The Ho Chi Minh City Stock Exchange (HoSE) is set to announce the results of its review of the VN-Diamond index for the first half of the year on April 21, with the changes taking effect on May 6.

Based on data as of February 29, HSC Securities Corporation (HSC) is forecasting that the VN-Diamond index will remove MWG and add CTD.

Explaining the reasons, analysts believe that MWG’s P/E ratio is three times higher than the average P/E ratio of the basket. When MWG is removed, HSC believes that CTD is a potential candidate for replacement. Currently, the foreign ownership limit (FOL) of CTD is about 91%, and other criteria also meet the requirements of VN-Diamond.

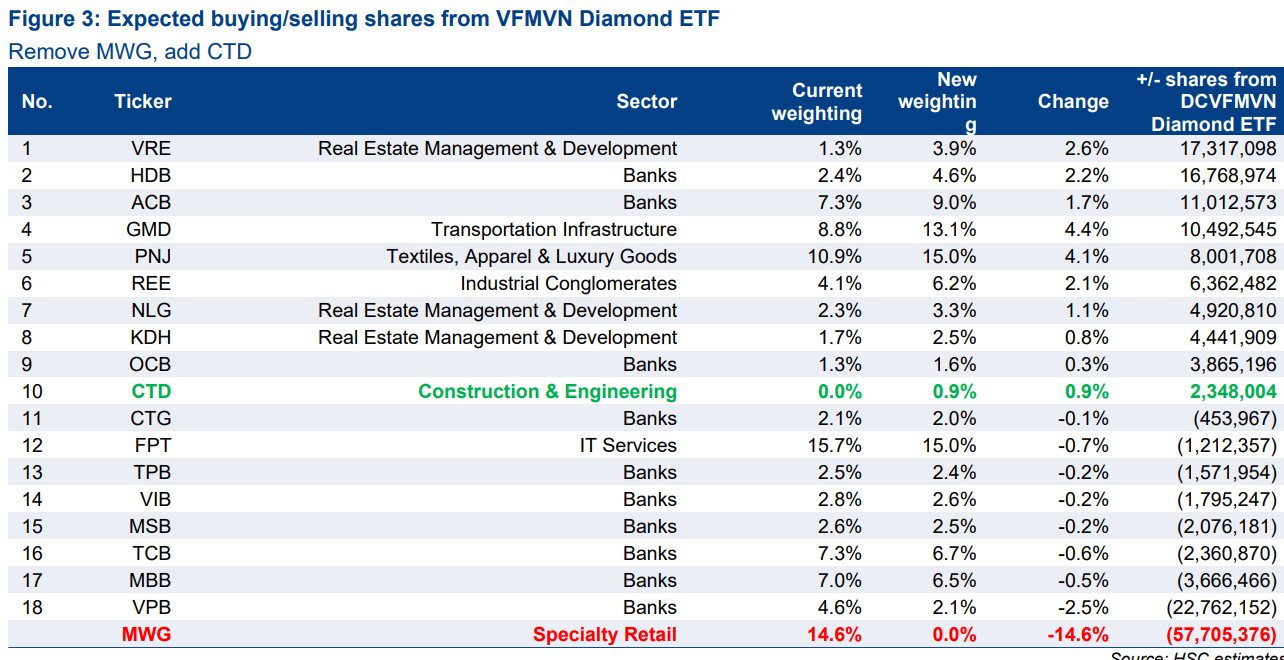

In addition, HSC predicts that the proportions of VRE, HDB, ACB, GMD, and PNJ will be significantly increased due to recent increases in FOL and liquidity. On the other hand, the proportions of VPB, MBB, and TCB may be reduced due to low liquidity and FOL in this period.

Currently, there are three ETF funds in the Vietnamese market that reference the VN-Diamond index: DCVFMVN Diamond ETF, MAFMVN Diamond ETF, and BVFVN Diamond ETF. Among them, DVFMVN Diamond ETF is the largest fund with a NAV of 17,674 billion VND.

With the forecast of MWG being removed and CTD being added, HSC estimates that the DCVFMVN Diamond ETF will sell all 57 million MWG shares and more than 22 million VPB shares. Conversely, the fund may buy more than 2 million CTD shares, buy 17 million VRE and HDB shares, 11 million ACB shares, 10 million GMD shares, and about 8 million PNJ shares.

|

Forecast in case MWG is removed and CTD is added

|

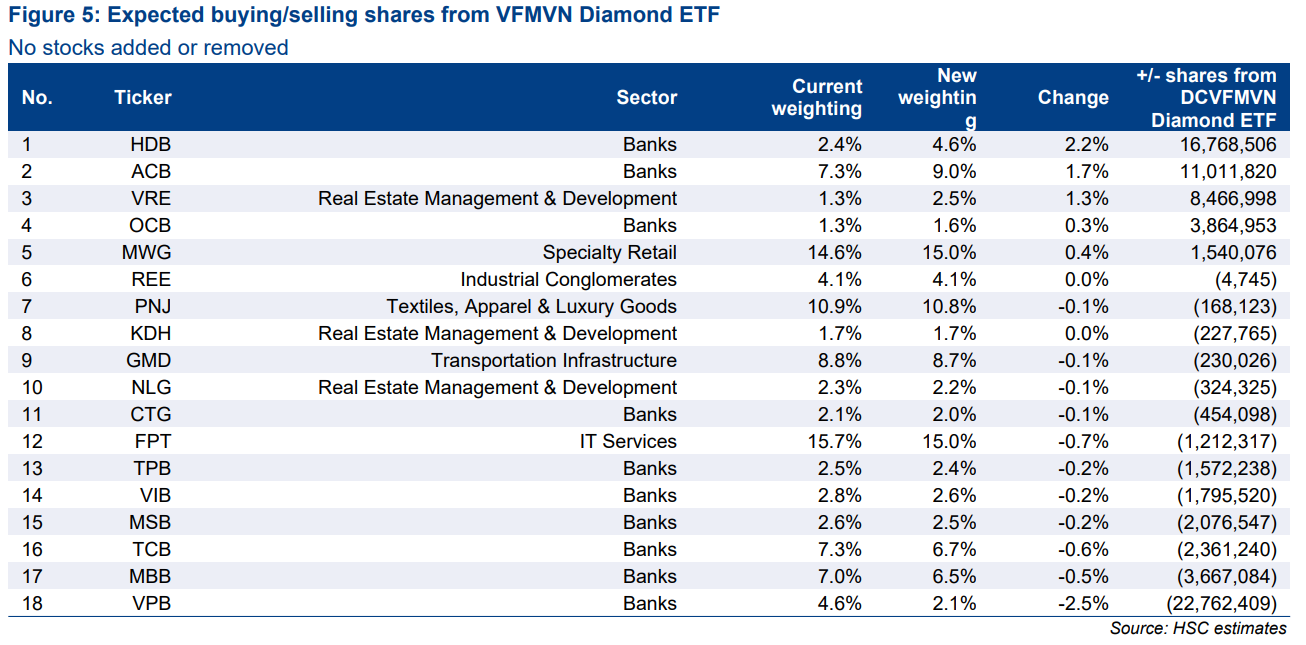

HSC also noted that if MWG remains in the portfolio, they forecast that no new stocks will be added to the VN-Diamond portfolio.

|

Forecast in case no stocks are added or removed

|