The stock market in Vietnam has seen many ups and downs of the stocks of different “families”. However, the stocks of Viettel and FPT families have been relatively quiet and resilient. Recently, stocks in these two families have been continuously increasing, with many stocks reaching new record highs.

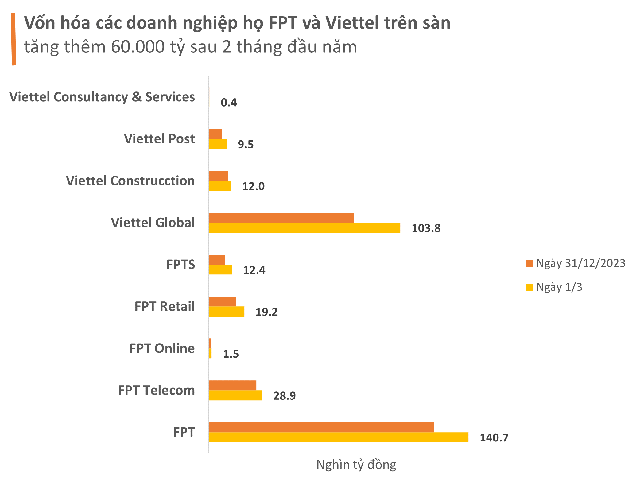

Currently, the total market value of four Viettel stocks and five FPT stocks on the exchange exceeds 328.5 trillion VND (13.2 billion USD) – an increase of 60 trillion VND compared to the end of 2023.

The highest priced stock in the Viettel group is the CTR stock of Viettel Contructions, which is currently at a historical high of 105,000 dong per share. The CTR stock has increased by 52% since November 2023.

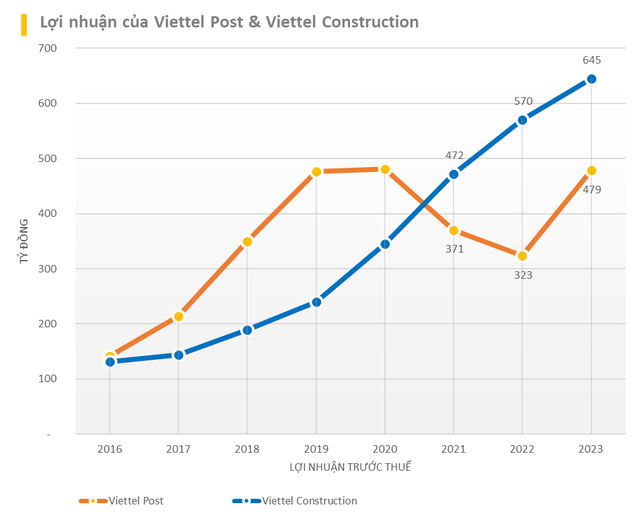

The stock’s performance has been positively supported by continued double-digit growth in business. In 2023, Viettel Contructions recorded net revenue of 11,299 billion VND and after-tax profit of 517 billion VND, an increase of 19% and 13%, respectively, compared to 2022.

Preparing to be listed on the HoSE exchange, the VTP stock of Viettel Post has been on a positive trajectory since the beginning of November 2023 and has surpassed its historical high. From the beginning of November 2023 to February 29, the last trading day on the Upcom exchange, VTP stock has increased by 92% to the price of 78,400 dong per share.

Viettel Post’s business performance has also improved after two years of declining profits. In 2023, Viettel Post recorded revenue of 19,590 billion VND, a decrease of 9% compared to 2022. However, a significant decrease in costs helped the gross profit increase by 35% to nearly 876 billion VND. After deducting expenses, Viettel Post’s net profit was over 380 billion VND, an increase of 49% compared to 2022.

After doubling in price, from the end of January to now, the VTK stock is currently in a sideways phase, with a price of 41,500 dong per share at the end of March 1.

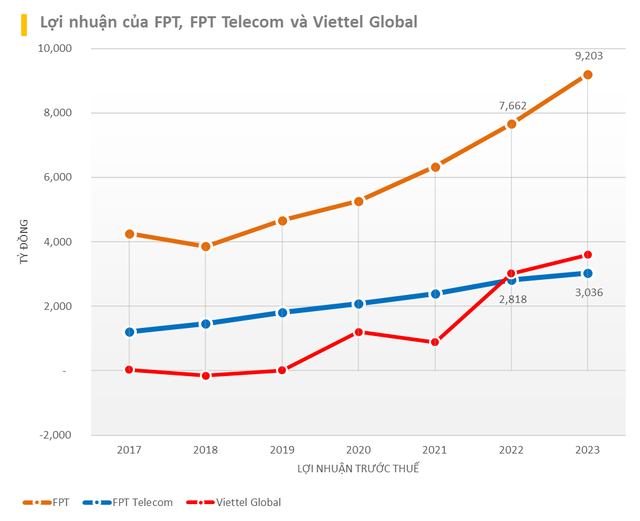

As the only billion-dollar company in the Viettel family, the VGI stock of Viettel Global has seen a slower increase compared to other companies. From November 2023 to now, the VGI stock has increased by about 40%. The current market capitalization of VGI is nearly 103.8 trillion VND.

