The US job data, testimony of the chairman of the Federal Reserve, a key date in the US election calendar, and President Biden’s Federal Message speech, all take place this week and are all being closely watched by investors.

Meanwhile, across the Atlantic, the European Central Bank (ECB) will hold its meeting and the UK will announce its budget. Asia is not missing the opportunity either, with the annual session of the Chinese parliament in a context where the world’s second-largest economy is facing many challenges.

Here are some of the most notable global financial events in the new week.

1/ Contradictory data from the US

The US earnings reporting season is coming to a close, but investors have little downtime as the Congressional testimony of Fed Chair Jerome Powell will take place on Wednesday and Thursday (7th and 8th March), as well as the US employment data for February, to be released on Friday (7th March).

The excitement over the business potential of AI has helped propel US stocks to new record highs, even as a strong economy has reduced the odds of the Fed cutting interest rates.

Indications of strength in the job market are likely to continue, potentially leading the Fed to caution against expecting rate cuts, which could be a source of concern for investors who may be unable to dispel worries that rates will remain high for longer, potentially impacting the market and the economy.

Among these impacts is the rising yields of US Treasury Bonds – which could disrupt the stock market if this continues. The yield on the 10-year US Treasury bond has risen 40 basis points this year.

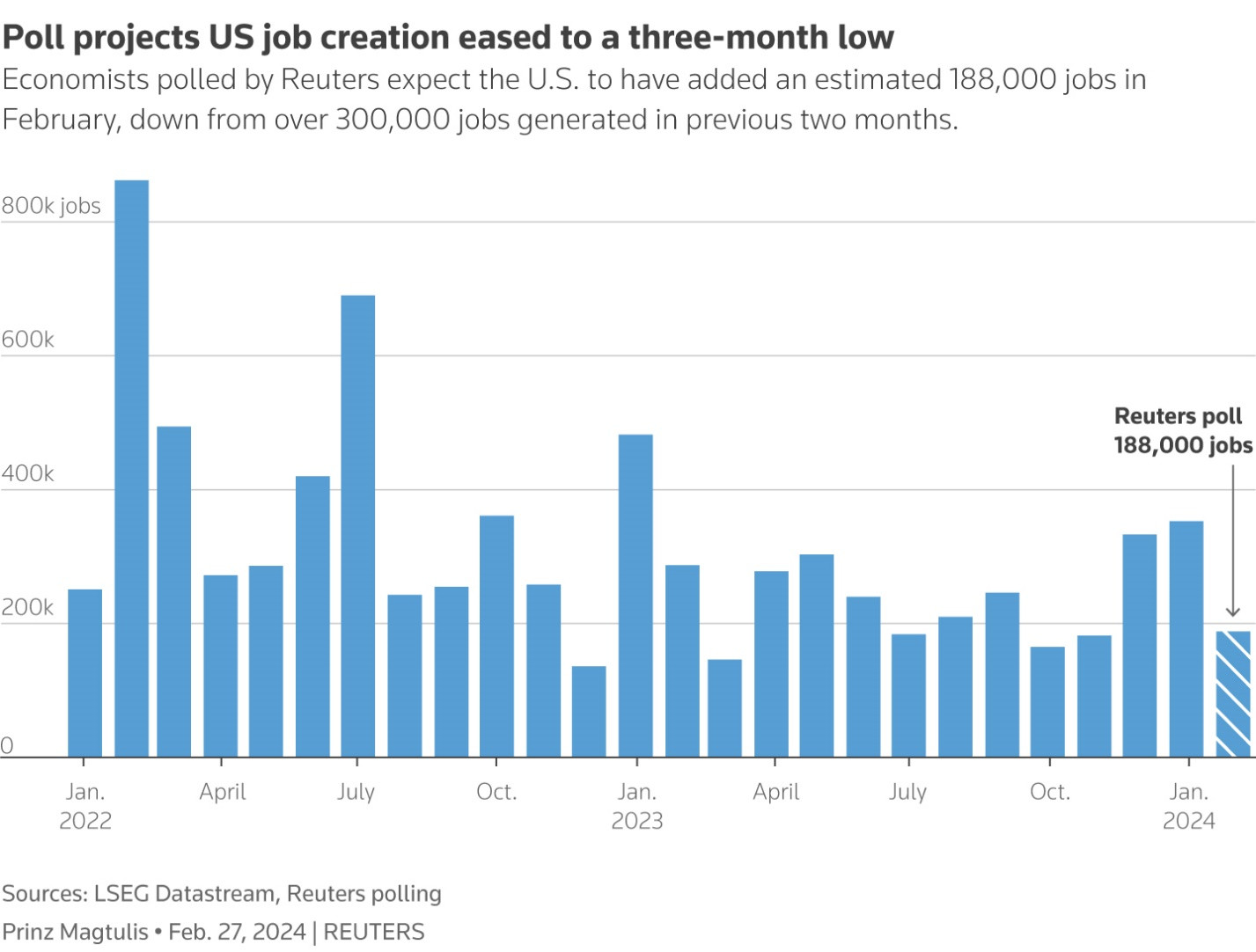

Economists surveyed by Reuters expect the US economy to have created 188,000 new jobs after losing 353,000 jobs in January.

Expectations for the US job numbers for February to be the lowest in 3 months.

2/ US “Super Tuesday”

The US election is not a financial event but it has a strong impact on the financial markets not only in the United States but globally.

It may still be too early to gauge and pinpoint the outcome of the November US presidential election, but next Tuesday (March 5) is “Super Tuesday,” a day that may shed light on the political divide and challenges facing the United States.

And the debt ceiling issue also returns. The US Congress last Thursday passed a temporary short-term measure to keep the federal government from partially shutting down, but only for a week.

The Bond Market soaked up $169 billion in bond sales this past week with relative ease. But the political polarization on fiscal issues is a reminder that the national debt is at $34 trillion and growing, so Treasury Bond yields may have gotten a bit “too hot”.

However, with elections in the air, positive fiscal consolidation is unlikely. Temporary spending measures are more likely to occur.

