The unofficial buying rate of USD in the market is about 25,350 dong, an increase of 100 dong compared to yesterday. The selling rate increased by about 80 dong to 25,430 dong.

From the beginning of the year until now, the free USD rate has increased by about 1,200 dong in the purchasing and 900 dong in the selling, equivalent to a 5% increase.

The USD rate at commercial banks also increased by about 20-30 dong today. Although it has also increased considerably recently, the bank’s USD rate has not yet reached the peak of 24,880 dong recorded at the end of 2022. The difference between the bank’s USD rate and the free USD rate is quite large, up to 600 dong.

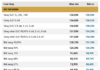

Specifically, Vietcombank is currently listing the USD rate at 24,480-24,820 dong, an increase of 30 dong compared to yesterday. Techcombank increased by 20 dong to 24,490-24,810 dong. ACB increased by 10 dong to 24,490-24,790 dong.

The central exchange rate published by the State Bank on February 29 is 24,002 dong. With a fluctuation range of +/- 5%, the floor rate and ceiling rate applicable to commercial banks are 22,802 dong and 25,202 dong respectively.

Internationally, the DXY index, which measures the strength of the greenback against major currencies, slightly adjusted down to 103.7 points but still at a high level. The Federal Reserve (FED) in the United States has not yet rushed to reduce interest rates, which has helped the USD maintain its strength. The yield on US treasury bonds also remains high.

In a recent macroeconomic report, Vietcombank Securities (VCBS) stated that the interest rate landscape continues to hit a record low, putting constant pressure on the exchange rate while the DXY index remains high. Therefore, the possibility of VND depreciation will still exist, and the exchange rate will depend largely on foreign currency supply at each point in time with factors related to direct and indirect investment flows, remittances, etc.