In 2023, the global economy faced many fluctuations accompanied by risks of instability, which reduced the prospects for economic growth. Inflation in the country is controlled and tends to decrease. Overall in 2023, core inflation and general inflation reached 3.25% and 4.16%, respectively, compared to the same period, lower than the Government’s target of 4.5%.

GDP growth in Q4/2023 has progressed better than previous quarters, estimated to increase by 6.72% (Q1 increased 3.41%, Q2 increased 4.25%, Q3 increased 5.47%). Overall in 2023, estimated GDP growth reached 5.05%, achieving the National Assembly’s target of over 5% GDP.

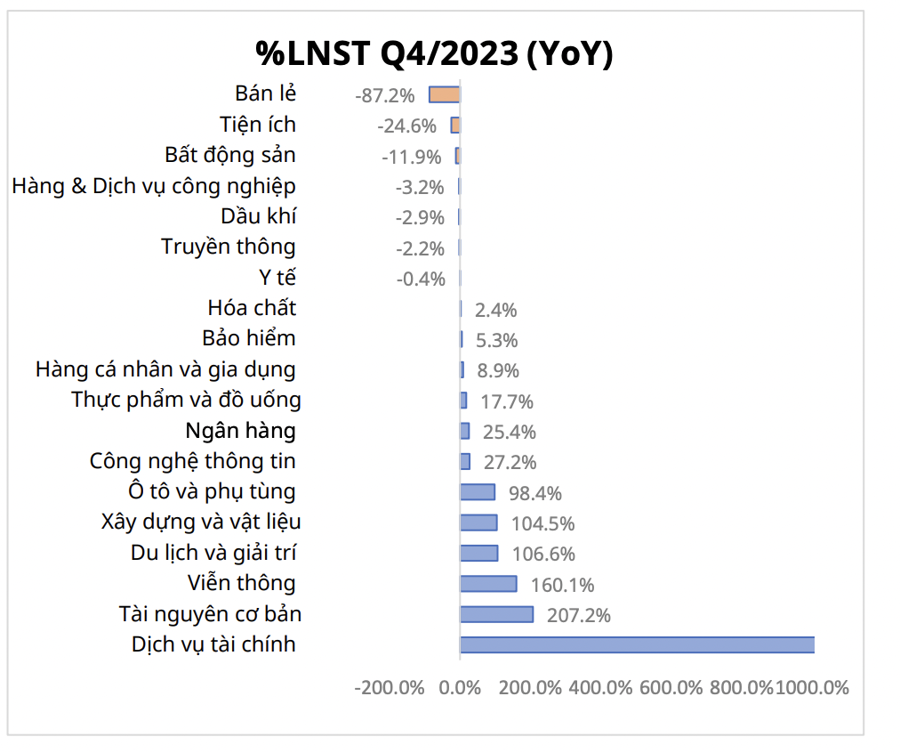

In the latest updated report, Mirae Asset Securities evaluates the overall business results in Q4, showing improvement and differentiation among industry groups. As of January 31, 2024, the after-tax profit of Q4/2023 grew by over 49% compared to the same period and increased by 16% compared to the previous Q3.

In which, the profit-growing industry groups include Financial services (+8,552% compared to the same period), Basic resources (+207%), Telecommunications (+160%), Travel and entertainment (+107%), Construction and materials (+105%), Automobiles and parts (+98%), Information technology (+27%), Banking (+25), Food and beverages (+18%), Personal and household goods (9%), Insurance (+5%), Chemical (+2%).

On the contrary, profit-declining industry groups include Healthcare (-0.4%), Media (-2%), Oil and gas (-4%), Industrial goods and services (-3%), Real estate (-12%), Utilities (-25%), Retail (-87%).

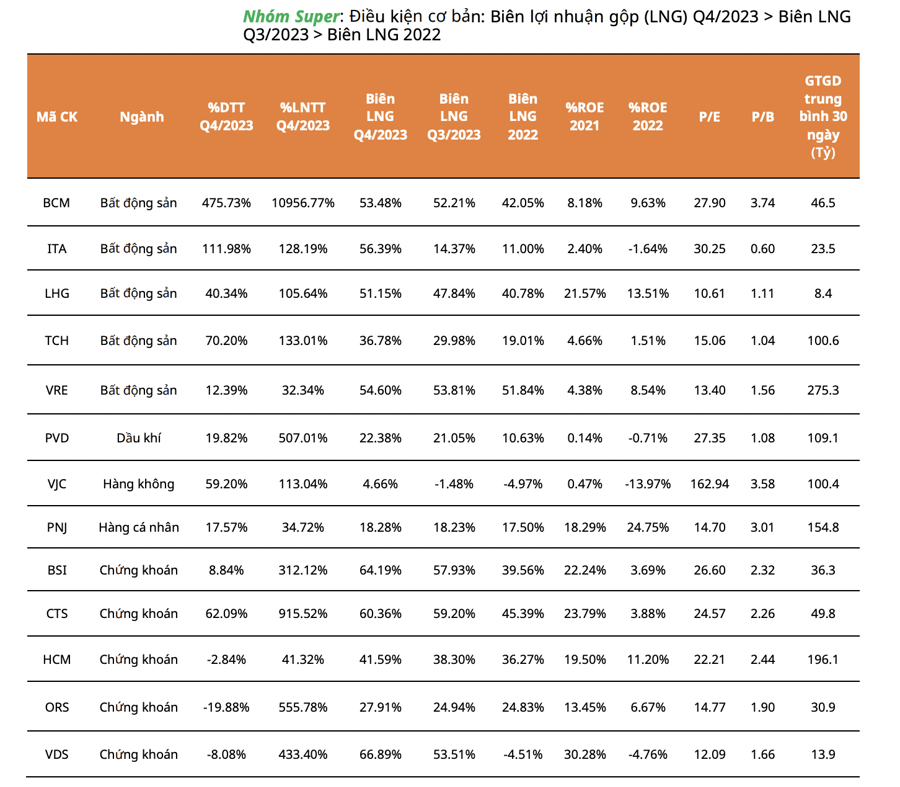

Based on the business results of Q4/2023, Mirae Asset screened stocks with stable business results, maintaining good growth prospects, and having their own stories. The selection and evaluation are based on comparing gross profit margins between the two most recent quarters and the previous year to produce a list of potential stocks with revenue and profit growth. At the same time, it must meet the criteria for trading value, which means the stocks have liquidity.

Among them, stocks belonging to some stable industry groups such as food, chemicals, and insurance are considered relatively safe choices. In addition, the recovering industry groups with a story like real estate, securities are also suitable choices when falling to attractive price levels.

Mirae Asset recommends 24 “Super” – “super stocks” with the basic condition that the gross profit margin in Q4/2023 is higher than the gross profit margin in Q3/2023 and greater than the gross profit margin in 2022.

These include companies in the real estate group such as BCM, ITA, LHG, TCH, VRE; securities such as BSI, CTS, VDS, HCM, VND, VIX… or food companies DBC, VNM; retail FRT…

In addition, the analysis team also provides a list of 19 “Good” stocks with the basic condition that the gross profit margin in Q4/2023 is higher than the LNG margin in Q4/2023, including stocks in the real estate group DXG, PDR, NTL, IDJ, oil and gas BSR, insurance BMI, steel HPG, NKG, food PAN, LTG, BAF, LSS….