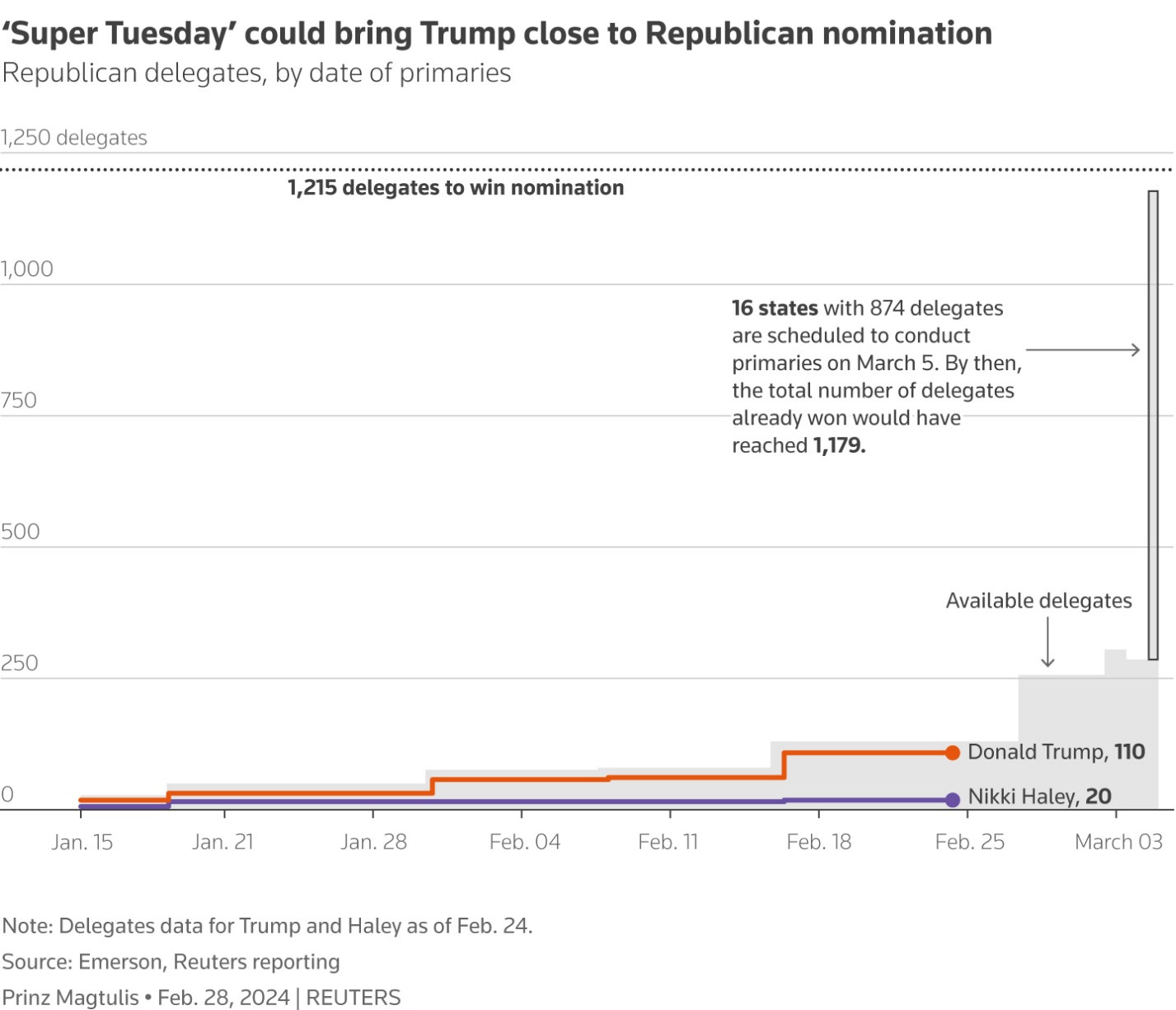

“Super Tuesday” marks the day in the US presidential primary cycle when more states vote, with both Biden and Donald Trump expected to secure their parties’ nominations.

Trump could score high in the “Super Tuesday” votes.

3/ Key data from China

The hope for China’s new stimulus package continues to rise as the National People’s Congress starts its annual session on Tuesday (5th March), aimed at reviving the crisis-ridden real estate sector and injecting additional vigour into the flagging consumer – in a context of the worst deflation in since the global financial crisis.

There is more at risk than hitting the targeted growth rate of 5% this year.

Chinese stocks have recovered from a 5-year low hit at the beginning of February, ending six months of consecutive declines, with February performance (vs January) the best since late 2022. The main driver has been state-led buying and tighter short selling regulation.

But it’s hard to forget that Chinese shares once slid to the lowest level in 5 years, largely due to the market scaling back expectations of Beijing’s economic stimulus. That is putting pressure on the market.

China’s economic growth forecast.

4/ Is it too early for the ECB to cut rates?

The European Central Bank (ECB) will hold its meeting on Thursday (7th March) and the market focus at this point is whether ECB policymakers will reiterate that it is still too early to discuss rate cuts or leave the door open for any moves.

Rates have been held steady since September and the ECB has pushed back on the timing for rate cuts, emphasising even if the next move is a rate cut it will be later than market pricing suggests.

Wage pressures still remain high despite having eased.

Therefore, from a starting market expectation that the ECB would cut rates by 150 basis points in early 2024, the market now anticipates a cut of around 90 basis points with the first move predicted to come in June.

Europe’s price action in rate cuts is even later than the US Federal rates market.

ECB interest rate policy forecast.

5/ How will the UK plan its budget?

UK Chancellor Jeremy Hunt needs to find a way to cut taxes in the budget announcement on Wednesday (6th March) to boost the election prospects for Prime Minister Rishi Sunak – currently flagging – without causing further instability in the bond market.

Memories of former Prime Minister Liz Truss’s “small budget” crisis still linger and the fiscal outlook hasn’t shown signs of improvement since, leaving Hunt little room to manoeuvre as he makes a pitch to Parliament on the 6th of March.

But the media is currently focused on the possibility of the UK cutting income taxes or reducing other welfare rates, and market participants are expecting Hunt to use most, if not all, of the financial leeway he has.

The UK has little financial leeway left.

Reference: Reuters