The market liquidity increased compared to the previous trading session, with the trading volume of VN-Index reaching nearly 1.061 billion shares, equivalent to a value of nearly 26 trillion dong; HNX-Index reached nearly 105 million shares, equivalent to a value of over 2 trillion dong.

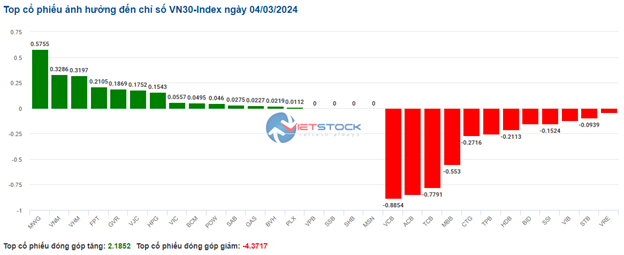

VN-Index opened the afternoon session fluctuating around the reference level and continued until the end of the session, closing at a slight increase. In terms of impact, GVR, CTG, HVN, and BCM were the most positive impacting stocks on VN-Index with an increase of over 2.1 points. On the other hand, VCB was the most negative impacting stock, taking away more than 1.7 points from the index.

| Top 10 stocks with the strongest impact on VN-Index on 04/03/2024 (Measured in points) |

HNX-Index also had a similar trend, with the index being positively impacted by stocks such as TNG (4.67%), L14 (3.33%), L18 (2.8%), DDG (1.92%),…

|

Source: VietstockFinance

|

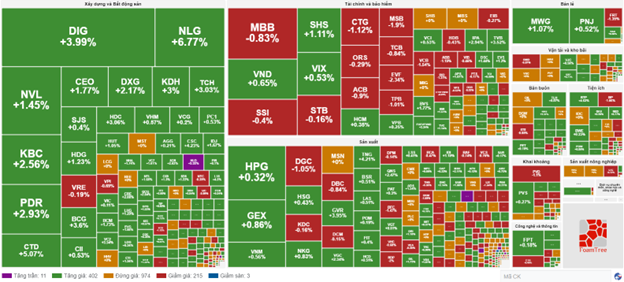

The retail sector is the strongest sector with a 1.51% recovery mainly attributed to stocks such as MWG (+1.72%) and FRT (+0.57%). Following that are the transportation – warehouse and other financial sectors with increases of 1.31% and 1.2% respectively.

On the other hand, the machinery manufacturing sector had the sharpest decline in the market with -0.37%, mainly due to stocks such as NHH (-1.04%), SBG (-1.51%), and CTB (-0.42%).

In terms of foreign trading, this group continued to net buy over 102 billion dong on HOSE, focusing on stocks such as KBC (281.53 billion dong), DIG (103.9 billion dong), VND (77.03 billion dong), and MWG (75.78 billion dong). On HNX, foreign investors net sold over 13 billion dong, focusing on stocks such as PVS (37.1 billion dong), MBS (12.6 billion dong) and CEO (6.2 billion dong).

Morning session: Stable demand, positive trading on VN-Index

At the end of the morning session, VN-Index increased by 4.13 points (+0.33%), reaching 1,262.41 points; HNX-Index increased by 1.82 points (+0.77%), reaching 238.25 points. The market breadth tilted towards buyers, with 446 stocks increasing and 226 stocks decreasing. In the VN30 basket, the color green also dominated with 17 stocks gaining, 8 stocks decreasing, and 5 stocks remaining unchanged.

The demand remained stable and spread evenly to stock groups from Large Cap, Mid Cap to Small Cap. In particular, the real estate group made an impressive contribution to the increase of the index in the morning session. Stocks showed positive performance such as VRE (+1.5%), BCM (+1.73%), DXG (+1.9%), CEO (+1.77%), KDH (+3.43%), KBC (+5.45%), DIG (+3.63%), PDR (+2.93%). NLG stock hit the ceiling price with an increase of 6.89%.

The plastic – chemical manufacturing group continued to lead the market in the morning session. GVR led the way with a 3.6% increase, followed by DCM and DPM with increases of 0.88% and 0.85% respectively.

Similarly, the securities group had broad green coverage with most stocks showing gains such as VND (+1.08%), VCI (+0.85%), SHS (+1.67%), HCM (+1.24%), VIX (+1.06%), MBS (+1.06%), BSI (+0.86%),…

The flow of money also spread to the electrical equipment group, with notable stocks such as GEX, CAV, RAL… ending the morning session with good growth.

10:30 AM: Uncertainty creeps in

As of 10:30 AM, the overall indices were still fluctuating around the reference levels. Specifically, VN-Index decreased by more than 1 point, traded around 1,258 points. HNX-Index increased by more than 1 point, traded around 237 points.

In the VN30 group, banking stocks were under selling pressure, with VCB decreasing by 0.88 points, ACB decreasing by 0.85 points, TCB decreasing by 0.78 points, and MBB decreasing by 0.55 points. On the other hand, MWG, VNM, VHM, and FPT played a supportive role in the market, contributing more than 1 point to the overall index.

Source: VietstockFinance

|

The real estate group appeared to show positive gains. Specifically, NLG reached the ceiling price, DXG increased by 1.73%, KDH increased by 1.47%, and DIG increased by 1.27%… Conversely, only a few stocks experienced slight declines such as D2D (-0.42%), IJC (-0.33%), and VRE (-0.75%).

The construction group continued to attract investors’ attention with most stocks showing gains from the beginning of the session. Prominent stocks can be listed such as CTD (+4.41%), HUT (+3.66%), CII (+2.86%), and BCG (+2.51%)…

On the contrary, the banking group is still under strong selling pressure with some major players in the industry such as VCB (-1.13%), BID (-1.31%), ACB (-1.08%), CTG (-0.84%)…

Compared to the opening, buyers overwhelmingly dominated. The number of increasing stocks was 413 (11 ceiling stocks) and the number of decreasing stocks was 218 (3 floor stocks). The total trading volume on all 3 exchanges reached over 487 million units, equivalent to over 11.4 trillion dong.

Source: VietstockFinance

|

Market opening: Positive sentiment spreads

At the beginning of the session on 04/03, by 9:30 AM, VN-Index had a good increase of over 4 points, reaching 1,262 points. HNX-Index also had a positive increase of nearly 2 points, reaching 238 points.

Large-cap stocks such as GVR, HPG, and PGV led the index with an increase of over 2 points. On the flip side, VCB, BID, and TCB were weighing down the market, causing a total decrease of over 1.8 points.

The color green had the upper hand in the morning session, with some stocks in the plastic – chemical manufacturing sector shining from the beginning of the session such as GVR with a 4.29% increase, PHR with a 1.6% increase, and DPR with a 1.14% increase. The remaining stocks such as DGC, DPM, DCM, BMP, NTP, AAA all showed a slight shade of green.