Statement on the content “Monetary policy management contributes to stabilizing macroeconomic, controlling average inflation, supporting economic recovery, and supporting the development of the stock market,” Deputy Governor of the SBV Pham Thanh Ha emphasized that the goal of developing a stable, safe, healthy, transparent, efficient, sustainable and integrated stock market with a reasonable structure for market sectors to become an important channel for mobilizing long-term capital for the economy, the Prime Minister has issued many decisions, communications, orders to direct relevant ministries and branches to urgently implement according to their authority, especially to quickly resolve obstacles in their respective areas of responsibility to meet the criteria for upgrading the stock market from frontier to emerging markets.

Based on closely following the directions of the Government, the Prime Minister, in the role of the state management agency for currency, banking operations and foreign exchange, in the operation, the State Bank of Vietnam (SBV) has proactively closely monitored macroeconomic and monetary developments to flexibly and proactively manage monetary policy; timely coordinated with the Ministry of Finance and related ministries in coordinating monetary policy, fiscal policy and other policies to contribute to stabilizing macroeconomic, controlling inflation, and supporting economic growth; thereby, to support the development of the stock market, towards the goal of upgrading the stock market from frontier to emerging markets.

In 2023, the domestic economy faced many difficulties in the context of slow global economic growth, high inflation, declining global trade, fluctuations in prices of basic commodities, and geopolitical conflicts. Besides, central banks of countries continued to raise interest rates to control inflation, the international USD fluctuated sharply, and the currencies of many countries depreciated, which also had negative effects on the domestic economy. The driving forces of export growth, investment, and consumption all faced challenges due to low global demand, and businesses faced difficulties due to declining orders.

To cope with the rapid fluctuations of the world situation and domestic situation, the SBV has proactively closely monitored macroeconomic and monetary developments to timely adjust policies, issue and implement synchronous and optimized monetary policy tools and solutions to contribute to stabilizing macroeconomic, controlling average inflation in 2023 to achieve 3.25%, lower than the target of 4.5% set by the National Assembly and the Government, supporting economic recovery, and ensuring the safe development of the credit system; thereby, contributing to stabilizing the psychology of investors, supporting the development of the stock market.

In particular, the SBV has reduced interest rates to support the removal of difficulties for the economy. Specifically, the SBV has implemented a range of measures to strive to reduce interest rates for loans, remove difficulties for the economy, enterprises, and people, specifically: (i) Continuously adjusted interest rate floors 4 times, with a total reduction of 0.5-2.0%/year in the context of continued rising world interest rates and staying at a high level; thereby continuing to guide the reduction of the lending rate benchmark of the market, increasing the accessibility of capital for businesses and people; (ii) Guided credit institutions to continue reducing costs to reduce the lending rate benchmark…

By the end of 2023, the domestic interest rate benchmark had been significantly reduced (new deposit and lending interest rates decreased by more than 2.5%/year; the end-of-period lending rate reduced by 1.1%/year). With the delayed impact of policy adjustments, after reducing lending rate benchmarks and other synchronous measures, the SBV expected that lending rate benchmarks would continue to decrease in the coming time.

Continue to flexibly and appropriately operate exchange rates in line with market conditions at home and abroad, flexibly intervene to stabilize the foreign exchange market.

In the first 6 months of 2023, the balance of supply and demand of foreign currencies in the country improved, the foreign exchange market was relatively stable, and liquidity was smooth, so the SBV was able to buy foreign currencies from credit institutions to supplement the state foreign exchange reserves. However, from about June 2023 to the beginning of November 2023, the VND was under pressure to depreciate due to the strong resurgence of the USD and the shift in the difference between the VND interest rate and the USD interest rate to negative in the context of the US raising interest rates and Vietnam continuously reducing interest rates. Faced with that situation, the SBV flexibly operated the exchange rate, contributing positively to absorbing external shocks, while also implementing measures to limit large short-term exchange rate fluctuations, towards the goal of overall macroeconomic stability. Thanks to this, the VND exchange rate remained relatively stable compared to other currencies in the region, with smooth liquidity. At the end of 2023, the VND depreciated by about 2.89% against the USD, which was consistent with the general trend of other currencies in the region.

In general credit management, right from the beginning of the year, the SBV allocated credit growth targets for credit institutions and directed banks to target credit to production and business sectors, priority areas, and growth drivers according to the Government’s direction, ensuring safe and effective credit activities; continued to closely control credit to potentially risky sectors; created favorable conditions for businesses and individuals to access bank credit.

By the end of 2023, credit to the entire economy reached about VND 13.56 quadrillion, an increase of 13.71% compared to the end of 2022. The credit structure continued to focus on capital for production and business sectors, priority areas, and growth drivers according to the Government’s direction; actively supported the recovery process and economic development. Credit to potentially risky sectors was controlled.

In 2023, the liquidity of the credit system was abundant, the monetary market was stable, and operations were smooth, the interbank interest rate maintained at a low level, both contributing to achieving the goal of monetary policy and creating favorable conditions for the Ministry of Finance to issue Government bonds in 2023 with a volume of VND 298.476 trillion, accounting for nearly 100% of the planned issuance; average term of 12.58 years; average interest rate of 3.21%/year, continuing to decrease by 0.27%/year compared to 2022 and currently at a very low level (much lower than the government bond interest rate in developed countries like the US), reducing borrowing costs for the state budget. At present, credit institutions both provide credit funds to the economy and are active investors in the government bond market (the volume of government bond purchases by credit institutions in 2023 accounts for about 44% of the total issuance; credit institutions held nearly 40% of the government bond portfolio as of the end of 2023); thereby creating resources to actively support the recovery process and the economic development. In terms of guaranteed government bond issuance, the SBV continued to encourage banks to buy government-guaranteed Bank for Social Policies (BSP) bonds. In 2023, the BSP issued VND 24.351 trillion worth of bonds guaranteed by the government (of which credit institutions bought 95.1% of the issuance volume), reaching 100% of the assigned issuance limit, thereby contributing to creating favorable conditions for the BSP to stabilize capital sources to increase credit for the poor households and policy beneficiaries.

