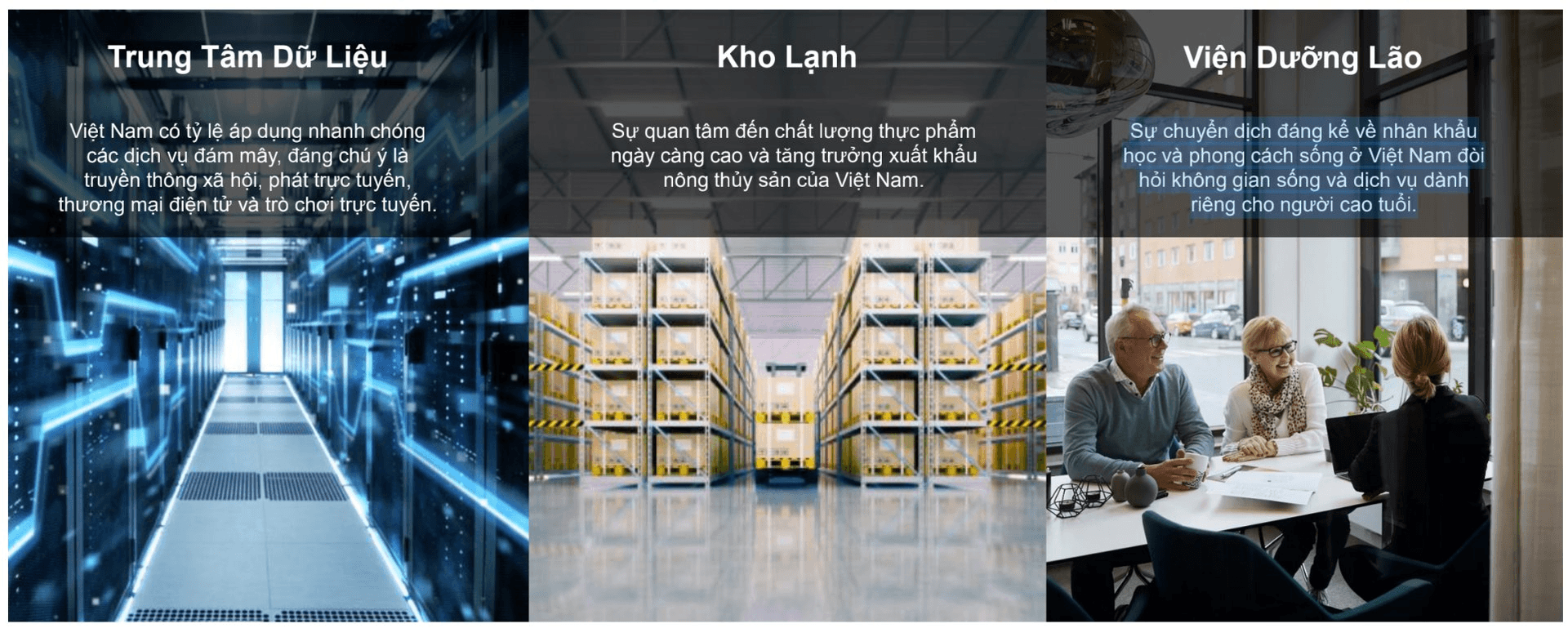

Specifically, according to Trang Le, data centers, cold storage, and nursing homes will be product lines with great potential in the future.

Among them, data centers benefit when Vietnam has a fast adoption rate of cloud services, notably social media, online streaming, e-commerce, and online gaming.

In the Asia-Pacific region, Indonesia, Malaysia, Thailand, and Vietnam have fewer data centers than Hong Kong and Singapore, despite having a population more than 30 times larger. However, Vietnam’s data centers are evaluated as one of the fastest-growing markets in the world thanks to the digitization process of local small and medium-sized enterprises and the digital-savvy young population, the appearance of 5G, the need for self-supply of digital infrastructure, and local data localization laws.

