The bullish push of blue-chip stocks helped VN-Index break through the resistance level of 1,250 points in the session on February 28. The index closed the session at 1,254.55, up 17.09 points (+1.38%), which is the highest level in over 18 months since September 2022. The liquidity continued to improve with a trading value of over VND 21,000 billion on the HOSE.

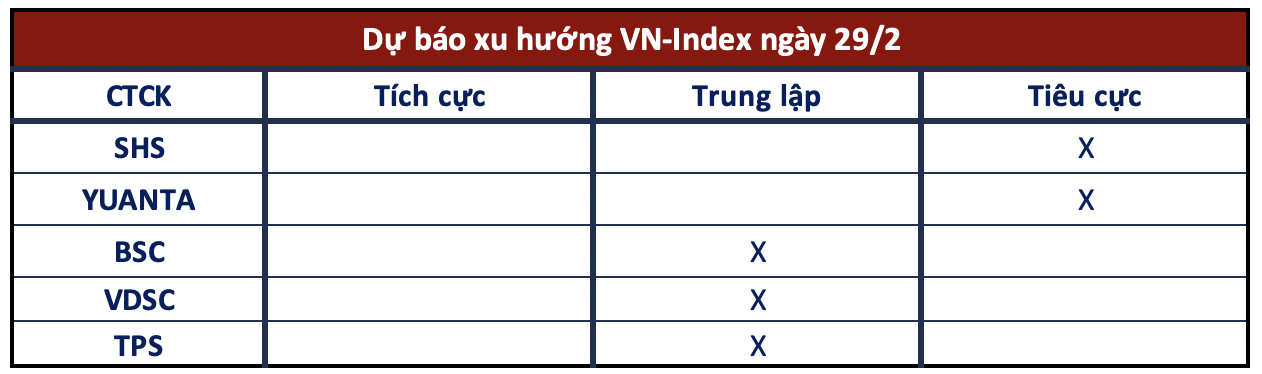

Regarding the market outlook in the coming sessions, most securities companies believe that VN-Index’s strong breakthrough of the resistance level will reinforce the upward trend in the medium term, but in the short term, there may be volatile sessions for consolidation. Therefore, investors need to observe the supply and demand dynamics to assess the market conditions.

Risk is increasing

SHS Securities

The resistance level around 1,250 points is strong and VN-Index is not easy to overcome in the short term. Therefore, the market will continue to have unusual movements in the upcoming period and there may be a strong sell-off and subsequent accumulation. Short-term investors should be cautious at the current stage as the risk is increasing.

Yuanta Securities

The market may have a correction in the next session and VN-Index could target the next resistance level at 1,268 points. At the same time, the short-term risk is low as money is flowing evenly between different groups of stocks and large-cap stocks in particular have started to break out with new 52-week highs or new all-time highs. In addition, the short-term sentiment is still optimistic.

BSC Securities

VN-Index surpassed the short-term peak and psychological level of 1,250 points thanks to technical uptrends from large bank stocks, especially VCB. In the upcoming sessions, VN-Index will have consolidation sessions to solidify the new price range before forming strong bullish sessions to establish new high price levels in the year.

Possible volatile sessions

Rong Viet Securities (VDSC)

The market broke through the 1,250-point barrier with a Three White Soldier candlestick pattern, indicating that the uptrend is still being maintained. The market may have a state of contention and volatility due to the increasing point levels, but the current uptrend signal may provide support for the market in the near term.

The 1,240 – 1,250 point range is becoming a nearby support level for the market, and the target range can be raised to 1,300 points. Therefore, investors need to observe the supply and demand dynamics to assess the market conditions. Currently, it is advisable to focus on stocks with good signals from the support level to hold or accumulate, but also take advantage of the uptrend to take profits on stocks with significant developments at the resistance level.

TPS Securities

Today’s positive point session has pushed the index past strong short-term resistance. This reinforces the upward trend of VN-Index in the medium term. In the next session, the market’s strength will depend on the points gain of large-cap stocks. Volatility may continue to appear in the 1,250 – 1,260 point range. If it fails to break through this range, the index is likely to have a correction to the 1,230 – 1,235 point range.