The banking stock group has been the focus of the market since the end of 2023 until now. Within a short period of time, a series of stocks have increased significantly, with some stocks reaching historic highs such as VCB, ACB, BID, while CTG, MBB approaching the peak of 2021. Some others also have good growth rates like TCB, STB…

BANKING STOCKS SURPASSING THE PEAK

The rise of the banking group reflects the positive profit growth of 25% in the fourth quarter of 2023, and some banks also share plans for generous dividends.

For example, Vietcombank’s 2022 standalone audited net profit reached over VND 29.387 trillion after tax. After allocating supplementary capital reserve (VND 1.469.5 trillion), financial reserve (VND 2.939 trillion), and reward and welfare fund (VND 3.291 trillion), the bank will use all of the remaining after-tax profit of over VND 21.68 trillion to distribute dividends in the form of stocks to the shareholders.

With the current charter capital of nearly VND 55.891 trillion and the dividend distribution value in the form of stocks of over VND 21.68 trillion, the estimated percentage for Vietcombank to distribute dividends in the form of stocks will be 38.79%/charter capital, equivalent to issuing about 2.17 billion shares to pay dividends to existing shareholders.

On February 23rd, the Vietinbank Board of Directors approved the profit distribution plan for 2022. Accordingly, after deducting reserves, the remaining profit of VietinBank is VND 11.648 trillion. The bank plans to use all of this remaining profit to distribute dividends in the form of stocks.

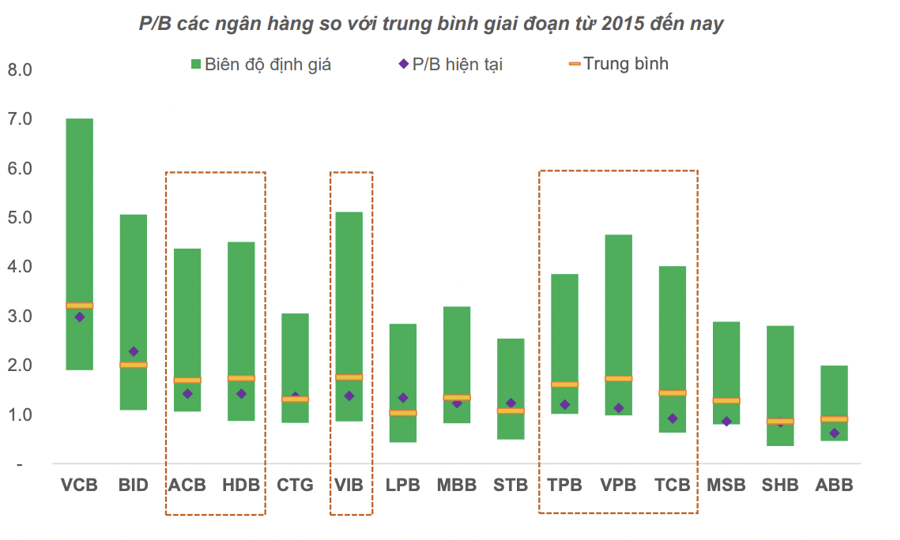

Regarding the outlook for banking stocks, according to FiinGroup, the low valuation will be maintained for more than a year and the profit prospects for 2024 will rebound from the low level in 2023, which will provide price motivation for the banking sector.

Similarly, BSC believes that the current valuation level of the industry is still suitable for accumulation, especially for private banks, while state-owned banks still have grounds to raise their acceptable valuation from private placements. Note that tighter risk governance regulations and improved balance sheet health are the main differences in the current cycle compared to the past. The amended Credit Institutions Law towards minimizing systemic risks has also been recently passed.

BSC continues to maintain an optimistic recommendation for the banking industry in 2024 based on the following main points: low-interest rate environment and economic recovery prospects supporting improved credit growth and NIM rebound due to reset capital cost, strengthening bad debt resolution in 2023 creating room for profit recognition from debt recovery in 2024, thereby enhancing the optimistic profit growth prospects for 2024, supported by the still appropriate valuation range for accumulation.

FOREIGN FUNDS BUYING

The breakthrough of banking stocks in the first month of the year has helped many foreign funds achieve good growth, including Vietnam Holding (VNH). Accordingly, the performance of the fund in January increased by 2.4% compared to the 1.8% increase of VNAS.

In a recent report, Finnish investment fund Pyn Elite Fund also announced that the fund’s growth performance in January 2024 reached 6.8%, exceeding the 3% increase of the VN-Index. Among them, the best-performing stocks were ACV, MBB, and CTG, all with a 17% increase. In contrast, SAB and CMG decreased by over 8%.

Currently, foreign funds own the most shares in STB, HDB, CTG, MBB, TPB, ACV, SHS, VEA, and VHC. On the other hand, VRE and CMG with ownership ratios of 4.7% and 3.1% of the portfolio as of the end of December 2023 are no longer in the Top 10 (replaced by DNSE and VHC).

The fund believes that Vietnam’s listed companies will achieve profit growth of over 20% in 2024. This year will be a positive year for the largest banking sector on the stock exchange. Stocks on the stock exchange, especially banking stocks, are still undervalued for several years.

“The price increase potential of these stocks is very large as the economy continues to recover with favorable monetary market cycles,” emphasized the Finnish fund.

On the other hand, VinaCapital believes that the banking sector will benefit from profit growth from about 7% in 2023 to 18% in 2024, and the valuation of bank stocks in Vietnam is currently lower than a standard deviation below the average trading value of about 1.8x P/B compared to the expected 17% ROE in 2024. The expected profits of Vietnamese banks will be driven by rapid credit growth for both real estate developers and new home buyers, consistent with modest expectations for real estate development this year.

Similarly, in its recent Q1/2024 performance report, VEIL, a $1.7 billion fund from Dragcon Capital, recorded a 1.3% growth performance compared to the 2.5% profit of the VN-Index. “The strong recovery of 8.2% of the top 5 banking stocks in VEIL has consolidated the position of the fund and indicated that the worst is over,” the fund emphasized.

As of January 31, 2024, the top 10 stocks in VEIL’s portfolio accounted for about 59% of the fund’s NAV. Among them, the banking group dominated both in terms of the number of stocks and the proportion, with 5 stocks including VPB, ACB, VCB, TCB, MBB. Most banking stocks have increased their proportion compared to December 2023.