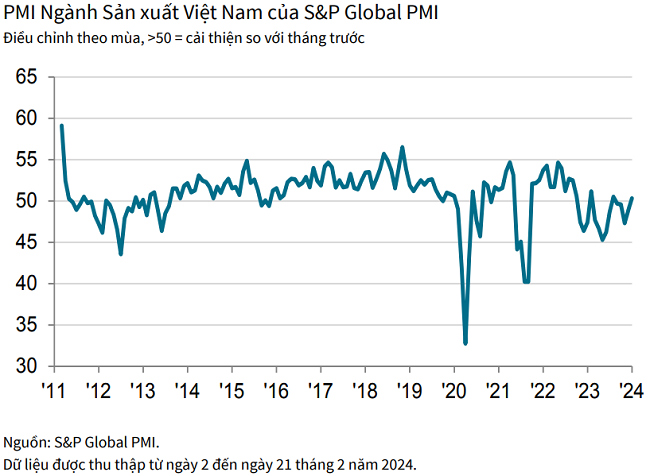

On March 1, 2024, S&P Global released the Purchasing Managers’ Index (PMI) report for the manufacturing industry in Vietnam in February 2024. The report highlighted three key points: New order volumes continued to improve, supporting job growth; output prices increased after a decline in January; business sentiment reached a one-year high.

The report noted that the manufacturing sector in Vietnam continued to experience mild growth in February, with both production and new order volumes increasing for the second consecutive month. The sustained growth has helped to boost employment, while business confidence reached its highest level in a year.

However, companies continued to reduce purchasing activity and instead utilized existing inventory to meet production needs and fulfill orders. Meanwhile, companies also raised selling prices to offset the increase in input costs, although the increase was minimal.

“Vietnam’s manufacturing PMI scored 50.4 in February, a slight increase from January’s 50.3 and above the 50 threshold for the second consecutive month. The degree of improvement in the health of the manufacturing sector remains moderate,” the report stated.

New order volumes increased slightly for the second consecutive month, and some survey respondents attributed the increase in overall new order volumes to improved new orders from abroad. However, the pace of growth in new export orders slowed, with only a slight increase.

Corresponding to the picture of new order volumes, output increased for the second straight month in February. This month’s growth was slight and nearly equal to that recorded in January. Output increased in consumer goods and basic investment goods, but decreased in intermediate goods.

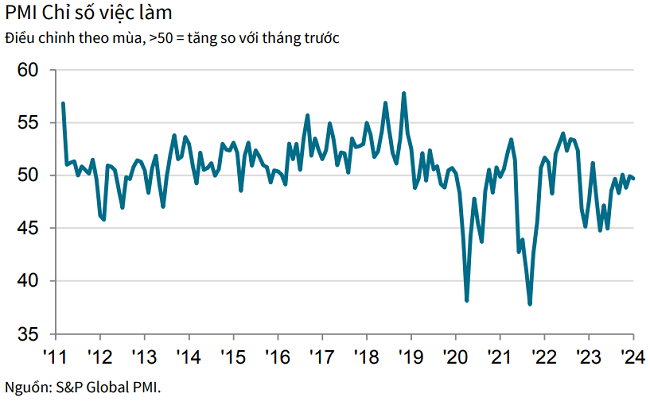

The increase in new orders encouraged manufacturers to hire additional staff for the first time in four months, with the increase being the highest in a year. However, some survey respondents indicated that they were only hiring new personnel temporarily.

With increased employment and relatively low growth in new order volumes, companies were able to complete outstanding work for the first time in three months.

Part of this achievement was attributed to manufacturing companies using their finished inventory to meet order requirements, resulting in a continued reduction in post-production inventory. In fact, this was the fastest reduction in four months and one of the two most significant decreases since January 2023.

Manufacturers also chose to use purchased inventory in February instead of making new acquisitions. Purchasing activity decreased slightly for the fourth consecutive month, while this inventory reduction was the most significant since June 2021.

In places where companies made input purchases, they continued to face extended delivery times from suppliers in February, as reports indicated delays in transportation. However, the decline in seller performance was minimal.

The report by S&P Global further stated that the transportation delays coincided with rising transportation costs, which are usually attributed to increases in oil prices. As a result, input costs continued to rise significantly in February, although the rate of increase was the lowest since September last year. Manufacturers of basic investment goods experienced particularly strong increases in input costs.

Some manufacturers passed on the burden of higher input costs to customers, leading to a slight increase in selling prices after a slight decline in the previous survey period. The price increase only reflected the reality that some companies were trying to limit price increases due to competitive pressures.

Expansion plans in production and the introduction of new products contributed to increased business confidence in the first quarter, and the optimistic sentiment about output also reflected expectations of growth in new orders. Business confidence reached a one-year high, with nearly 55% of survey respondents expressing optimism.

Commenting on the survey results, Andrew Harker, Economics Director at S&P Global Market Intelligence, stated that manufacturers have been able to build on the return to growth seen in January with continued growth in February. The particularly positive aspects of the latest PMI survey are the return of employment and the highest business confidence in a year.

However, overall growth remains relatively weak, and this has led companies to continue to exercise caution in purchasing activities and maintaining inventory levels. Similarly, despite the increase in output prices after the decline in January, the magnitude of the price increase is slight as some companies remain hesitant in raising prices in a competitive environment.

Manufacturers will need stronger and sustained growth in new order volumes before they can confidently make input purchases and begin to raise selling prices to compensate for the increased cost burden.