Nearly 21% of bad debts

From March 5th to April 29th, the Ho Chi Minh City People’s Court will hold a trial in the first instance of the case involving Van Thinh Phat Corporation and Saigon Commercial Joint Stock Bank (SCB).

According to the indictment, SCB is headquartered at 19-25 Nguyen Hue, Ben Nghe Ward, District 1, Ho Chi Minh City and was established on November 26, 2011, based on the merger of three joint stock commercial banks: Saigon Commercial Bank (formerly), Vietnam Tin Nghia Joint Stock Commercial Bank, and Dai Nhat Joint Stock Commercial Bank.

The initial charter capital was over 10,583 billion VND, and up to now, the charter capital has exceeded 15,231 billion VND. In October 2022, SCB has 1 headquarters, 50 branches, and 184 transaction offices nationwide.

As of October 2022, Truong My Lan owned and controlled 1,394,253,393 shares of SCB, accounting for 91.5% of the charter capital of SCB.

At the time of the crime being prosecuted, the SCB’s bookkeeping system showed that the total amount of money deposited by the public and borrowed from other organizations was 673,586 billion VND. In which, 511,262 billion VND was customers’ deposits, 76,845 billion VND was issued papers with a value, 66,030 billion VND was borrowed from the State Bank, 12,693 billion VND was deposits, and 6,756 billion VND was borrowed from other credit institutions.

As of October 17, 2022, SCB’s shareholders’ equity recorded in the books was 21,036 billion VND, including: Banks’ capital, allocated reserve funds, exchange rate differences, undistributed profits. The total capital sources of SCB according to the accounting books as of October 17, 2022 were 713,420 billion VND, including mobilized capital, shareholders’ equity, and SCB’s obligations to be paid but not yet paid, other payable amounts and debts amounting to 18,798 billion VND.

The inspection conclusion of the interagency inspection team (Bank Supervision Inspection Agency, Government Inspectorate, State Audit, National Financial Supervisory Commission) determined that SCB’s financial situation as of June 30, 2017 was very bad. Specifically, the bad debt ratio reached 20.92% (while the regulations did not exceed 3%), the individual capital adequacy ratio (CAR) was 6.5% (the regulations required it to be higher than 9%), the short-term capital-to-medium and long-term lending ratio was 13.28% (regulations required it to be greater than or equal to 50%), the proportion of real estate lending/total debt was 62.95% (while the State Bank allowed it to be no more than 55%).

On October 8, 2022, the State Bank issued a decision on special control over SCB. The special control board requires SCB to hire an independent audit organization to review and evaluate the financial situation, determine the true value of the charter capital… of the bank.

On May 31, 2023, KPMG Audit Company, Ho Chi Minh City branch issued an independent audit report, determining that SCB has negative shareholders’ equity of 443,769 billion VND, and accumulated losses of 464,547 billion VND.

Since October 2022, SCB has closed dozens of transaction locations.

During the period from January 1, 2012 to October 17, 2022, Truong My Lan directly and directed, operated individuals who were key officials at SCB and Van Thinh Phat Corporation to commit many violations to manipulate SCB, violate regulations on banking activities, other activities related to banking activities, and embezzle assets.

Setting up 3 units to disburse funds for Ms. Lan

The indictment determined that after merging the shares of 3 banks to form SCB, Ms. Truong My Lan had 73 shareholders owning 85.6% of SCB’s charter capital, and at the same time continued to buy and use individual shares named after SCB to increase her ownership percentage at the bank to 91.5% on January 1, 2018.

As of October 2022, Ms. Truong My Lan owned and controlled 1,394,253,393 shares of SCB, accounting for 91.5% of the charter capital, through 27 legal entities in and outside the country, individuals named as helps. Ms. Truong My Lan directly owns 75,888,800 shares, accounting for 4.98% of the charter capital.

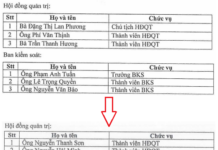

Ms. Truong My Lan has selected and brought trusted individuals with expertise in finance and banking to key leadership positions at SCB (Board of Directors, General Directors, directors of major branches, Head of Supervisory Board), paying salaries ranging from 200 – 500 million VND/month, giving bonuses in cash and SCB shares to these individuals to manage all the activities of SCB.

By acquiring, owning, and controlling shares, and directing the activities of key individuals, Ms. Truong My Lan used SCB as a financial tool, mobilizing deposits and capital from other sources, and then directing withdrawals by creating false loans to serve personal purposes.

SCB has negative shareholders’ equity of 443,769 billion VND, and accumulated losses of 464,547 billion VND.

To withdraw money from SCB, Ms. Truong My Lan directed trusted individuals with key roles at SCB and Van Thinh Phat Corporation to organize the establishment of numerous departments, units, companies, to hire and use thousands of individuals, closely colluding with each other, in conspiracy with appraisal companies, to implement withdrawals from SCB.

It is worth noting that Ms. Lan established units under SCB solely for lending and disbursing loans according to her own request. Specifically, since 2020, Ms. Lan has directed a series of SCB’s leaders to establish 3 lending units solely to serve her loans, including: Wholesale Customer Business Center, Direct Business Channel under the Corporate Business Block, Direct Business Channel under the Banking and Personal Financial Services Block.

All 3 units have the functions of lending like branches but are under the management and administration of SCB Headquarters, without treasury department and separate seals but use the seals of other units when operating and only establish loan files for Ms. Truong My Lan’s loans.

From June 3, 2020, to June 24, 2022, the 3 lending units have established loan files and disbursed funds for 396 loans with a total outstanding balance of 212,725 billion VND. In which the principal outstanding balance was 185,183 billion VND, and the interest or fee was 27,542 billion VND.