achieved a revenue of 409 billion VND, a 34% increase compared to the same period. The after-tax profit surpassed 34 billion VND, 2.6 times higher than the previous year, marking a record profit for the company since its establishment in late 2007. PCT exceeded 82% of its profit target for the year.

|

Business performance and 2024 plan of PCT

Source: VietstockFinance

|

The company stated that 2023 was a challenging year with continuous interest rate hikes worldwide and the impact of geopolitical tensions. The transportation and port sectors also faced unpredictable developments in the early months. However, the shipping market showed signs of recovery in the later months, leading to increased demand while supply remained stable. This helped improve freight rates, a favorable factor for PCT’s operations.

In 2024, PCT believes that the worst is behind them. Although global growth forecasts may be lower, anticipated obstacles are expected to decrease. The chemical shipping market is expected to revive due to increased demand from Asia and limited vessel supply.

To achieve the plan, PCT stated that it will fully utilize its fleet in the international market, minimize idle and waiting vessels, optimize operations, and expand the market. Additionally, it will enhance marketing efforts, expand relationships and networks, while closely managing repair costs and controlling economic and technical indicators, particularly fuel consumption and materials, to reduce expenses.

50 million shares higher than market price, what does PCT say?

In 2023, PCT conducted a secondary public offering of over 22.4 million shares, accounting for nearly 81.3% of the total shares offered, raising over 224 billion VND and increasing its charter capital to over 500 billion VND. The initial issuance was aimed at supplementing capital for the investment in a 19,000 – 25,000 DWT petroleum/chemical tanker (the “Loyal” vessel). According to the report, PCT spent nearly 151 billion VND to pay for the vessel, using the remaining amount (almost 74 billion VND) to supplement working capital and business capital.

Scene at PCT 2024 Annual General Meeting (Photo: Châu An)

|

In 2024, the AGM also approved a plan to offer additional shares to existing shareholders to increase capital. Under this plan, the company expects to offer an additional 50 million shares (equivalent to the entire outstanding shares) at a price of 10,000 VND per share. If the issuance is successful, the company’s charter capital will increase to over 1 trillion VND.

The exercise ratio is 1:1 (one new share for each owned share), and the rights to purchase shares can be transferred once, with the offered shares freely transferable.

The expected proceeds (over 500 billion VND) will be used by PCT to supplement investment capital for VLGC type gas carriers with a capacity of 75,000 – 80,000 CBM (deadweight tonnage of 45,000 – 50,000 DWT). The ship investment plan has also been presented and approved at the 2024 AGM.

The vessels will be built in one of three locations: Japan, South Korea, and the EU, with a total investment ranging from 64 to 80 million USD, expected to be carried out from the second quarter of 2024. Not more than 74% of the total investment will be financed through loans (excluding VAT), which can be provided by banks, credit institutions, or individuals capable of funding.

Currently, PCT’s stock price is around 7,500 VND per share, lower than the offering price. Addressing this issue, Chairwoman of the BOD, Nguyễn Thị Ngọc Đẹp, shared that it is just the market price. Based on book value, PCT’s stock price is 11,507 VND per share. Moreover, shareholders will focus on the company’s development potential and growth prospects, “not just the stock price,” stated Ms. Đẹp.

According to Chairwoman PCT, the purchase of the Loyal vessel last year helped the company operate more smoothly and exceed its set targets. However, due to the need to use funds to purchase the vessel, the company does not plan to distribute dividends this year.

Regarding compensation plans, the AGM approved a sum of 810 million VND for the BOD and the Internal Control Board in the case of a dedicated Chairman of the BOD. In the case of a non-dedicated Chairman, the total compensation for the entire leadership team is 288 million VND.

In addition, the AGM approved the resignation of a member of the BOD, Mr. Lê Hoàng Phương (submitted on January 24, 2024). The BOD for the term 2023-2028 will consist of 5 members.

Another noteworthy change at the meeting was the approval of a name change and the relocation of the company’s headquarters. As a result, PCT will change its name to CTCP Vận tải Biển Global Pacific and move its headquarters from The Everrich Building (3/2 Street, Ward 15, District 11, Ho Chi Minh City) to The Nexus Tower 1 (Tôn Đức Thắng, Bến Nghé, District 1, Ho Chi Minh City).

Châu An