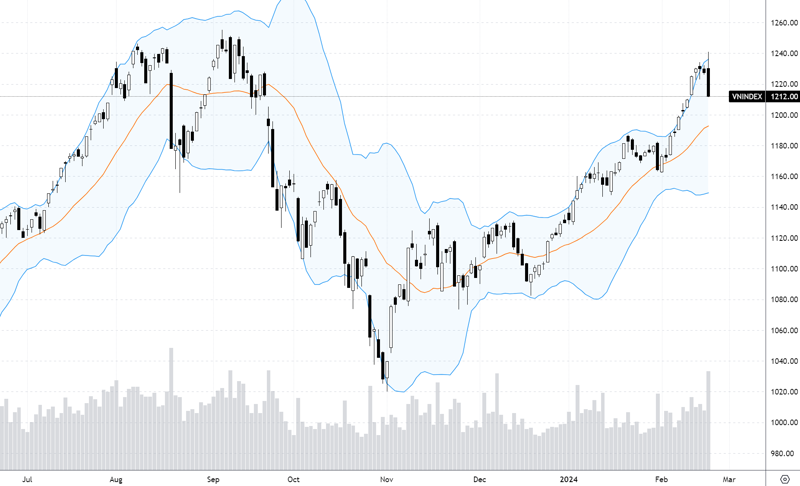

With the majority being cautious as the VN-Index enters the mid-term peak in September 2023, experts were quite surprised by the strong performance of VCB pulling the index to break out last week. The high liquidity during the week surpassing the previous peak also promises to open up a new wave of increase to higher peaks. However, the most cautious point of view still doubts the possibility of a “trap” (price increase trap) that can occur.

Rising for 4 out of 5 sessions last week with a range of + 3.8%, VN-Index set a record for the strongest weekly increase since January 2023. Despite the strong amplitude during the first 3 sessions of the week, the market only slightly adjusted for the day before officially surpassing the September 2023 high. The most important driving force for the index can be attributed to VCB when this pillar increased 9.4% during the week, also a record since the first week of December 2022.

Although the mark of VCB was very prominent in the week, experts also believed that it was reasonable to have more attention and create a very large liquidity in this stock. Furthermore, the market was not only pulled up by VCB alone but also had a good spread, with overall high liquidity. This is the most reliable point to create confidence in the breakthrough of the index.

In the previous discussion, most experts were cautious about the possibility of breaking the index’s peak. The development of VCB brought unexpected effectiveness and perspectives became more optimistic. Most opinions expect the index to continue to rise further. However, some cautious opinions believe that the VN-Index has not really broken through yet, but should wait for more developments in the next few sessions. There is still a possibility that the market only just surpassed the peak but then adjusted, and such developments are considered as a “trap” to attract investors following the explosive and trapped boom.

On the other hand, although the viewpoint of the experts is more optimistic than cautious, their actions are still cautious with the stock allocation still at an average level. If there is short-term speculation, it is only with a small position on the available stock volume.

Currently, I am predicting 2 scenarios for the market: this peak breakout is just a “trap” and from next week or the following weeks, the market may enter a correction; The market continues to rise next week and reach a strong resistance zone around 1,285, new correction phase appears.

Mr. Nguyen Viet Quang

Nguyen Hoang – VnEconomy

The most surprising development last week was the sudden strength of VCB, and this stock helped VN-Index erase the decline on February 23, surpassing the strong resistance area that you mentioned last week, even surpassing the peak in September 2023. Were you surprised by this development?

Mr. Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

Normally, the movement of VN30 group stocks will fluctuate with a smaller range compared to mid-cap and small-cap stocks, especially the leading stocks with the largest market capitalization on the exchange, such as VCB. However, with the limit-up increase accompanied by record high liquidity, this is a very rare development in trading history, and I was also quite surprised by the fierce reaction of the money flow to the news surrounding this stock. The fact that VCB has the highest market capitalization has contributed greatly to the recovery momentum of the index in recent sessions.

Mr. Le Duc Khanh – Director of Analysis, VPS Securities

The recovery trend of the market has been stronger than breaking through the 1,250 mark to touch the high of 1,260 instead of just recovering and staying in the range of 1,230-1,250 points. The good participation of the money flow has made many stocks increase to new highs. Not only VCB but many other large-cap stocks such as FPT, GMD, DGC, PVD, BID… have impressive price increase phases.

Mr. Nguyen Viet Quang – Director of 3 Yuanta Trading Center Hanoi

I was also a bit surprised when the money flow continued to enter the market strongly, alternating between pillars, and every day there was a group with stocks hitting the upper limit, creating a sense of excitement for the whole market. Currently, I am predicting 2 scenarios for the market: this peak breakout is just a “trap” and from next week or the following weeks, the market may enter a correction; The market continues to rise next week and reach a strong resistance zone around 1,285, new correction phase appears.

Mr. Nguyen Van Son – Analyst, Phu Hung Securities Joint Stock Company

I also agree with the role of VCB in the past week’s trading, when the strong price increase of this stock has contributed to VN-Index surpassing the peak. However, the movements and increase of VCB’s stock are quite suitable rather than surprising if looking back, as it was rather slow and somewhat “out of sync” compared to other major “bank” stocks.

Then, when other “bank” stocks gradually enter the accumulation phase, VCB starts to attract attention from the money flow. Coupled with strong support information for a dividend payout in shares of over 38%, has created a catalyst for VCB to increase and close the price increase gap compared to other large “bank” stocks.

Therefore, I am not too surprised by the developments of VCB last week.

Mr. Nguyen The Hoai – Director of Dong Nai Branch, Dragon Securities

I’m also quite surprised when the market approached the resistance area and the adjustment took place quite quickly. Then the market immediately rose above the peak with wide spread. I think this may just be a market oscillation and market adjustment.

Mr. Nguyen Van Son – Analyst, Phu Hung Securities Joint Stock Company

According to me, a market rising and breaking through the peak with a strong increase in liquidity is a positive signal because this development shows that the buying power is strong and the market has new money participating. I believe that if the money flow continues to maintain a level higher than 23 trillion VND per session as it is now, it will not only help VN-Index surpass the 1,250 point peak but also be able to go further in the coming period.

Mr. Nguyen Viet Quang – Director of 3 Yuanta Trading Center Hanoi

Liquidity increasing along with the rising prices is always a positive signal. At present, although the market has closed above the previous peak in September 2023, but only slightly, so the next 1-2 weeks will be an important week to see if this is a real breakthrough or just another trap.

Mr. Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

Based on the positive view of the medium and long-term trend of the market, and the previous sharp decline session could only be a technical adjustment, I still keep a high stock allocation with long-term positions, as well as taking advantage of the fluctuation phase to short-term speculation.

Therefore, the profit-taking activities and reducing the stock allocation are only to restructure the short-term portfolio to be more suitable for the market rotation between sectors of the general money flow in the market.

Mr. Nguyen Van Son – Analyst, Phu Hung Securities Joint Stock Company

Based on the positive view of the medium and long-term trend of the market, and the previous sharp decline session could only be a technical adjustment, I still keep a high stock allocation with long-term positions, as well as taking advantage of the fluctuation phase to short-term speculation.

Mr. Nguyen The Hoai – Director of Dong Nai Branch, Dragon Securities

When approaching the resistance area, it is easy to understand the reduction of stock allocation, especially for accounts with high margin ratios. And when the market undergoes a correction and rises above the peak again, we need to consider the market to take appropriate actions. The positive point of the market when surpassing the peak this time is that liquidity is still stable, leading stock groups are still stable, and the money flow begins to spread out to other sectors with attractive valuations. Opportunities are imminent.