Illustrative Image

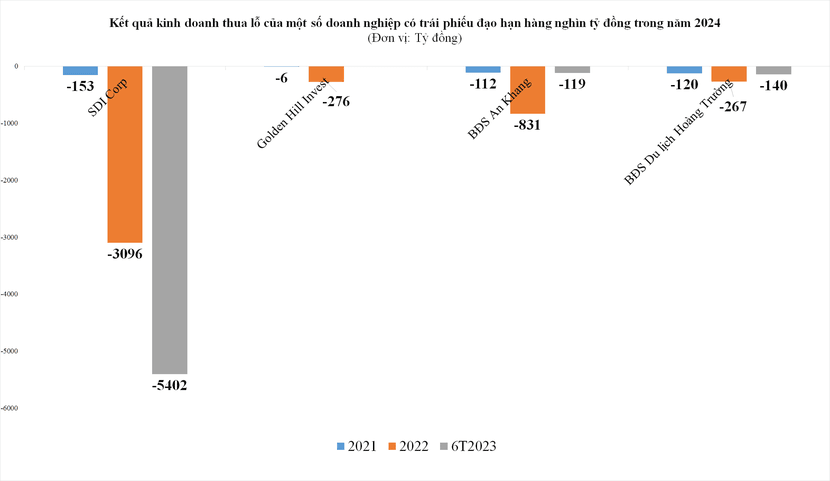

2024 will be the peak of corporate bond maturities, including trillions of dong worth of bonds from real estate, construction and materials, tourism and entertainment companies. However, the business results of many of these companies are quite poor. This raises questions about the ability to pay principal and interest on the bonds of these companies.

Many companies are continuously losing money, owing multiple times their equity

The financial capacity is a question mark for Golden Hill Investment Company (Golden Hill Invest – the investor of the high-rise project at 87 Cong Quynh street, Nguyen Cu Trinh ward, district 1, Ho Chi Minh City) as the company will have a 5,760 billion dong bond maturing on April 15.

According to the latest financial report released, Golden Hill Invest’s 2022 after-tax profit was nearly negative 276 billion dong, 48 times the negative 5.8 billion dong of 2021.

By the end of 2022, the company’s equity stands at 2,421 billion dong, a decrease of more than 10% compared to the end of 2021. The payable debt is nearly 12,347 billion dong, 5.1 times the equity.

In addition to poor business results, in late January, Golden Hill Invest was also subject to an enforcement decision to suspend customs procedures for exported and imported goods by the Head of Customs Department for Management of Investment Goods under the Ho Chi Minh City Customs Department. The reason for the enforcement is that Golden Hill Invest has tax arrears exceeding 90 days from the tax payment due date, beyond the deadline for tax payment extension as prescribed. The amount subject to enforcement is more than 1,289 billion dong.

With Nam An Investment and Business Company Limited (a company with a 4,700 billion dong bond maturing in September 2024), the business situation is not much better.

According to the semi-annual financial report of 2023, in the first 6 months of 2023, the company’s after-tax loss was nearly 256 billion dong, while the after-tax profit of the same period was more than 679 billion dong. By mid-2023, the company’s payable debt increased sharply compared to the same period to 13,784 billion dong, 5.64 times the equity.

The same goes for An Khang Real Estate Development Company Limited (with a 1,000 billion dong bond maturing in June 2024), in the first half of 2023, this company lost an additional 119 billion dong, after already having a loss of 112 billion dong and 831 billion dong after-tax profit in the two years of 2021 and 2022 respectively. The company’s payable debt until the end of June 2023 is 14,050 billion dong, 26.99 times the equity.

Similarly, the Hoang Truong Tourism Real Estate Investment Company Limited (with a 1,400 billion dong bond maturing in December 2024) also reported a 140 billion dong after-tax loss in the first half of 2023, after already having a net loss of more than 267 billion dong in 2022 and 120 billion dong in 2021.

Though not recording negative profit, the business results of Danh Viet Trading and Service Joint Stock Company (with 8 bonds maturing in August 2024 with a total value of over 3,400 billion dong) are also not very optimistic. In 2022, this company only made a profit of 4 billion dong and has not yet announced its financial situation for the first 6 months and the whole year 2023.

In December 2023, this company was also fined by the State Securities Commission (SSC) for not disclosing information about the use of capital raised from bond issuance, as well as the report on the situation, interest and principal payment of bonds in 2022.

The question of ability to repay debt is also raised for some companies such as Phuong Nam Urban Investment and Development Joint Stock Company (with a bond worth 4,695 billion dong maturing in September 2024), Lan Viet Real Estate Company Limited (with a bond worth 4,100 billion dong maturing in November 2024), Dai Phu Hoa Joint Stock Company (with a bond worth 3,560 billion dong maturing in December 2024), or Phu Tho Land Joint Stock Company (with a bond worth 1,900 billion dong maturing in August 2024),… as these companies have not yet disclosed any information about their financial situation on the specialized bond page of HNX.

Difficulty in relieving payment pressure

It can be seen that in the context of difficult business conditions, liquidity pressure on businesses will increase when they need to prepare funds to repay principal and interest on the bonds.

