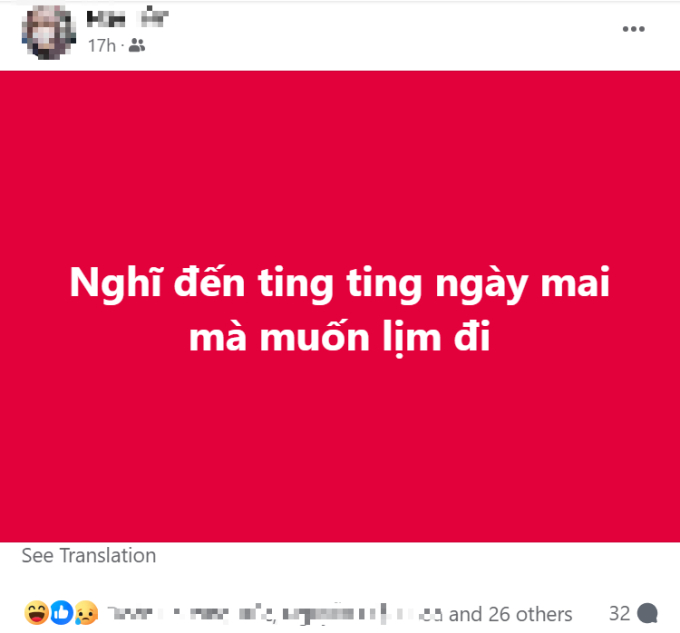

For office workers, the sound of “ting ting” on the last day of the month is the sound of both the joy of life and the motivation to work. It’s easy to understand, most of us are working to make a living, with a passion so strong that even a meager salary feels like a bucket of cold water poured on a blazing fire.

Today, that same sound wakes us up from our afternoon nap, but the number on our phone screen is quite surprising…

Receiving February salary: Some disappointed, others smiling, all because of the words “Tet bonus”

T. Huong (29 years old), an office worker in Hanoi, said, “My February salary is significantly reduced compared to previous months. Of course, I felt a little down at first, but I wasn’t surprised. Before Tet, I already anticipated this, so I proactively saved money and cut back on some expenses like dining out, going for coffee, or impulse shopping to make up for the deducted salary in February.”

T. Huong

Van Loan (33 years old), who also lives and works in Hanoi, shared with us, “My February salary was reduced a significant amount compared to previous months. I knew in advance that my post-Tet salary would be subject to tax deduction, but I was still shocked because the deducted amount was larger than I expected.”

Van Loan and her disappointment…

Both Thanh Huong and Van Loan have over 5 years of work experience, which means they are not clueless about their salary and bonuses being subject to tax deduction, but Thu Trang (24 years old) is different.

“This year is my first Tet bonus because I’ve only been working for over a year. Actually, my Tet bonus is not much, but my February salary is reduced quite a lot… It’s like I have to squint my eyes to see if I’m seeing things correctly,” Thu Trang shared.

In a different development, when we contacted Thanh Trung (26 years old), who currently lives and works in Ho Chi Minh City, to ask about the situation of his February salary compared to previous months, we received a reverse question, the gist of which was: “It’s the same every month, what’s new to ask about?“

In actuality, Thanh Trung’s post-Tet salary remains unchanged compared to other months because he doesn’t receive a 13th-month salary or Tet bonus.

“Well, technically it’s not like nothing, but it’s insignificant because my company is small, with only 10 employees. Each person receives a bonus of less than 1 million, it’s more like a lucky money for the new year. This lucky money is handed directly to each person by the boss, not added to the salary transfer,” explained Thanh Trung.

Why does the bigger the Tet bonus, the smaller the February salary?

The answer can be summed up in one sentence: Personal income tax refund!

In case you don’t know: Personal income tax (PIT) is a direct tax based on the income of the taxpayer after deducting tax-exempted income and family deductions according to the provisions of the Personal Income Tax Law and related documents and guidelines.

Currently, individuals with a monthly income of over 11 million VND (132 million VND/year) are subject to personal income tax. In the case of a worker with one dependent, the income must be over 15.4 million VND/month to be subject to tax, and the income must be over 19.8 million VND/month for two dependents.

Illustrative image

According to the law, Tet bonus is taxable income. The worker has the obligation to pay personal income tax on this bonus according to the progressive tax rates by portion. Specifically as follows:

– Below 5,000,000 VND: 5% tax.

– From 5,000,000 VND – 10,000,000 VND: 10% tax.

– From 10,000,000 VND – 18,000,000 VND: 15% tax.

– From 18,000,000 VND – 32,000,000 VND: 20% tax.

– From 32,000,000 VND – 52,000,000 VND: 25% tax.

– From 52,000,000 VND – 80,000,000 VND: 30% tax.

– Over 80,000,000 VND: 35% tax.

That means our February salary will be deducted two portions of personal income tax: One portion based on the February salary, and one portion of tax refund from the Tet bonus.

Now you understand why your February salary is lower than other months, right?

Paying tax is the responsibility of citizens. The tax revenue will be used to serve the people and public works. Therefore, we need to pay taxes to enjoy the benefits from the state budget.