The stock market in Vietnam has just closed February with a slight correction after reaching a 17-month high. In February, the VN-Index increased by 7.59%, marking the fourth consecutive month of gains. This 7.59% increase is also the highest monthly gain for this index since July 2023.

The market has been continuously rising for a long time with almost no significant corrections, and profit-taking pressure is inevitable. Therefore, it won’t be easy for the VN-Index to continue its upward trend in March. However, historical data is supporting the upward trend, although it’s only for reference.

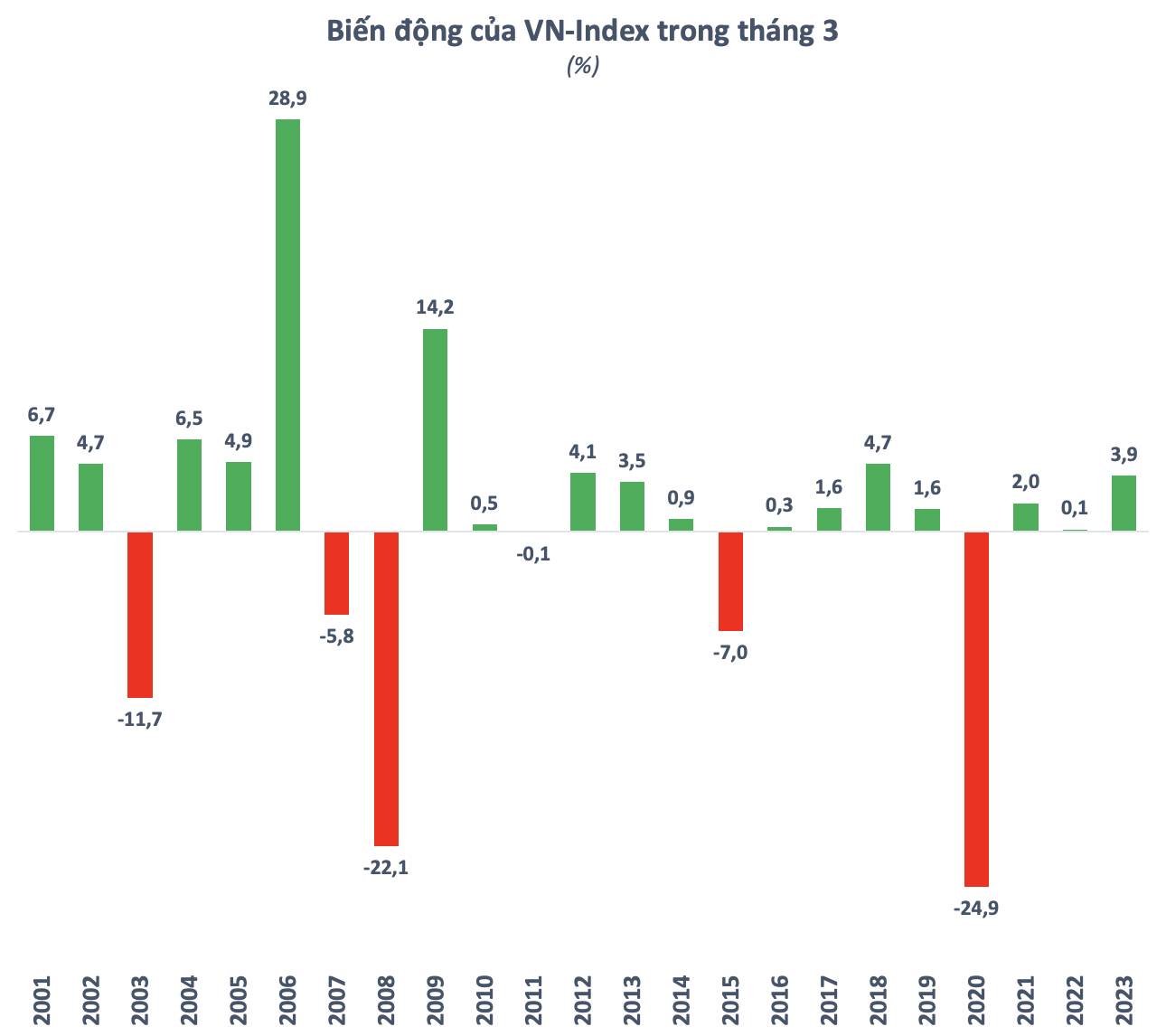

According to statistics over the past 23 years, the VN-Index has increased 17 times in March, corresponding to a probability of 74%. This makes March the month with the highest probability of gains in the year. However, in the past decade, the stock market has rarely experienced strong increases during this period (less than 5%).

On the contrary, the Vietnam stock market has only declined in March twice in the past 10 years, but the decreases were significant. Especially in 2020, the VN-Index even lost 24.9% in March, reaching a long-term low due to Covid.

In general, March is usually a time when businesses prepare for their Annual General Meetings. Business plans, dividend distribution, capital increase through issuance or offering,… revealed in meeting documents will have a significant impact on stock movements. In addition, information related to estimated first-quarter business results also has a certain impact on the market.

It is difficult to accurately forecast the market trend in March, but the general outlook for 2024 is highly regarded by major organizations.