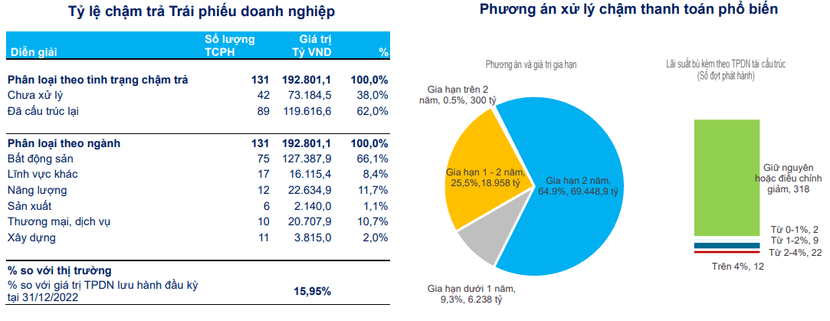

VNDirect’s bond market report for 2023 shows that in 2023, the list of late payment entities for corporate bond obligations continued to increase.

Since the fourth quarter of 2022, the list of organizations with delayed payment of bond obligations has continuously increased. According to VNDirect’s aggregated data, by the end of 2023, there were about more than 70 businesses on the list of late payment of interest or principal of corporate bonds. It is estimated that the total corporate bond debt of these companies is about more than 172,000 billion dong, accounting for about 16.5% of the total corporate bond debt of the whole market. Most of them belong to the real estate group.

VNDirect said that in the context of many issuing organizations still facing difficulties in business activities and cash flow, especially real estate businesses, many issuing organizations have chosen the negotiation solution with bondholders to extend the term of bonds coming due to have more time to recover business production and generate enough cash flow to repay bond debts.

By the end of 2023, nearly 70 issuing organizations have reached an agreement to extend the term of bonds with bondholders and have officially reported to HNX, with a total value of extended bonds of more than 116 trillion dong.

FiinRatings’ report on the prospects of the capital market in 2024 also states that since the issuance of Decree 08/2023/ND-CP allowing bond restructuring, businesses tend to choose restructuring options to deal with short-term liquidity issues.

Source: HNX, FiinRatings

Data from this credit rating agency shows that 62.04% of the restructuring corporate bond value with extended principal/interest period (accounting for 76.13% of the total value of restructuring corporate bonds) is a widely applied option thanks to its cost optimization feature and only requires consent between the two parties involved, alongside more complex pricing options such as liquidation of collateral, exchange of real estate assets or receivables. Some bond lots also saw changes in terms such as interest rate adjustment, supplementary collateral, and other commitments.

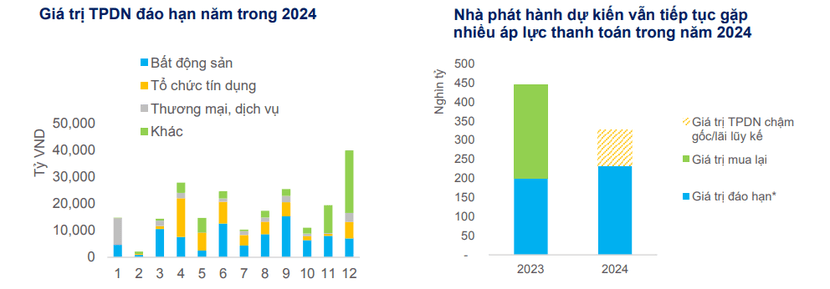

However, according to FiinRatings, in 2024, in addition to the pressure of large bond maturities (about 239,000 billion dong, an increase of 19.7% compared to 2023), the market will face an additional burden from bonds with extended principal/interest periods previously under Decree 08, with an estimated value requiring solution of 94,100 billion dong.

“The payment pressure of real estate companies is expected to be difficult to relieve when the market has not fully recovered, legal obstacles still persist due to policy delays, and companies need time to balance operating cash flow. The slow payment risk of the market will also increase due to some extension terms in Decree 08 expiring and pressure from bond issuances with buy-back commitments in 2024,” FiinRatings commented.

However, FiinRatings still expects that the corporate bond market in 2024 will enter a new phase of tighter development with higher requirements for all participants in the market, thereby helping to gradually recover new bond issuance activities. Many provisions of Decree 65/2022/ND-CP will become effective in 2024 and will establish stricter discipline for all involved and support the restoration of market confidence.

Source: HNX, FiinRatings

Indeed, in an effort to make the corporate bond market transparent, SSC has also increased penalties for businesses that violate regulations on information disclosure about bonds. Most recently, in early February 2024, SSC issued a sanction decision for a series of businesses for not disclosing information about completing the early redemption of bonds.

Accordingly, SSC has penalized a group of businesses including WorldWide Capital Joint Stock Company, Air Link Joint Stock Company, and Kien Hung Thinh Construction Joint Stock Company for not sending information on completing the early redemption of bonds issued in 2022 as well as information about the use of raised capital from bonds, the payment situation of bond interest and principal in 2022 and 2023 to HNX.

Earlier, in March 2022, WorldWide Capital issued two bonds with the codes WWCCB2223001 and WWCCB2223002 valued at 1,260 billion dong and 2,150 billion dong respectively; Air Link issued two bonds with the codes ALICB2223001 and ALICB2223002 worth 1,240 billion dong and 2,570 billion dong respectively; Kien Hung Thinh issued two bonds with the codes KHTCB2223001 and KHTCB2223002 worth 2,500 billion dong and 1,110 billion dong respectively. All these bond lots have a term of 18 months, maturing on September 30, 2023 and have been redeemed early by the companies.

Vast King Investment Joint Stock Company, another company in Masterise’s ecosystem, or some companies related to Van Thinh Phat such as Sunny World Investment and Development Joint Stock Company, Eagle Side Investment and Development Joint Stock Company, Minh Truong Phu Construction Joint Stock Company were also fined for similar violations.