The after-tax profit of VGI in 2023 decreased by nearly 4% to 1,485 billion VND.

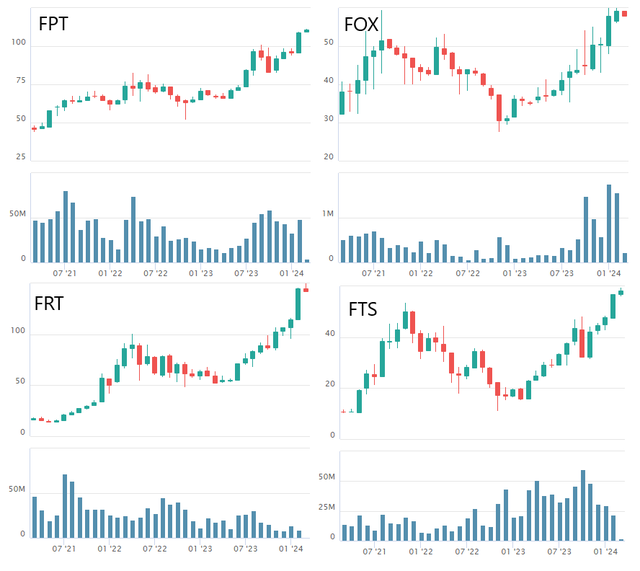

For the FPT family, the two billion-dollar companies, FPT and FPT Telecom (FOX), have achieved “consistent growth” in profits from 2019 to now. The increase in the stock prices of these two companies has been supported by positive business results, with continuous growth in revenue and profit over the years. In 2023, FPT recorded revenue of 52,618 billion VND, pre-tax profit of 9,203 billion VND, an increase of 19.6% and 20.1%, respectively, compared to the same period last year. Meanwhile, FOX recorded net revenue of 15,806 billion VND and after-tax profit of 2,428 billion VND, an increase of 7% and 8%.

The FPT stock is establishing a new record high with a price of 110,800 dong per share at the end of March 1. The company’s market capitalization is over 140.7 trillion VND.

Meanwhile, FOX stock has been sideways since the beginning of February after an increase since November 2023 and is currently priced at 58,600 dong per share.

The highest priced stock in the FPT family is currently the FRT stock of FPT Retail. The stock is priced at 141,000 dong per share at the end of March 1, an increase of about 47% since mid-November.

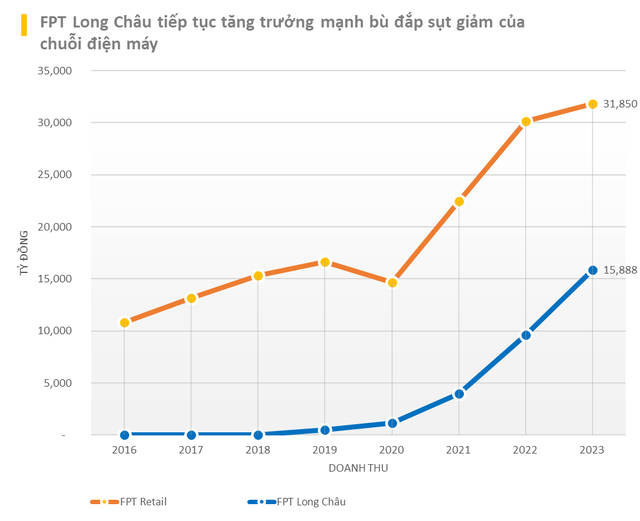

In the context of the ICT industry facing many difficulties, the main growth driver of FRT is acknowledged to come from Long Chau. In 2023, Long Chau’s revenue “surpassed” that of FPT Shop and became a major factor for the company. Along with the strong growth of Long Chau, FRT stock has increased 15 times in value over 4 years (since the bottom in March 2020).

The FOC stock of FPT Online, which started to rise at the end of November 2023, has increased by about 26% since then, but the price is still far from its historical high. The market capitalization is nearly 1,500 billion VND, the smallest among the FPT “family” companies on the stock exchange.

In 2023, FPT Online’s revenue reached 620 billion VND, a decrease of 20% compared to the previous year. After-tax profit was 113 billion VND, a decrease of 54% compared to 2022. This is the lowest profit level of the company since 2015.