The market liquidity decreased compared to the previous trading session, with the trading volume of VN-Index reaching over 890 million shares, equivalent to a value of over 22 trillion dong; HNX-Index reached nearly 105 million shares, equivalent to a value of over 2 trillion dong.

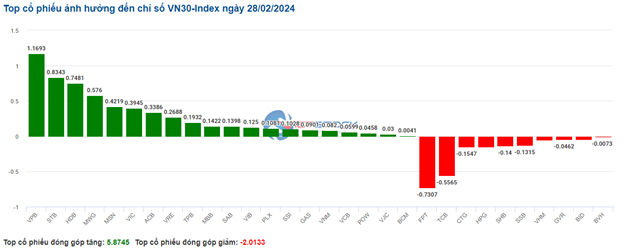

| Top 10 stocks affecting VN-Index on 01/03/2024 (in points) |

VN-Index opened the afternoon session with fluctuation, and until near the end of the session, buying pressure took the lead, pushing the index to a near daily high. In terms of impact, BID, VHM, FPT, and GVR were the most positive influencers on VN-Index, with an increase of 2.4 points. Conversely, VPB, TCB, VNM, and HPG were the most negative influencer, taking away more than 1.2 points from the index.

HNX-Index also had a similar trend, in which the index was positively affected by stocks like L18 (6.9%), DTD (4.27%), PLC (3.75%), and BVS (2.55%),…

|

Source: VietstockFinance

|

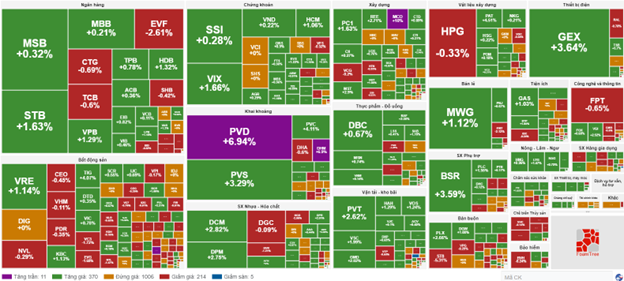

The finance sector is the strongest sector with a 3.64% increase mainly attributed to stocks such as IPA (+6.25%), OGC (+0.69%), and TVC (+1.15%). The following sectors are supporting manufacturing and consulting services, with growth rates of 3.56% and 2.61% respectively. Conversely, the rubber product sector saw the most significant decline in the market with -1.05%, mainly due to stocks like DRC (-0.3%), CSM (-0.78%), and SRC (-4.92%).

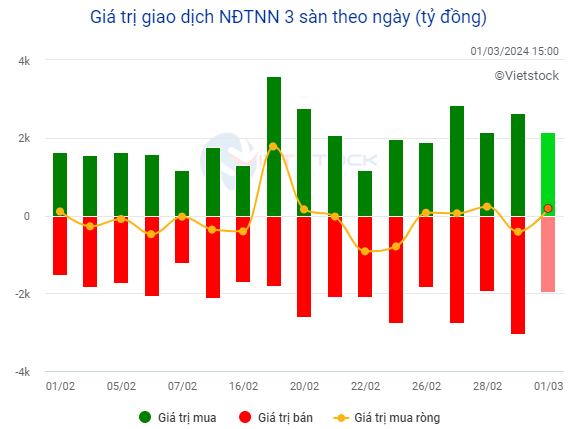

In terms of foreign trading, this group returned with a net purchase of nearly 178 billion dong on HOSE, focusing on stocks like VIX (124.34 billion), SSI (115.49 billion), STB (109.07 billion), and MWG (90.5 billion). In HNX, foreign investors sold more than 4 billion dong, focusing on stocks like PVS (38.06 billion) and IDC (7.41 billion).

Source: VietstockFinance

|

Morning session: Cautious sentiment still present

VN-Index slightly increased and hovered around the reference level throughout the morning session. Meanwhile, foreign investors continued to be net sellers, indicating that the situation is still not optimistic. At the close of the morning session, VN-Index increased by 1.08 points, equivalent to 0.09%. HNX increased by 0.99 points, equivalent to 0.42%.

