According to the 2023 annual report, the leadership board of the Hai An Shipping and Stevedoring Joint Stock Company (stock code: HAH) stated that the general maritime transportation market and container transportation market in 2024 compared to 2023 will have a stable and slight increase in transportation rates and charter rates. However, the market will still face many difficulties and challenges.

First, the supply continues to increase. The ship fleet supply will significantly increase in 2024 as the expected number of newly delivered ships will account for 10.4% of the total fleet supply with a total of 2.95 million TEUs, the highest since 2010. According to Clarkson, the supply is expected to exceed demand by 3.1% in 2024.

Second, the factors affecting the demand have not been improved in 2023 and will continue to affect in 2024. For example, consumers tighten their spending due to inflation, rising interest rates, and the shift from goods to services such as travel and healthcare spending after the Covid-19 pandemic.

Third, political instability in hot spots around the world continues and cannot end soon, continuing to directly impact the global economy.

Based on the above market developments and long-term investment plans, Hai An has the following business orientation: For the ship fleet, it must continue to strive to increase the market share of container transportation and expand its operations on domestic routes by increasing the number of trips and new ports of call.

Together with the Joint venture ZIM-HAIAN, develop Intra-Asia routes (Southeast Asia, Northeast Asia, and the Middle East), maximize the efficiency of the fleet through flexible vessel utilization rates. The company self-operates and leases fixed-term vessels to save costs and ensure profitable ship operations.

With the recent delivery of the HAIAN ALFA vessel in December 2023 and the reception of 3 more newly built vessels in 2024, Hai An will increase the transportation capacity of the company and seek suitable partners (foreign shipping lines) for cooperation and capacity-sharing on intra-Asia routes to gradually expand the Intra-Asia routes.

For the Port, Depot, and Logistics businesses, must strive to achieve higher profit than in 2023 to support the ship fleet. In addition, Hai An continues to acquire appropriate vessels when opportunities arise to increase capacity and quality for the ship fleet while actively seeking and investing in infrastructure projects to improve the supply chain for the company. The company also aims to increase the foreign transportation volume to 30%-40% of the total annual transportation volume of the ship fleet by 2025.

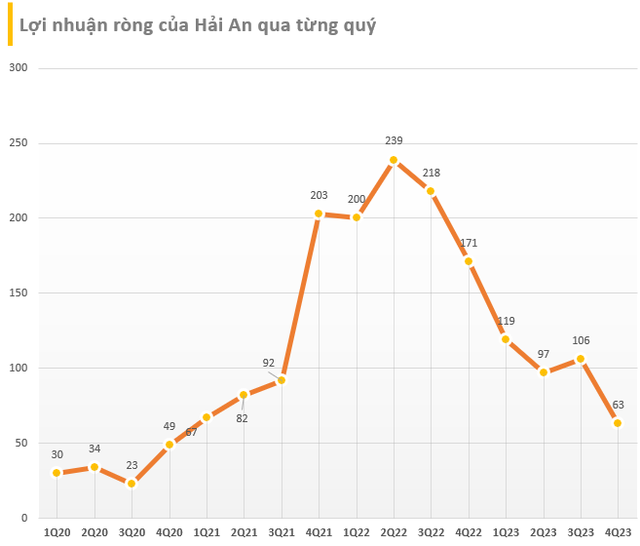

In terms of business operations, in Q4/2023, Hai An recorded a revenue of 664.76 billion VND, a 21.4% decrease compared to the same period, and a net profit after tax of 52.56 billion VND, a 72.3% decrease compared to the same period last year. In which, the gross profit margin continues to decrease from 32% to only 17%.

Accumulated in 2023, this maritime transportation company recorded a revenue of 2,612.69 billion VND, a decrease of 18.5% compared to the same period, and a net profit after tax of 371.2 billion VND, a decrease of 64.3% compared to the same period last year.