“M&A is a path we are very interested in, 2020-2021 is a challenging period for foreign investors, but 2023 is a successful year for us as we have completed 3 deals.” Sharing of Mr. Angus Liew – Chairman of the Board of Directors of Gamuda Land at the M&A forum organized by Investment Newspaper in late November 2023 described a different color of the real estate M&A picture in the past year.

Weak demand, legal obstacles, difficult access to capital, depleted cash flow,… are a series of difficulties mentioned in the real estate market in the past period. While domestic investors, even big names like Novaland, Dat Xanh… have to restructure debt, reduce investment scale, streamline their organizations, and reduce labor force…. there are “silent sharks” hunting.

The Vietnamese real estate market witnessed M&A transactions worth about 1 billion USD in 2023.

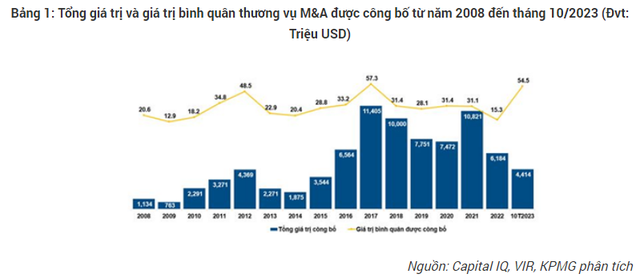

According to KPMG, in just the first 10 months of 2023, the total value of M&A transactions nationwide reached 4.4 billion USD, with 265 transactions. Of which, real estate M&A accounted for 23% of the total transaction value and 2/5 of the largest M&A transactions.

According to RCA and Cushman & Wakefield Vietnam, foreign investors still account for about 90% of real estate M&A activities. In addition to Asian investors, the interest of European and American countries in the Vietnamese real estate market is also increasing.

According to KPMG, in the first 10 months of 2023, foreign investors dominated the top 5 positions in terms of M&A transaction value. Japan, Singapore, and the US accounted for more than 70% of the total announced transaction value; while domestic investors only accounted for 161.6 million USD, equivalent to about 4% of the total announced transaction value of real estate M&A, completely opposite to 2 years ago.

Illustration image

Names like Gamuda Land, ESR Group Limited, or Keppel Land have taken advantage of a difficult year to increase their presence in the Vietnamese market by acquiring many projects from struggling domestic investors.

Two of the largest M&A deals last year belong to Gamuda Land and ESR Group Limited.

First, the M&A deal in the industrial real estate sector must be mentioned. ESR Group Limited spent 450 million USD to acquire a strategic stake in BW Industrial Development Joint Stock Company (BW Industrial), one of the largest and fastest-growing industrial and logistics developers in Vietnam.

BW Industrial plans to use new capital to continue to maintain its leading position in developing important infrastructure for the new economy and take advantage of changes in production to Vietnam.

In July 2023, Gamuda Land Nam Viet Investment Co. Ltd., a subsidiary of Gamuda Berhad Malaysia Group, spent about 316 million USD (about 7.2 trillion VND) to acquire 98% of the capital of Tâm Lực Real Estate Joint Stock Company (SAR Corp). Thereby, Gamuda owns a commercial project named The Riverdale, with an area of 3.7 hectares, located in An Phu Ward, Thu Duc City (formerly changed to Eaton Park).

This investor is planning a premium complex project worth 1.1 billion USD on land purchased in the center of Thu Duc City.

Speaking at the M&A forum 2023, Mr. Angus Liew, Chairman of Gamuda Land Vietnam, noted that the demand for housing in Vietnam is very high due to limited supply.

He said that his company, like other developers, can sell its products while the project is still under construction, a practice that has been allowed in some countries. The Chairman also added that Gamuda Land chooses M&A because it provides the shortest path for the real estate sector.

Angus Liew, Chairman of Gamuda Land Vietnam, speaking at the M&A Vietnam 2023 forum in Ho Chi Minh City, on November 28, 2023. Photo provided by Investment Newspaper.

Keppel – the Singaporean Real Estate Corporation also finalized a $50.4 million deal with a Hanoi-based company holding commercial real estate and spent an additional $136 million for a 49% stake in two residential projects in Ho Chi Minh City.

Another name is CapitaLand, a familiar foreign investor in the Vietnamese real estate market, has also been conducting consecutive M&A deals, such as accepting the transfer of the Tan Thanh Binh Duong residential urban area project from the Industrial Investment and Development Corporation – JSC (Becamex IDC, HOSE: BCM) and acquiring part of the Vinhomes Smart City project in Nam Tu Liem District, Hanoi through Anh Sao Trading and Development Business Limited Liability Company and rename this project Lumi Hanoi, with a scale of nearly 5.6 hectares, about 4,000 apartments in 9 towers from 29 to 35 floors. The total investment is over 1 billion SGD (about 18 trillion VND).

In 2023, experts predict that the motivation for real estate M&A activities in Vietnam will continue to increase due to the convergence of factors: Global economic recession and weak purchasing power in both primary and secondary markets; the development of the financial market and the need to diversify real estate investment capital; rapid urbanization and Vietnam still being a bright spot of economic growth and FDI attraction; real estate legal bottlenecks are gradually being removed…