The trading volume of VN-Index recorded in the morning session reached over 437 million units, with a value of over 11 trillion dong. HNX-Index recorded a trading volume of over 61 million units, with a trading value of over 1.2 trillion dong.

Source: VietstockFinance

|

The supporting industries group contributed significantly to the growth of the main index at the end of this morning session. In which, stocks recorded significant increases, such as ACG increased by 1.86%, PTB increased by 1.74%, and TLG increased by 1.39%. Meanwhile, BKG shares hit the ceiling at the beginning of the session with an increase of 6.87%.

In addition, the securities sector is also among the most volatile sectors in the market this morning. All stocks in this group are showing positive signs, such as SSI (+1.08%), VND (+2.65%), VCI (+3.29%), HCM (+2.15%), SHS (+1.69%), MBS (+3.23%), VIX (+2.73%), FTS (+1.58%), CTS (+3.89%), AGR (+3.72%),… The most outstanding is BSI stock with a limit increase of 6.99%.

The information technology sector is also a highlighted group with stocks like FPT (+1.56%), CMG (+2.25%), SGT (2.51%), ELC (1.38%),…

On the other hand, the rubber, banking, seafood, healthcare, food and beverage, and machinery manufacturing groups are all showing negative signs.

10:30 AM: Tug of war around the reference level

The buying and selling forces in the market are quite balanced, so the main indexes have not been able to break through. As of 10:30 AM, VN-Index slightly increased by 0.42 points, trading around 1,253 points. HNX-Index decreased by 0.75 points, trading around 236 points.

The VN30 basket is experiencing mixed increases and decreases, but selling pressure seems to dominate. Specifically, 4 banking stocks TCB, ACB, VPB, and HDB took away 1.21, 1.18, 0.69, and 0.52 points respectively from the overall index. On the other hand, FPT, MWG, STB, and SSI are being strongly bought and contribute more than 4 points to the VN30-Index.

Source: VietstockFinance

|

The supporting industries group and the seafood processing group are experiencing strong selling pressure with stocks like TCB down 1.42%, ACB down 1.07%, HDB down 1.07%, VCB down 0.51%, ACL down 1.52%, ASM down 0.86%, and VHC down 1.22%.

On the contrary, the securities industry is a standout group since the beginning of the session and leading the market, with contributions from prominent stocks like SSI, VND, VCI, HCM, SHS, VIX, CTS, AGR,… The most notable is BSI stock with a limit increase of 6.99%.

The retail group is also showing impressive gains, with three large-cap companies MWG up 1.73%, PNJ up 1.77%, and FRT up 1.45%. However, CTF and HTC stocks are still under considerable selling pressure.

Compared to the beginning of the session, buyers and sellers are fiercely competing, with over 900 stocks trading at the reference price and sellers having a slight advantage as the number of declining stocks is 284 (including 11 floor falling stocks) while the number of rising stocks is 329 (including 24 limit-up stocks).

Source: VietstockFinance

|

Market open: Cautious at the beginning

A slight red color appeared at the beginning of the trading session. This shows that investors’ caution is still present in the market as the main indexes are fluctuating around the reference level. VN-Index slightly decreased and traded around 1,252 points; HNX-Index slightly increased and traded around 235 points.

A temporary advantage goes to the red color in the VN30 basket, with 12 losing stocks, 11 gaining stocks, and 7 stocks trading at the reference price. Specifically, CTG, TCB, and ACB are the stocks with the strongest decrease. Conversely, VCB, FPT, and STB are the stocks with the strongest increase.

The securities industry is one of the most dynamic sectors in the market this morning. All stocks are showing positive signs, such as SSI, VND, VCI, HCM, SHS, VIX, CTS, AGR,… Meanwhile, BSI and MBS stocks have been increasing since the beginning of the session with increases of 2.87% and 4.41% respectively.

Lý Hỏa