The money poured into the market today reached its highest level in 6 sessions, totaling 31,385 billion dong in total market transactions. Over 60 stocks traded over 100 billion dong this session, with real estate and securities stocks attracting money. However, the core stocks performed poorly, causing the VN-Index to increase by only 3.13 points, equivalent to +0.25% compared to the reference, closing at 1,261.41 points.

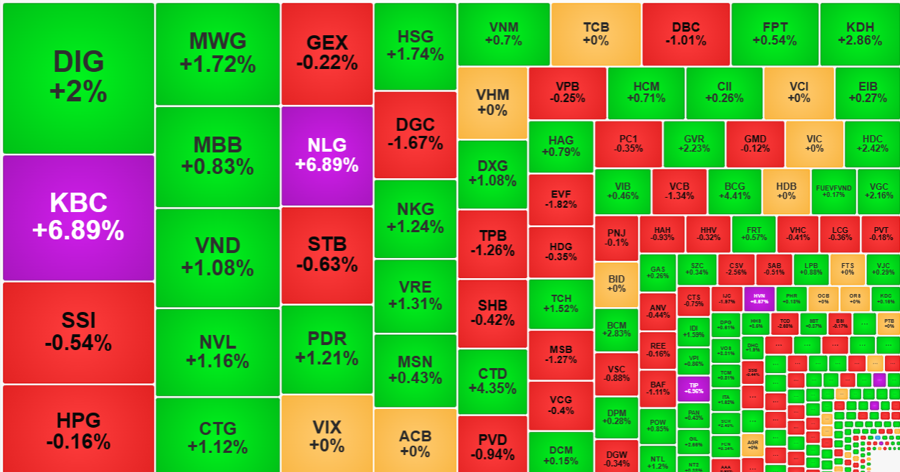

The restraint in the main index comes mainly from important banking stocks such as VCB down 1.34%, TPB down 1.26%, MSB down 1.27%, and VPB down 0.25%. In addition, HPG also decreased by 0.16% along with BID, VHM, VIC, TCB showing no significant increase. Among the top 10 stocks with the largest market capitalization, only 3 stocks increased, with CTG up 1.12%, GAS up 0.26%, and VNM up 0.7%.

It is clear that the VN-Index is lacking the strength of leading stocks to truly reach a reliable peak. The VN30-Index also only increased slightly by 0.12% despite having 15 stocks up and 9 stocks down.

The positive point is that the VN-Index’s breakthrough did not have much impact on stock trading. Money is flowing abundantly and constantly circulating. Real estate stocks traded impressively today and most of them increased significantly. KBC and NLG are the two leading stocks in this group with a large trading volume. KBC ranks 2nd in the market with 1,165.5 billion dong and NLG ranks 11th with 561.7 billion dong. KBC even set a liquidity record in 28 months, while NLG set a record in 25 months. Another “land stock” leading in market liquidity is DIG with a trading volume of over 1,400 billion dong, a record in 6 months, and a 2% price increase. NVL and PDR are two other real estate stocks with a trading volume of over 500 billion dong and a price increase of over 1%.

Not only real estate, but also hundreds of other stocks in the VN-Index increased by more than 1%, spread across different sectors. Retail representative MWG increased by 1.72% with a trading volume of 784.8 billion dong; Securities representative VND increased by 1.08% with a trading volume of 755.7 billion dong; Steel representative HSG increased by 1.74% with 446.3 billion dong, NKG increased by 1.24% with 401 billion dong; Construction materials, Construction, and even banking stocks all had good price increases with high liquidity.

When closing, the breadth of the VN-Index recorded 276 stocks up/190 stocks down. Although the upward trend is quite dominant, this is still a sign of differentiation. In fact, even extremely strong groups as mentioned above still have representatives with price decreases. There were even clear instances of selling off. In the morning, the VN-Index had a clear drop below the reference, and in the afternoon at 2:20 PM, the index almost lost all its gains and the breadth was quite balanced with 238 stocks up/223 stocks down.

Therefore, the market is still not really showing profit-taking, but the strong inflow of money is preventing prices from collapsing completely. The total value of HoSE’s trading volume this session reached nearly 25,928 billion dong, second only to the more than 30,000 billion dong level on February 23. Up to today, HoSE and HNX have had 7 consecutive sessions with trading volume exceeding 20,000 billion dong/session, and in the 13 sessions since the Lunar New Year, there have been 10 sessions with trading volume exceeding this threshold.

It is clear that the money flowing into the market is very different from before the Lunar New Year, with only one clear adjustment session when the VN-Index lost 15.31 points on February 23. The high liquidity and intra-day price fluctuations indicate that the market is only adjusting during the session. The profit-taking waves were absorbed by the inflow of money immediately.