In Vietnam, there are a total of 28 data center projects with a total capacity of 45 MW. The market has the participation of 44 service providers. Currently, most companies participating in Vietnam’s data center segment are domestic telecommunication companies such as Viettel IDC, global data centers NTT, FPT Telecom, CMC Telecom, HTC Telecom International, VNPT, and VNTT. IT infrastructure providers include HP, Dell, Cisco System, Fujitsu, Hitachi, Huawei, IBM, Lenovo, NetApp, NEC Corp, and Oracle.

The government has a Digital Transformation Program with the goal of shifting 50% of business operations to the digital platform by 2025. Vietnam’s 5G connectivity supports the deployment of edge data centers and provides low-latency connections for last-mile services.

Therefore, developing a data center portfolio in the Asia-Pacific market is very potential, but it will take time due to the current fragmentation of the industry. Currently, most data center leases are long-term contracts, and demand is less affected by cycles like traditional lease real estate, which helps investors benefit more stable and long-term. There’s also the profit from selling data center real estate tends to increase more than other traditional lease real estate products.

According to JLL Vietnam, these 3 product lines will attract investment in the future. Source: JLL

Cold storage develops from the increasing demand for high-quality food and Vietnam’s growing exports of agricultural and aquatic products.

Consumer shopping habits are gradually shifting towards fresh, high-quality food, which has led to an increasing attention on the cold storage real estate segment.

According to economic experts, in recent years, industrial and logistics real estate has been gaining more attention from investors with record levels of investment capital. Among them, cold storage real estate (a segment of industrial real estate), which is used to preserve special goods, is one of the attractive investment options that attracts capital from many investors.

Currently, Vietnam’s cold storage real estate market is developing on a small scale, while the market demand is still very large, so it is very potential for investors. This is not to mention that the supply of cold storage in Vietnam is currently relatively small and concentrated in some major cities. In the South, there has been more dynamic development due to greater demand for food, seafood, and retail products. Specifically, the majority of cold storage supply is concentrated in Ho Chi Minh City and neighboring provinces such as Binh Duong, Long An, or Dong Nai, accounting for 87% of the total supply nationwide.

In recent times, many businesses have seen the potential and have started to invest heavily in this cold storage real estate market. The investment cost of cold storage is many times higher than building regular warehouses. Cold storage service providers usually have to rent construction areas for 10-30 years to ensure the investment capital they have spent. Therefore, investors need to prepare financial resources in advance and identify risks such as many potential issues in operation, economic fluctuations.

Elderly care real estate has great potential in the future, according to JLL, thanks to a significant shift in demographics and lifestyles in Vietnam that requires living spaces and services dedicated to the elderly.

This product line promises to be a segment with development potential in the future because the average life expectancy of Vietnamese people is increasing, the elderly population is aging rapidly, …

Many statistics show that Vietnam is one of the countries with the fastest aging population in the world. According to the forecast of the population according to the assumption of the average birth rate, the number of elderly people will reach 17.28 million people (accounting for 16.5% of the total population) by 2029; 22.29 million people (accounting for 20.21% of the total population) by 2038; 28.61 million people (accounting for 27.11% of the total population) by 2069.

Keeping up with the trend, in recent times, many corporations and businesses have started to participate in the development of elderly care real estate. However, this segment is still not given the right attention. The number of elderly care projects invested in comprehensively still remains small compared to the number of resort real estate targeting young people.

According to the survey and statistics of Bao Viet Insurance Company (BVI), by 2021, Vietnam has only about 80 non-public facilities for taking care of the elderly. Among the 63 provinces and cities nationwide, only 32 provinces have nursing homes for elderly care, and most of these nursing homes are privately owned. That is, it does not meet the average score of one center per province.

However, the elderly residential real estate segment in Vietnam is still in its infancy, with not many professional units going deep in development, as Vietnamese customers are not familiar with the concept of living in nursing homes. Moreover, the people’s industrial nature of hard work, saving money makes not many people willing to pay for this service.

The development trend of the nursing home model in Vietnam specifically and worldwide in general in the future will focus more on meeting the increasing demand for quality and sufficient needs of the elderly, aiming to improve the quality of life, create optimal care and living environment for them.