At the Investor day earlier this year, Mr. Le Anh Tuan – Director of Securities Department at Dragon Capital, believed that the stock market has more bright spots than in 2023. He stated that the VN-Index is in a recovery cycle with converging factors such as low interest rates, stable macroeconomics, and the beginning of bottoming out in profit growth.

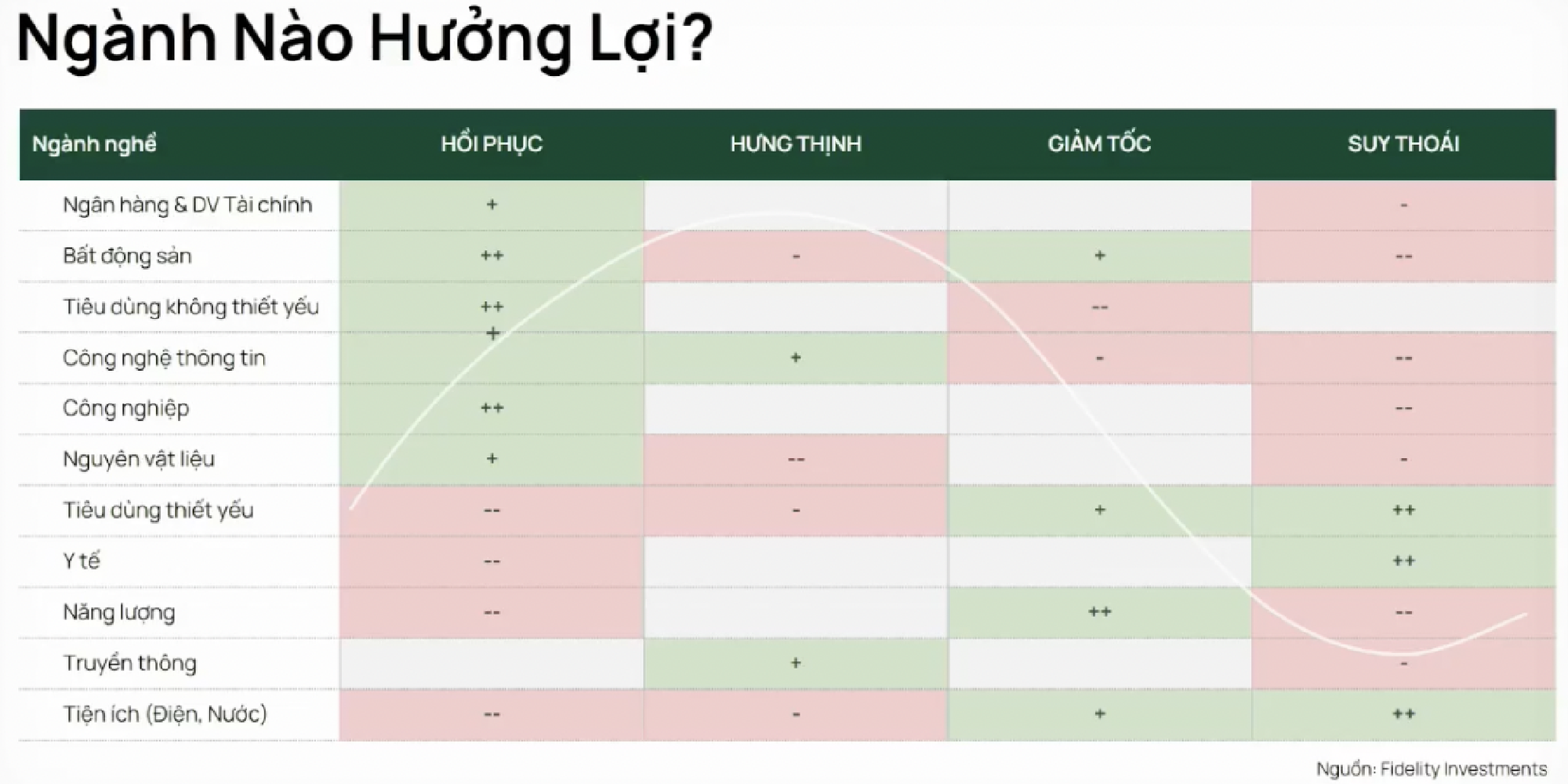

With this cycle, investors can expect outstanding performance of over 20%. In a recovery cycle, high-beta and high-volatility sectors will have good performance, such as non-essential consumer goods, real estate, and banking and finance sectors will have higher growth and bring high profits. Conversely, sectors such as essential consumer goods, healthcare, energy, and utilities like electricity and water are likely to have lower performance in this cycle.

On the other hand, there are still relatively cautious views despite the favorable general context for the stock market with low interest rates and simultaneous recovery of growth in many industries. According to SGI Capital, when the VN-Index surpasses 1,200 points, it will return to near the historically average valuation range with P/E of 14.x and P/B of 1.9 times. The valuation of many stocks has approached, or even exceeded, the long-term average valuation.

“The current valuation reflects expectations of recovery and growth in many stocks, but investment efficiency will only come when these expectations become reality. Conversely, when the valuation has increased, overly optimistic and distorted expectations will become pitfalls for investors this year. Therefore, the stock market in 2024 will be a highly differentiated environment,” emphasized SGI Capital.