Affordable housing shortage, surplus of high-end housing

Mr. Hoang Hai – Director of the Housing and Real Estate Market Management Department, Ministry of Construction – said that currently, there are almost no affordable housing projects (priced under 25 million VND/m2) available on the market, mainly medium and high-end housing projects (priced from 25-70 million VND/m2). Among them, the price of affordable apartments ranges from 25-35 million VND/m2; the price of mid-range apartments is around 35 million to less than 50 million VND/m2; the price of high-end apartments is above 50 million VND/m2, commonly at 60-70 million VND/m2.

Savills’ data shows that out of every 100 new apartments sold in Hanoi in 2023, only three apartments are priced below two billion VND. The shortage of affordable housing has reached its peak in 2023 as most new projects are from the mid-range and high-end segments. Based on the total new supply in the past year, high-end apartments accounted for 75% in Hanoi and 84% in Ho Chi Minh City.

Despite the difficult economy, apartment prices are rising sharply.

Mr. Nguyen Van Dinh – Chairman of the Vietnam Real Estate Brokers Association – believes that the product structure in the housing market is increasingly imbalanced as the market lacks affordable commercial housing. This segment accounted for 30% of the total new supply in 2019, but now it accounts for only about 6%. The price below 25 million VND/m2 is only available in social housing projects or projects in suburban areas.

According to Mr. Dinh, the short-term supply is difficult to increase, so the paradox of a shortage of affordable housing and a surplus of high-priced housing may continue this year. The legal bottleneck has made the management authorities more cautious in approving projects, but it also made it difficult for businesses to sell, they have no resources to repay debts and develop new projects.

Rising house prices despite economic difficulties

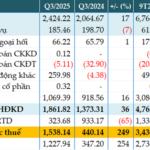

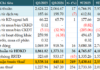

When the real estate market started declining from mid-2022, expectations of price adjustments similar to the 2008-2009 period emerged. Especially in 2023, when the market faced comprehensive difficulties, the expectation of price reduction increased. However, data from many research units shows that the selling prices of apartments and landed houses continue to rise continuously, regardless of the general difficulties of the economy.

According to the latest statistics by Savills, Hanoi’s condominiums at the end of 2023 had prices ranging from 51-70 million VND/m2 – setting a new price threshold, accounting for 63% of the new supply, up 24% compared to the same period in 2022. The apartments in this price range accounted for 49% of the total units sold. The price of landed houses increased by 3% quarterly to 194 million VND/m2 of land. The price of commercial townhouses also increased by 3% quarterly to 328 million VND/m2 of land.

According to Ms. Do Thu Hang – Senior Director of Research and Consultancy Department, Savills Hanoi, the villa, townhouse, and landed house market is facing great challenges as all indicators are negative while prices continue to rise. In 2019, low-rise houses priced below 20 billion VND accounted for 80% of the supply, but by 2023, it accounted for only 50% of the total supply. The products priced over 30 billion VND only accounted for 10% in 2019 and by 2023, it had increased to 23% of the total market supply. This is a very high price level, while the rental business potential for townhouses is facing difficulties.

Mr. Nguyen Quoc Anh – Deputy General Director of Batdongsan Channel – said that contrary to the expectation of a sharp drop in real estate prices in 2023, the general market level increased slightly by 6% compared to the beginning of the year. This situation may continue to challenge the housing market in 2024 due to the difficulty in opening up short-term supply. Meanwhile, there are many reasons that have driven housing prices up, such as objective factors (increasing input costs including land, materials, and interest rates) and subjective factors (developers prioritizing high-end and luxury housing).

Experts warn that continuously rising house prices, surpassing the affordability of most people, may lead to negative consequences for the market, such as the formation of a virtual price framework, causing supply-demand imbalances, and declining liquidity.