Vietnam’s Manufacturing Sector Continues to Grow in February

Vietnam’s manufacturing industry continued to experience slight growth in February, with both production and new order volumes increasing for the second consecutive month. The sustained growth has contributed to a rebound in employment, while business confidence reached its highest level in a year. However, companies continue to reduce purchasing activity and instead utilize inventory to meet production demands and fulfill orders. Meanwhile, companies have also raised selling prices to offset the increase in input costs, albeit only by a small margin.

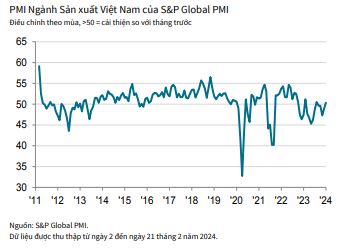

The Manufacturing Purchasing Managers’ Index™ (PMI®) for Vietnam’s manufacturing sector, as measured by S&P Global, reached a score of 50.4 in February, slightly up from January’s 50.3 and above the 50-point threshold for the second consecutive month. The improvement in the sector’s health, as indicated by the index, remains only modest. New order volumes increased slightly for the second consecutive month, with some survey respondents attributing the increase to improved new orders from abroad.

However, the pace of growth in new export orders slowed down, with a mild increase recorded. Corresponding to the pattern of new orders, production levels increased for the second month in a row in February. This month’s increase was modest and nearly on par with the level recorded in January.

Production growth was observed in the consumer goods and basic investment goods sectors but declined in the intermediate goods sector. The increase in new orders encouraged manufacturers to increase employment levels for the first time in four months, with the rate of increase being the highest in a year.

However, some survey respondents noted that they only hired temporary workers. With the increase in employment and relatively low growth in new order volumes, companies were able to clear backlogs for the first time in three months. Partly, companies utilized finished goods inventory to meet order requirements, resulting in a further reduction in post-production inventory. In fact, the pace of reduction this month was the fastest in four months and one of the two sharpest declines since January 2023.

Manufacturers also opted to use purchased inventory in February instead of making new purchases. Purchasing activity decreased for the fourth consecutive month, while the current decline in input inventory was the most significant since June 2021.

At locations where companies procured input goods, they continued to experience extended delivery times from suppliers in February as reports indicated transportation delays.

However, the decrease in vendor performance was only marginal. The transportation delays coincided with increased transportation costs, which are believed to be driven by rising oil prices.

As a result, input costs continued to rise notably in February, although the rate of increase was the lowest since September of last year. Manufacturers of basic investment goods saw particularly strong increases in input costs. Some manufacturers shifted the burden of high input costs onto customers, hence resulting in a slight increase in selling prices following a mild decrease in the previous survey period. The price increase was only modest, reflecting the reality that some companies are attempting to limit price increases due to competitive pressures. Expansion plans and the introduction of new products have contributed to an optimistic business outlook for the first quarter, and the positive sentiment towards production also reflects expectations of increased new order growth. Business confidence reached its highest level in a year, with nearly 55% of survey respondents expressing optimism.

Commenting on Vietnam’s February 2024 PMI, Andrew Harker, Economics Director at S&P Global Market Intelligence, said:

“Manufacturers have been able to build on the return to growth seen in January with momentum continuing into February. Particularly positive factors from the latest PMI survey were the return of employment and the highest business confidence in a year. However, overall growth remains relatively weak, leading companies to remain cautious in purchasing activity and maintaining inventory levels. Similarly, although output prices have risen following a fall in January, the rate of increase is only modest as some companies remain reticent to raise prices in a competitive environment. Manufacturers will need sustained and stronger growth in new orders before they can be confident enough to purchase input goods and start to increase selling prices in line with cost burdens.”