“In practice, the SBV and the Ministry of Finance have always exchanged information on the currency market, stocks, bonds… to synchronize communication messages, create trust for domestic and foreign investors, maintain the stability of the overall markets; improve legal basis related to the stock market in general and the bond market in particular.” – Deputy Governor said.

The results of monetary policy management have contributed to stabilizing macroeconomic, controlling average inflation in 2023, maintaining stability of the monetary and foreign exchange markets, and strengthening the state foreign exchange reserves. These are factors contributing to Fitch upgrading Vietnam’s long-term sovereign credit rating to BB +, Outlook “Stable”, which is important in the effort to enhance Vietnam’s position and reputation in the international market.

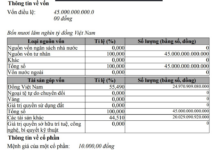

Currently, the Vietnamese stock market is included in Group 3 – frontier markets by two market rating organizations, MSCI and FTSE Russell. In particular, FTSE Russell is currently including Vietnam in the waiting list for upgrading to Group 2 – emerging markets. The development of the stock market has an important role and significance for the development of the economy and businesses. For the credit institution system, the stock market’s development supports credit institutions in issuing shares, bonds to increase capital to create additional long-term capital sources to meet the capital needs of individual customers and organizations, ensuring the safety ratios of activities according to the regulations of the SBV.

Deputy Governor Pham Thanh Ha said that in the past time, the SBV has always paid attention and actively coordinated with the Ministry of Finance in finding solutions to serve the work of upgrading the stock market. The SBV has worked with the two rating organizations to answer questions and problems of investors related to the banking sector, step by step develop the foreign exchange market, support foreign exchange liquidity when necessary to serve the increasing capital needs of investors, especially foreign investors.

According to the Deputy Governor, it is necessary to continue to research, review, and complete the legal framework for the stock market in general, the bond market in particular, creating favorable conditions for credit institutions to issue shares, bonds on the market

Complete the legal framework for the stock market, creating favorable conditions for credit institutions to issue shares, bonds

Evaluating the stock market as an important channel for leading investment capital to the economy, in order for the stock market to develop, Deputy Governor Pham Thanh Ha proposed three solutions to the Ministry of Finance, the State Securities Committee.

According to Deputy Governor Pham Thanh Ha, in 2024, the global economy will continue to face difficulties under the impact of tightened financial conditions, geopolitical conflicts, and increased financial risks. Global inflation is expected to continue to slow down but still higher than the target in many countries in the context of risks of energy, food and food crises due to the strategic rivalry between major countries. The domestic economy continued to face challenges as global demand had not recovered strongly. However, with the delay of the solutions to support the economy continuously deployed since the beginning of 2023, along with the strong direction of the Government to guide the solutions to remove difficulties in the real estate market, corporate bonds, facilitating the recovery of markets, then the forecast of economic growth in 2024-2025 may recover compared to 2023. Some international organizations forecast that Vietnam’s GDP growth in 2024 is 5.5-6.5% and in 2025 is 6-7%.

In order to jointly support the safe, transparent, efficient, and sustainable development of the stock market in 2024 and the following years, in the coming time, the SBV will closely monitor market developments, domestic and international economic situations, closely coordinate with fiscal policy to proactively, flexibly and synchronously manage monetary policy tools and solutions to control inflation, contribute to stabilizing macroeconomic, and recovery of sustainable economic growth. The SBV will continue to flexibly manage the operation of the open market to ensure liquidity for the system of credit institutions; proactively and flexibly manage interest rates and exchange rates, appropriately, in line with macrobalance, inflation, and monetary policy objectives; proactively managing the volume and structure of credit growth, meeting the capital needs of the economy to contribute to controlling inflation, supporting economic growth… Together with policies to attract resources and invest in and outside the country in the stock market, the SBV’s proactive, flexible and synchronous management of monetary policy tools appropriate to the actual situation, maintaining stability in the monetary, foreign exchange, and exchange rate markets will contribute to making capital attraction policies from abroad more effective; helping build confidence for investors in a stable business environment; creating reserves for the future in attracting more foreign capital to invest and develop the stock market.

However, in the context of the large and mainly bank-based economy’s long-term capital needs with a significant proportion of medium and long-term credit causing pressure and risk to the credit institution system when the main capital source is short term. To develop the financial market harmoniously, transparently, and sustainably, develop a stable, safe, effective, sustainable, and integrated stock market with a reasonable structure, positive complementarity between the money market and the capital market, the SBV proposed to the Ministry of Finance, the State Securities Commission:

First, continue to research, review, and complete the legal framework for the stock market in general, the bond market in particular, creating favorable conditions for credit institutions to issue shares, bonds on the market; and at the same time, coordinate with related ministries to implement synchronous solutions for the stock market’s development.

Second, continue to diversify investors participating in the market, encourage funds, insurance companies, foreign investors… to participate more deeply and widely in the market.

Third, the Ministry of Finance continues to communicate closely with the SBV to strengthen coordination between monetary policy and fiscal policy.