WCS has just announced the list of shareholders eligible to receive an interim dividend for 2023 in cash at a rate of 144%/share, equivalent to VND 14,400/share. The ex-dividend date is March 14, 2024.

With 2.5 million shares outstanding, it is estimated that WCS will spend VND 36 billion to distribute the interim dividend for 2023 to its shareholders. The expected payment date is March 28, 2024.

According to the resolution of the 2023 annual general meeting of shareholders, WCS stated that the dividend distribution for 2023 will be based on the actual business results of the Company. The shareholders’ general meeting authorized the Board of Directors to decide the dividend distribution rate for 2023, which will not be less than 20%.

Therefore, with this interim dividend distribution, WCS has essentially exceeded expectations by distributing dividends in cash.

|

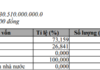

Major shareholders structure of WCS

Source: VietstockFinance

|

According to the latest update (as of January 23, 2024), WCS has three major shareholders: Saigon Mechanical Transport Corporation – SAMCO (holding 51% of capital), America LLC (owning 23.8%), and Thai Binh Investment Corporation (holding 10%).

With the above ownership ratios, the three major shareholders of WCS will receive dividends as follows: SAMCO (VND 18.36 billion), America LLC (VND 8.57 billion), and Thai Binh Investment Corporation (VND 3.6 billion).

WCS is famous for being one of the most stable dividend-paying companies on the stock market. Before the COVID-19 pandemic, the Company attracted attention by distributing dividends at a rate of 400% for 2018 and 516% for 2019. However, due to the severe impact of the pandemic on the Company’s business operations, the dividend distribution rate of WCS decreased to 20%/share (equivalent to VND 2,000/share) in the consecutive years of 2020, 2021, and 2022.

The return to a high dividend distribution rate of 144% partly indicates the excellent business results of WCS in 2023.

| Business results of WCS over the years |

In 2023, WCS achieved record net revenue of over VND 140 billion, a 49% increase compared to the previous year and exceeding the 17% revenue target (VND 120 billion). Net profit surged 73% to nearly VND 67 billion – the highest profit level in the past 4 years, starting from 2020, and nearly 50% higher than the annual profit target (VND 45 billion).